17.04.2025 11:49 AM

17.04.2025 11:49 AM在唐納·川普發起的關稅戰未來走向不明朗的陰霾中,黃金價格持續受到支撐。

過去四個月,黃金價格幾乎呈直線上升。主要推動力是市場因政治緊張局勢加劇——特別是北京與華盛頓之間的對峙——而對全球經濟可能崩潰的憂慮正在增加。

從技術角度來看,黃金價格已被過度推高,一旦美國與中國達成貿易協議的消息出現,則可能隨時暴跌。儘管目前看不到這場對峙的明確終點,但考慮到北京的強硬立場、川普的策略調整以及經濟壓力的真實風險——尤其是在美國——我們有理由相信兩國之間最終會開始談判。

技術設置和交易思路:

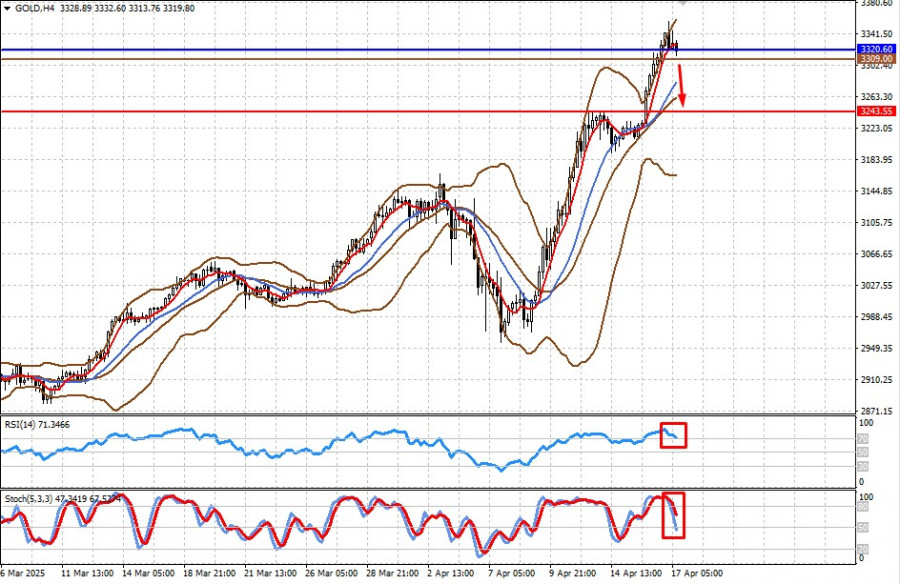

價格位於布林帶的中線之上,但低於5期SMA,並且高於14期SMA。RSI在超買區中向下轉向。隨機指標已經離開超買區,並且正在積極下降,發出賣出信號。

我認為金價可能會下跌至3243.55,這可能是在持續的短期上升趨勢中出現的本地回調修正。一個潛在的進場點可以考慮在3309.00水平附近。

昨日來自德國的數據超出預期。三月份的工業生產增加了3.0%,而此前預測為0.9%,二月份則下降了1.3%。

預計歐元/英鎊貨幣對將逆轉其下行趨勢並開始上漲。自4月11日以來的楔形下降顯然具有調整結構,並且這一下行走勢已顯示出首次疲軟和觸底的跡象。

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

电子邮件/短信

通知

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.