See also

10.02.2025 07:40 AM

10.02.2025 07:40 AMCrude Oil (CL)

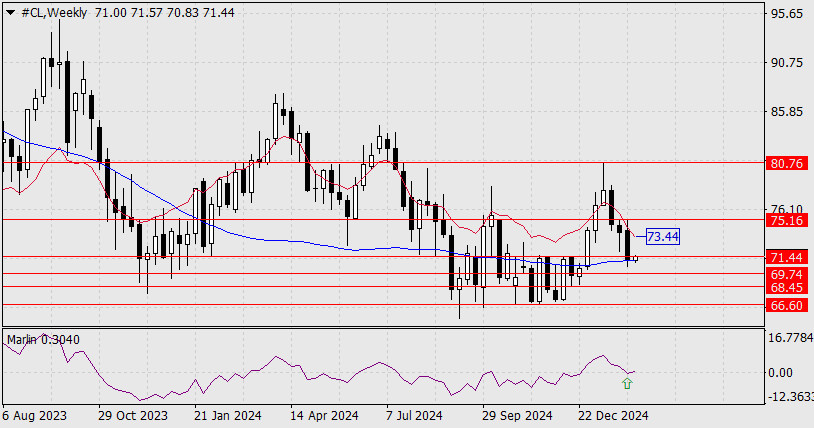

On the weekly chart, the price only briefly declined below the MACD indicator line before rebounding. The new trading week opened above this line, and the price is now testing resistance at 71.44. The Marlin oscillator's signal line is turning upward from the zero level, indicating potential upside momentum.

Given this technical setup, further declines toward 69.74 and 68.45 may not materialize. Instead, there is a higher probability of a rally toward 75.16.A break and consolidation above 71.44 will open the way toward the MACD line resistance at 73.44. If the price holds above 73.44, the next upward target will be 75.16.

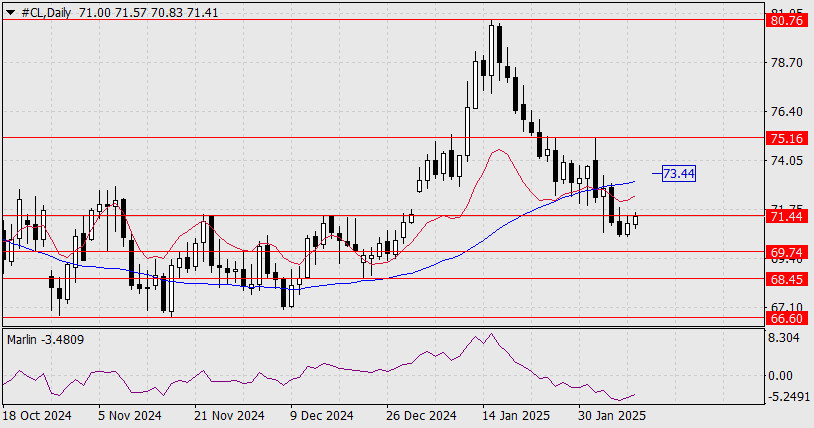

On the H4 timeframe, the MACD line is pressing against the 71.44 level from above, making it a key resistance zone. A confirmed breakout above this level would reinforce the bullish outlook, significantly strengthening buyers' positions. By the time this occurs, the Marlin oscillator is expected to enter positive territory, further supporting upward momentum.

Overall, the technical structure suggests a bullish shift, with key resistance levels 73.44 and 75.16 as potential targets.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Early in the American session, the EUR/USD pair is trading around 1.1378 within the downtrend channel formed on April 17 and showing signs of exhaustion of bullish strength. A technical

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Early in the American session, gold is trading around 3,384, above key support and rebounding after reaching 3,267. Gold is expected to regain strength if it consolidates above 3,381 (6/8

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

With the appearance of Divergent and Descending Broadening Wedge patterns on the 4-hour chart of the AUD/JPY cross currency pair, although its price movement is below the EMA (21) which

On the 4-hour chart of the main currency pair USD/JPY, it can be seen that the Stochastic Oscillator indicator forms a Double Bottom pattern while the price movement of USD/JPY

Early in the American session, gold is trading around the 3,310 level, where it is located at the 21SMA and within a symmetrical triangle pattern formed on April 23. Consolidation

Our trading plan for the coming hours is to sell below 1.1410 with targets at 1.1370 and 1.1230. The eagle indicator is giving a negative signal, so we believe

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.