CHFHKD (Swiss Franc vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

28 Apr 2025 21:15

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CHF/HKD currency pair is the cross rate against the U.S. dollar, which is not very popular on Forex market. As you can see, the U.S. dollar is not present in this currency pair, but it still greatly affects CHF/HKD. Just combine the USD/CHF and USD/HKD charts in the same price chart and you will get the approximate CHF/HKD chart, which proves graphically their interdependence.

Both currencies are under the strong influence from the U.S. dollar. Therefore, for a better forecasting of the future movement of this currency pair, you need to keep in mind the major indicators of the U.S. economy. These indicators include the interest rate, GDP, unemployment, new workplaces indicator and others. Please note that the Swiss franc and the Hong Kong dollar can react in a different way on changes in the economic situation of the United States.

The Swiss economy has been highly developed for several centuries. Thus, the Swiss franc is known as one the most reliable and stable of the world currencies. Because of the reason that this currency is the safest for the capital investment, that is the reason for the capital inflows to this country during the time of the economic crisis, which provokes the sharp increase of the Swiss franc value against other currencies. Don’t forget this peculiarity of the Swiss economy while trading this financial instrument.

To date, the Hong Kong dollar value is attached to the U.S. dollar. The rate of the U.S. dollar against the Hong Kong dollar is from 7.75 to 7.85.

Hong Kong has one of the largest stock exchanges in the world. Thanks to some factors, Hong Kong leaves behind the number of the major European and American stock exchanges. Today the Hong Kong Stock Exchange is regarded as a leader among the financial centers all over the world.

The economy of Hong Kong is characterized by the free trade, low tax rates and the government policy of the non-interference in the state economy. Because of its shortage in mineral and food resources, the economy of this country is highly dependent from these factors. The state revenue is provided by the service sector, the reexport from China and the well developed tourism sector.

In comparison with the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY, this one is relatively illiquid. So when you predict the future movement of this currency pair, you should pay special attention to the currency pairs that consist of the Swiss franc and the Hong Kong dollar in tandem with the U.S. dollar.

Please remember that the spread for cross currency pairs is usually higher than for the more popular ones. Therefore, before dealing with the cross rates read and understand the broker’s conditions for this specified trade instrument.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1228

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1078

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

853

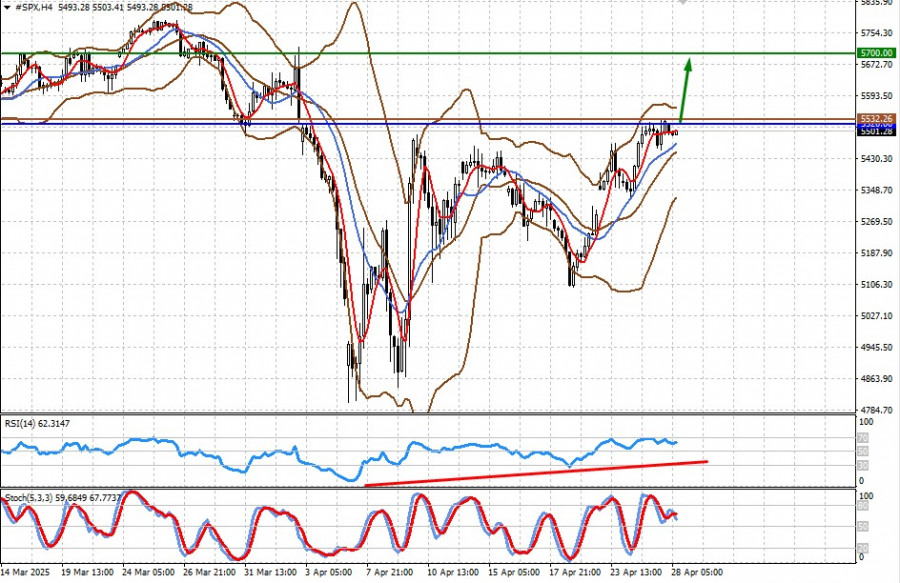

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

793

The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and AppleAuthor: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

748

Fundamental analysisThe Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

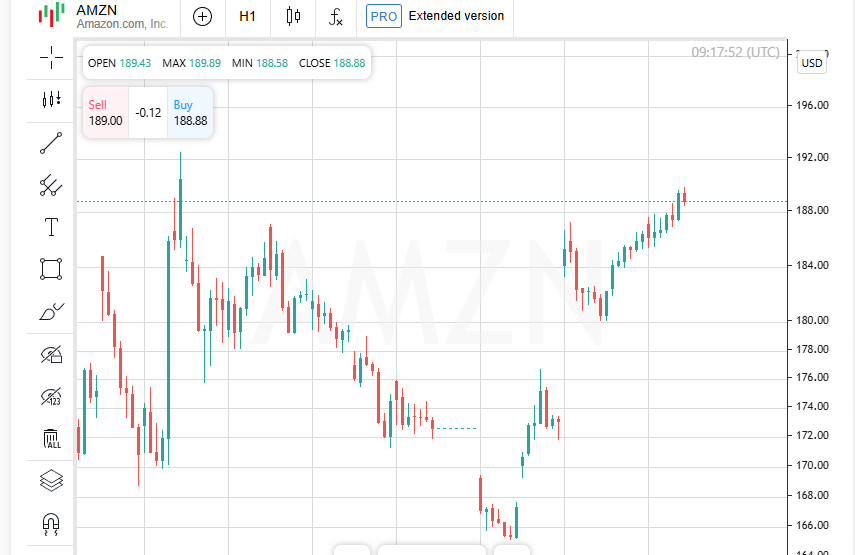

- Trump policy summaries European stocks rose on Monday after a second straight weekly gain Investors are eyeing tariff changes, as well as a busy week of earnings and economic data STOXX 600 index up 0.5% at 0709 GMT; other regional indexes also rose Majors Apple, Microsoft and Amazon to report.

Author: Thomas Frank

11:22 2025-04-28 UTC+2

748

Technical analysisTrading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

688

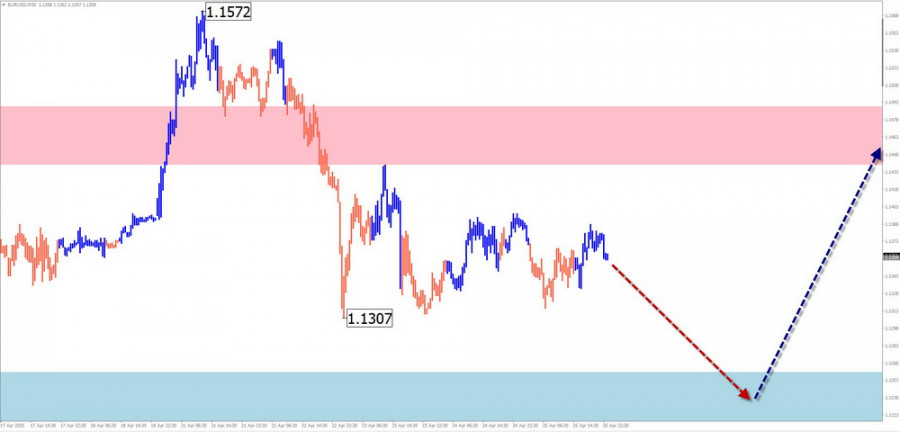

Technical analysisTrading Signals for EUR/USD for April 28-30, 2025: sell below 1.1370 (21 SMA - 7/8 Murray)

On the other hand, if bearish pressure prevails and the euro consolidates below 1.1370, it could be seen as a sell signal with targets at the 6/8 Murray located at 1.1230 and ultimately at the bottom of the downtrend channel around 1.1135.Author: Dimitrios Zappas

16:29 2025-04-28 UTC+2

628

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1228

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1078

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

853

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

793

- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and Apple

Author: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

748

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

- Trump policy summaries European stocks rose on Monday after a second straight weekly gain Investors are eyeing tariff changes, as well as a busy week of earnings and economic data STOXX 600 index up 0.5% at 0709 GMT; other regional indexes also rose Majors Apple, Microsoft and Amazon to report.

Author: Thomas Frank

11:22 2025-04-28 UTC+2

748

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

688

- Technical analysis

Trading Signals for EUR/USD for April 28-30, 2025: sell below 1.1370 (21 SMA - 7/8 Murray)

On the other hand, if bearish pressure prevails and the euro consolidates below 1.1370, it could be seen as a sell signal with targets at the 6/8 Murray located at 1.1230 and ultimately at the bottom of the downtrend channel around 1.1135.Author: Dimitrios Zappas

16:29 2025-04-28 UTC+2

628