CADHUF (Canadian Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

29 Apr 2025 02:00

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/HUF pair is quite popular among some Forex traders. This trading instrument is a cross rate against the US dollar, which has a significant impact on the pair. So, when comparing the CAD/USD and USD/HUF charts, we can get an almost clear picture of CAD/HUF movements.

Features of CAD/HUF

The Canadian dollar is highly correlated with global oil prices. Canada is one of the largest oil-exporting countries. For this reason, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. Therefore, the CAD/HUF pair is dependent on the world price of this fuel.

Although Hungary is part of the European Union, it has its own national currency, the forint.

The Hungarian economy depends strongly on the organizations and countries that do business in its territory. The state is characterized by a high share of foreign capital in the economy.

A large part of Hungary's income is generated by tourism. In addition, such sectors of the economy as engineering, metallurgy, chemical industry, and agriculture are also flourishing in the country. Most of the production is exported abroad. Hungary's main trading partners are the EU countries and Russia. Therefore, when assessing the future exchange rate of the Hungarian forint, special attention should be paid to the economic indicators of these regions.

How to trade CAD/HUF

When trading cross rates, remember that brokers usually set a higher spread on such pairs than on more popular currency pairs. Therefore, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

The CAD/HUF pair is a cross rate. Therefore, the US dollar has a significant impact on each of the currencies in this trading instrument. For this reason, when predicting the movement of the pair, it is necessary to take into account the major US economic indicators. These include the refinancing rate, GDP growth, unemployment, number of new jobs, and many others. Notably, the currencies mentioned above may react differently to changes taking place in the US economy. Therefore, CAD/HUF could be an indicator of fluctuations in these currencies.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

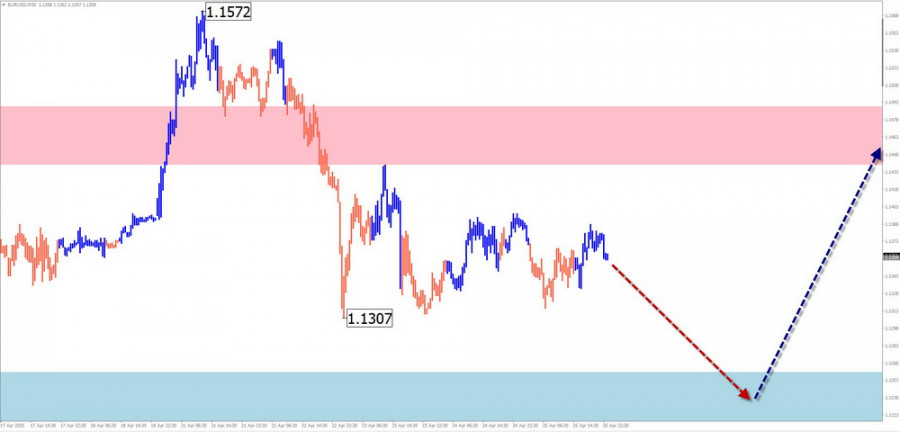

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1363

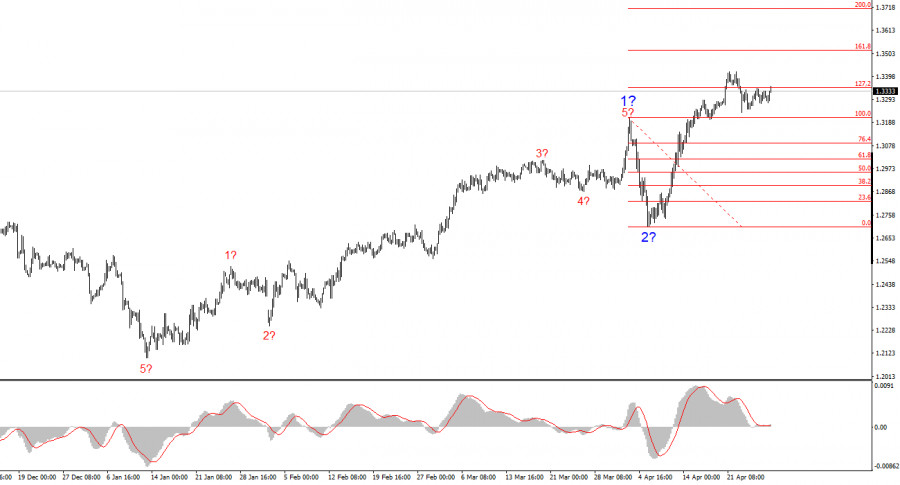

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1243

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

1048

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

958

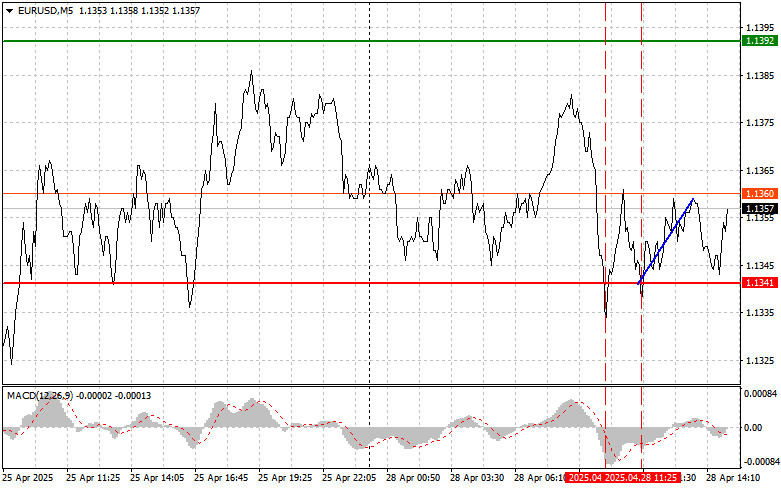

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

898

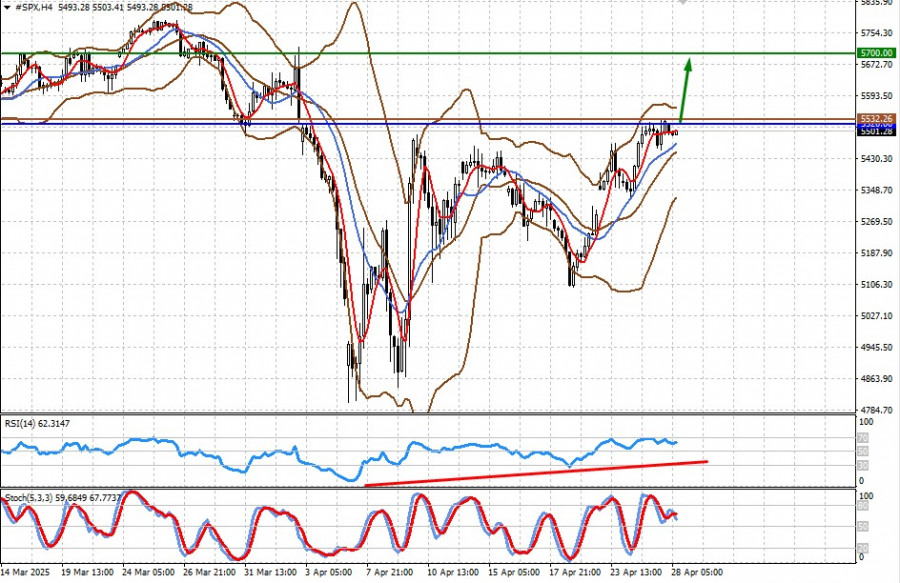

Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their AdvanceAuthor: Jakub Novak

09:06 2025-04-28 UTC+2

883

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

853

Technical analysis / Video analyticsForex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

838

Fundamental analysisThe Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

823

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1363

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1243

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

1048

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

958

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

898

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

883

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

853

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

838

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

823