NZDNOK (New Zealand Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

29 Apr 2025 02:54

(-0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The NZD/NOK pair is a cross rate against the US dollar, which means that the two currencies in the pair are valued against USD. Therefore, the US dollar has a significant impact on the currency pair. The approximate dynamics of NZD/NOK can be seen by combining the trading charts of the two currency pairs, NZD/USD and USD/NOK.

Principal features

Both countries have fairly strong economies. New Zealand is famous for its agriculture that is considered one of the most efficient and highly developed in the world. Most of the manufactured products are exported. That is why the island country's economy is greatly dependent on its export volumes.

Norway's economy characterized by developed industrial and agricultural sectors is regarded as one of the strongest in the world. This Scandinavian state is a major oil and gas producer and supplier to the global market. The export of energy resources represents a significant source of the country's revenue. In addition, Norway ranks among the world's largest exporters of fish and seafood.

How to trade NZD/NOK

In comparison to such major currency pairs as EUR/USD, USD/CHF, GBP/USD, and USD/JPY, the NZD/NOK currency pair is less liquid. When trading this instrument, you should primarily focus on currency pairs that include the US dollar along with each currency under consideration, and only then make a decision on entering the market with NZD/NOK.

It is also important to remember that brokers tend to set higher spreads on cross rates than on more popular trading instruments. Therefore, before starting to work with cross rates, you should thoroughly review all the terms and conditions a broker offers.

As previously mentioned, the greenback has a profound effect on each of the currencies. Thus, to make an accurate forecast of the NZD/NOK pair’s further movement, it is necessary to take into account the key US economic indicators, including GDP growth, producer prices, unemployment data, trade balance, job openings, and others.

Furthermore, do not forget to monitor the economic situation in Norway and New Zealand as well as in the countries that are their main trading partners.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

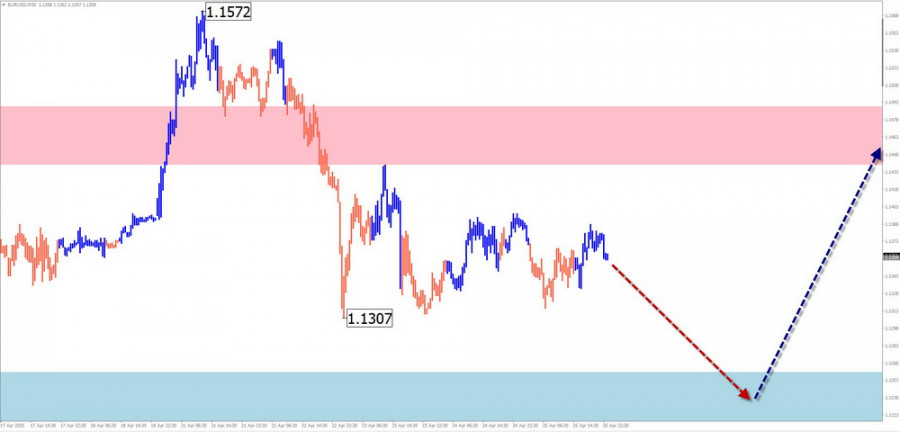

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1378

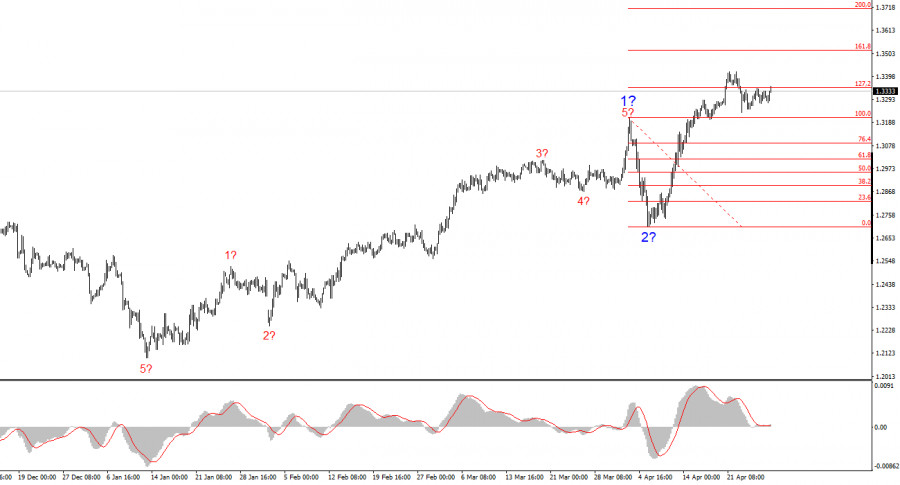

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1258

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

1063

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

988

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

913

The GBP/USD pair rose by 30 basis points on MondayAuthor: Chin Zhao

19:42 2025-04-28 UTC+2

883

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

868

EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

838

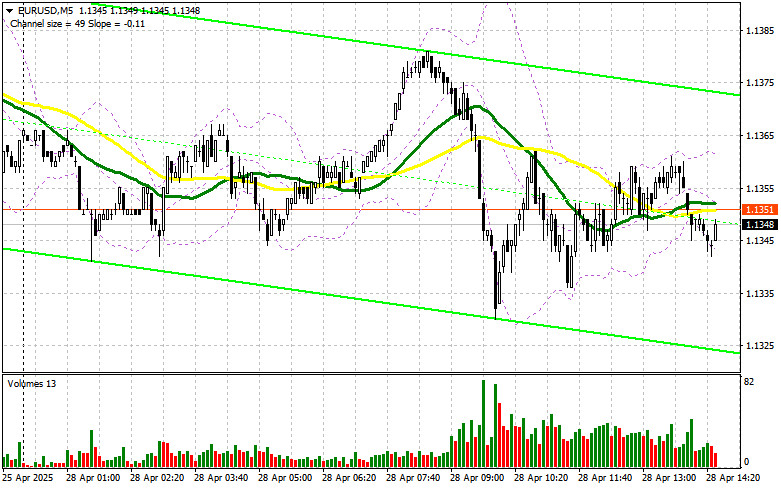

Technical analysisTrading Signals for EUR/USD for April 28-30, 2025: sell below 1.1370 (21 SMA - 7/8 Murray)

On the other hand, if bearish pressure prevails and the euro consolidates below 1.1370, it could be seen as a sell signal with targets at the 6/8 Murray located at 1.1230 and ultimately at the bottom of the downtrend channel around 1.1135.Author: Dimitrios Zappas

16:29 2025-04-28 UTC+2

838

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1378

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1258

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

1063

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

988

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

913

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

883

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

868

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

838

- Technical analysis

Trading Signals for EUR/USD for April 28-30, 2025: sell below 1.1370 (21 SMA - 7/8 Murray)

On the other hand, if bearish pressure prevails and the euro consolidates below 1.1370, it could be seen as a sell signal with targets at the 6/8 Murray located at 1.1230 and ultimately at the bottom of the downtrend channel around 1.1135.Author: Dimitrios Zappas

16:29 2025-04-28 UTC+2

838