SGDJPY (新加坡元 vs 日元). 汇率和在线图表。

货币转换器

28 Apr 2025 16:26

(0%)

前一天收盘价

开盘价。

最后一个交易日的最高价。

最后一个交易日的最低价。

在过去52周的价格区间高点

在过去52周的价格区间低点

SGD/JPY currency pair (Singapore Dollar vs Japanese Yen)

SGD/JPY is not a widely used currency pair on the Forex market. SGD/JPY is a cross rate against the U.S. dollar. Although the U.S. dollar does not appear obviously in this currency pair, it still exerts a significant influence on it. One can see that when the two charts are combined: USD/JPY and USD/SGD. By joining these two charts into one, you can get an approximate SGD/JPY chart.

The U.S. dollar has a big impact on both currencies. Therefore, it is essential to take into account the main U.S. economic data for the accurate forecast of a future rate of this financial instrument. These data include: the discount rate, GDP, unemployment, new vacancies and many others. Besides, it should be noted that the currencies under consideration could respond to changes in the U.S. economy at a various pace. Thus, the SGD/JPY currency pair can be used as a specific indicator of any changes in these currencies.

Singapore is a well-developed industrial country with a high level of the economic advance and living standards. Impressive economic results of the country are determined by its beneficial geographical position at the crossroads of vital shipping routes, which allow Singapore to carry on an active business with all the powerful states of the world. Nowadays Singapore's export sales primarily include: home electronics & hi-tech devices, pharmaceuticals, shipbuilding items; it also provides services in the area of finance. The economy of the country and its national currency rely heavily on export sales.

Singapore is one of the state-of-the-art countries of Asia. That is why it belongs to the group of so-called "Asian tigers", with the rapid development of its economy that is equal to affluent western countries such as the USA, Germany, France, Great Britain, etc.

The SGD/JPY currency pair is quite vulnerable to a variety of huge political events and economic trends taking place in the world. As a result, the price chart for this currency pair is hardly predictable, and it frequently goes in the opposite direction despite any analysis.

Novices are not recommended to begin their trading experience on the foreign exchange market with this currency pair. In order to trade this financial instrument successfully, you have to keep in mind lots of nuances of price fluctuations.

If you trade cross rates, you have to be aware of the fact that brokers usually set a higher spread on this pair than on more popular currency instruments. So, before you start working with the cross rates, you have to investigate the conditions offered by the broker to deal with this particular trading instrument.

See Also

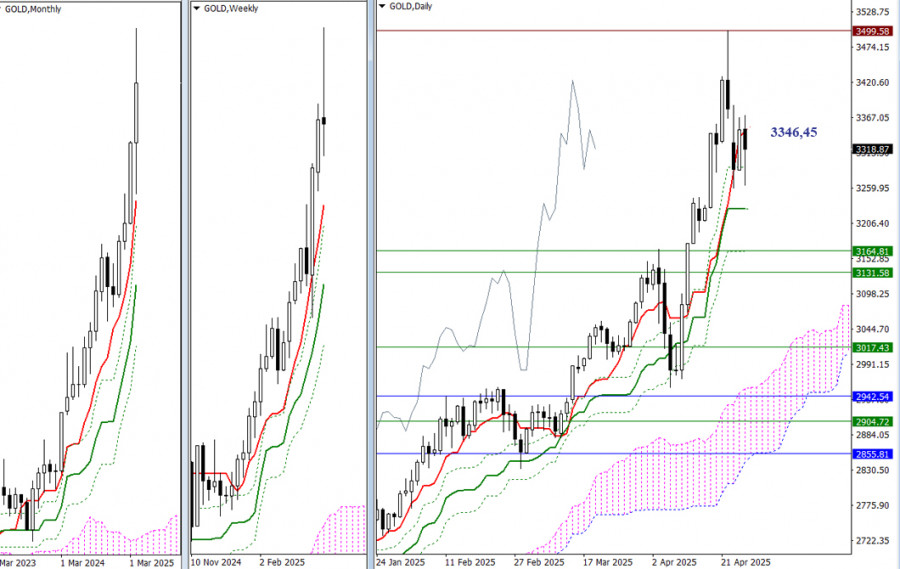

- Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.

Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1318

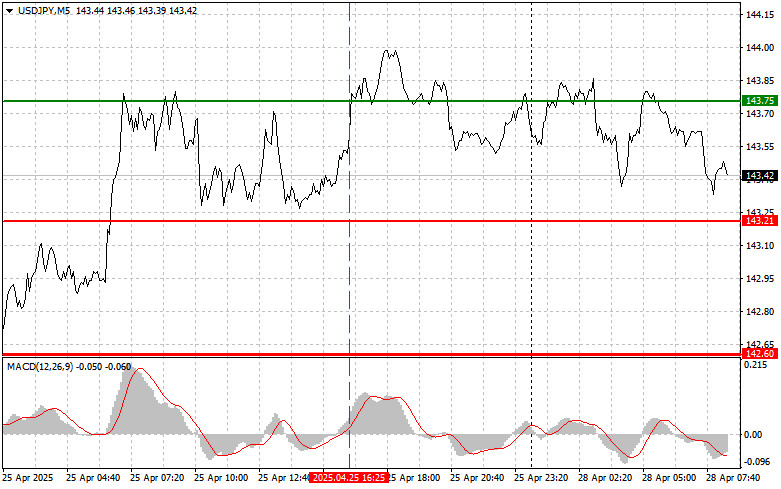

Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1213

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

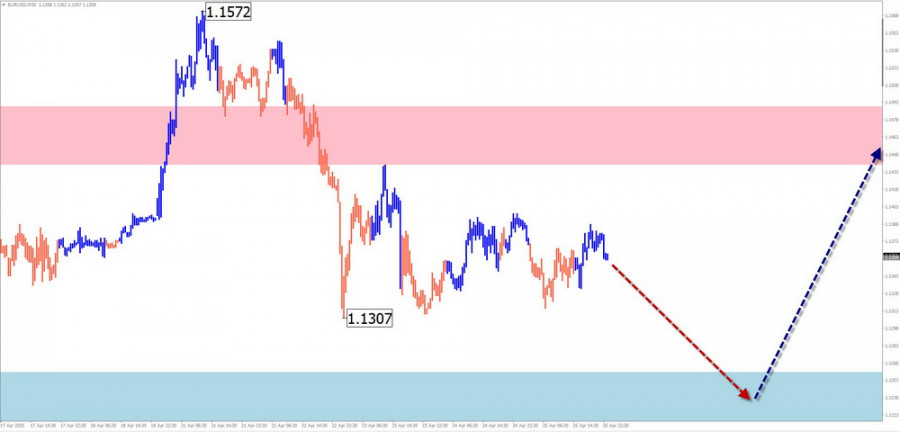

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1138

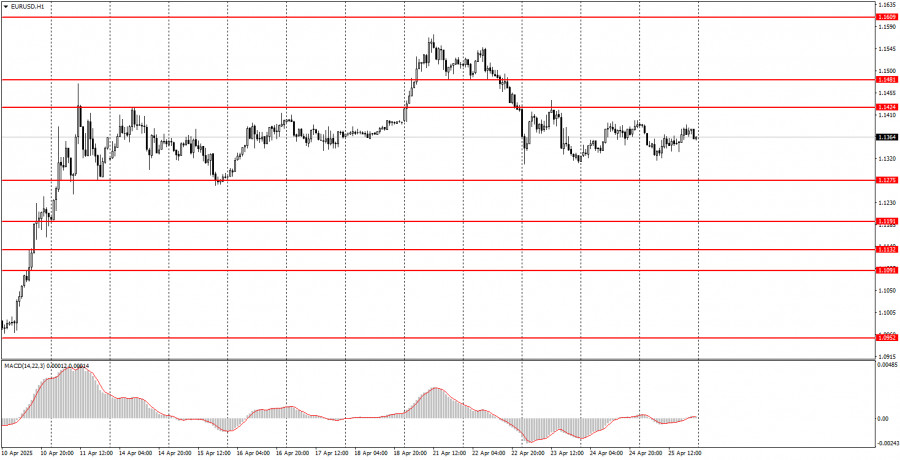

- The EUR/USD currency pair continued trading sideways throughout Friday

Author: Paolo Greco

04:13 2025-04-28 UTC+2

1108

Fundamental analysisEUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

1078

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1018

- Type of analysis

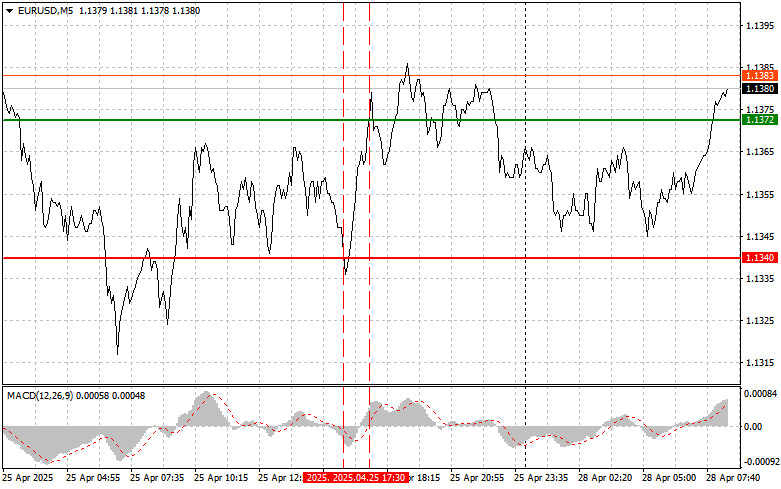

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1003

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

973

Fundamental analysisWhat to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

973

- Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.

Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1318

- Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1213

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1138

- The EUR/USD currency pair continued trading sideways throughout Friday

Author: Paolo Greco

04:13 2025-04-28 UTC+2

1108

- Fundamental analysis

EUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

1078

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1018

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1003

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

973

- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

973