USDDKK (美元 vs 丹麦克朗). 汇率和在线图表。

货币转换器

28 Apr 2025 19:59

(0.04%)

前一天收盘价

开盘价。

最后一个交易日的最高价。

最后一个交易日的最低价。

在过去52周的价格区间高点

在过去52周的价格区间低点

USD/DKK is an exchange rate of the Danish krone against the US national currency.

The currency pair’s history dates back to 1992.

Fundamental analysis of the pair depends on the US dollar position on the market. The latest tendencies testify that the level of confidence in the US dollar has considerably decreased. As a result, the main fundamental factors point at the further decline of the currency pair popularity. Since 2012 there has been a strong tendency toward depreciation of the pair. The price is steadily falling. Trading USD/DKK has calm and smooth character. The pair’s forecast is usually based on technical analysis.

During the last decade the Danish krone has been continuously gaining ground against the US dollar. As an example it can be noted that in 2001 the Danish krone traded at 8.5 against the US dollar and in 2003 it already traded in the range of kr6.5 to kr5.1 for $1.Deals with the Danish krone are quite common on the foreign exchange market; however the total trading volume is still small.

Interest in the Danish currency is connected with its high correlation to the euro. Despite the fact that Denmark is a member of the European Union, it was decided to maintain the national currency and not to introduce the euro. Nevertheless, the Danish krone trend is highly dependent on the general direction of the single European currency. The Danish krone is mainly affected by different events in the eurozone and by prices for agricultural products on the world market. However, an active trend can be seen even when there is a change in the US dollar exchange rate.

The US dollar fluctuations mostly depend on the macroeconomic factors of the US economy, which are released by the United States Department of Commerce. Consequently, according to the US official statistics data the US dollar exchange rate can be forecasted for this or that period.

See Also

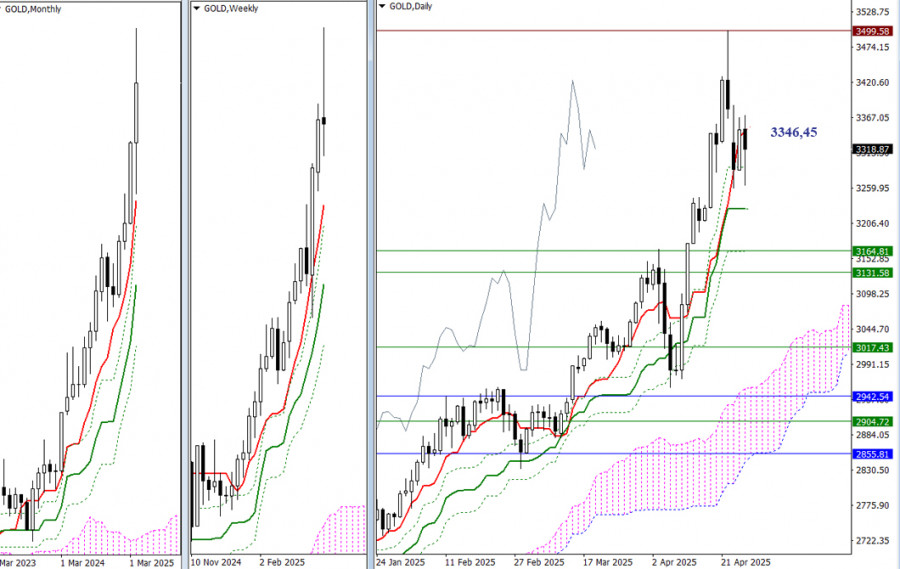

- Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.

Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1453

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

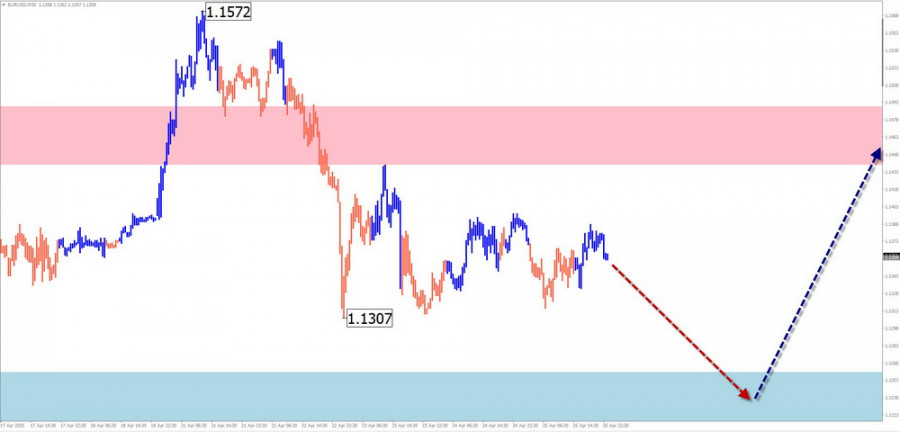

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1183

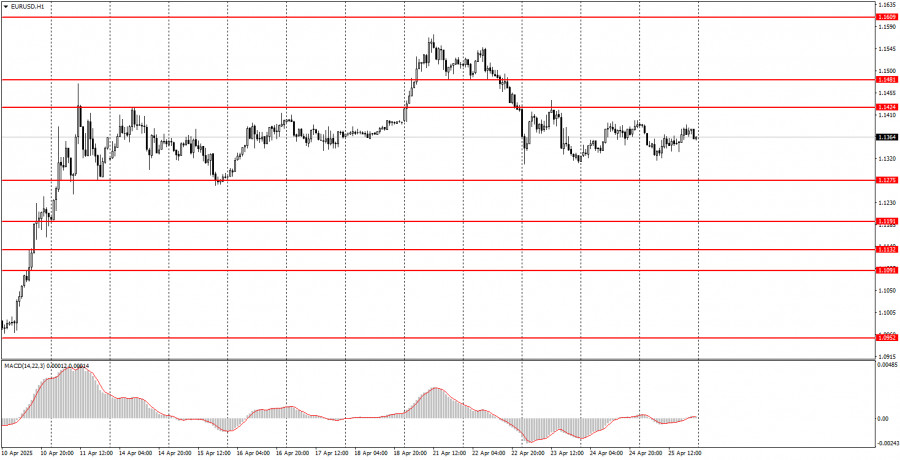

Fundamental analysisEUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

1153

- Type of analysis

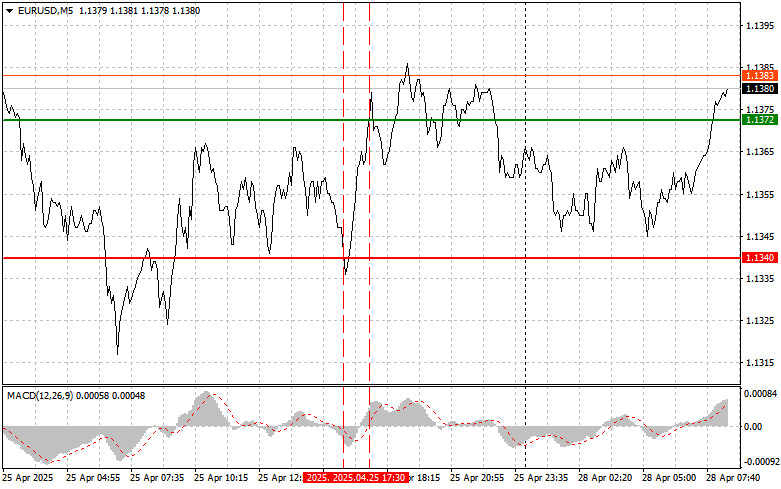

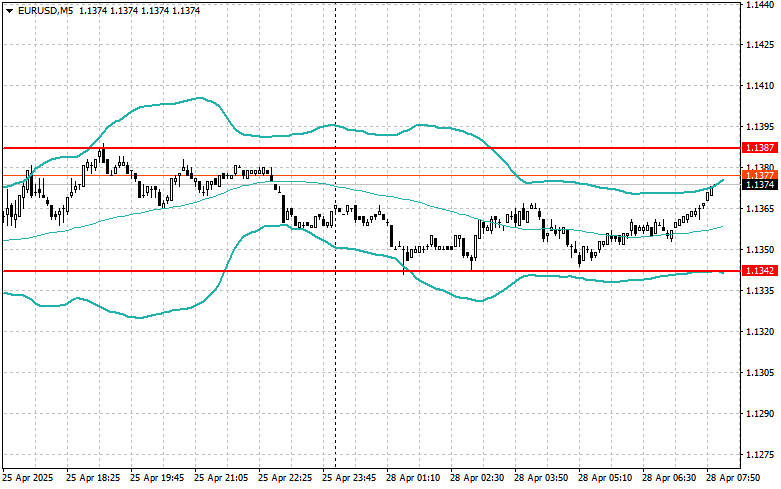

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1033

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1033

Fundamental analysisWhat to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

1018

- Type of analysis

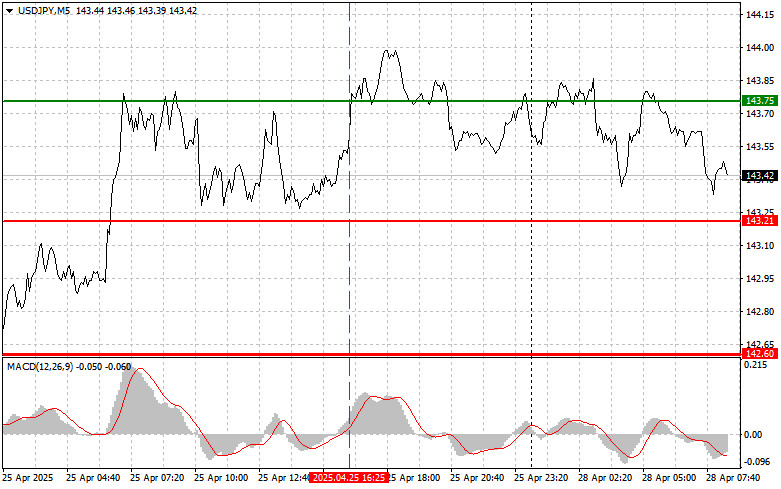

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1018

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

853

Intraday Strategies for Beginner Traders on April 28Author: Miroslaw Bawulski

08:19 2025-04-28 UTC+2

823

- Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.

Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

1453

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1183

- Fundamental analysis

EUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

1153

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1033

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1033

- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

1018

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:19 2025-04-28 UTC+2

1018

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

853

- Intraday Strategies for Beginner Traders on April 28

Author: Miroslaw Bawulski

08:19 2025-04-28 UTC+2

823