See also

25.02.2025 01:30 PM

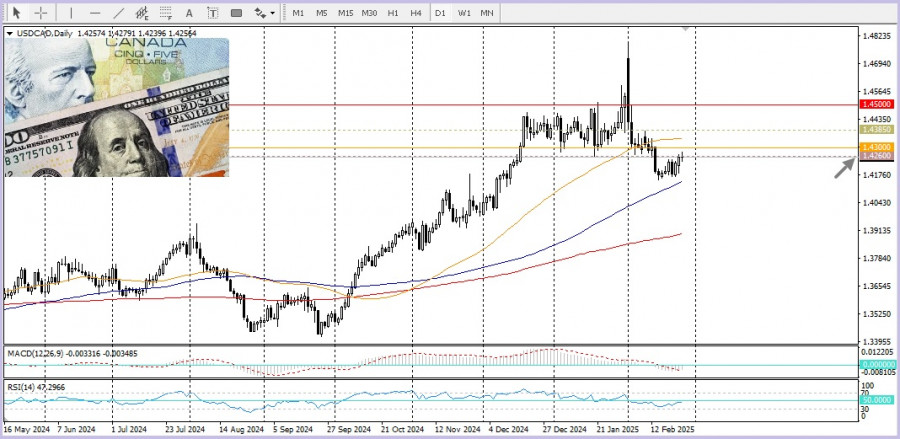

25.02.2025 01:30 PMAfter gaining during the Asian session, USD/CAD has stalled, trading below the 1.4260 level.

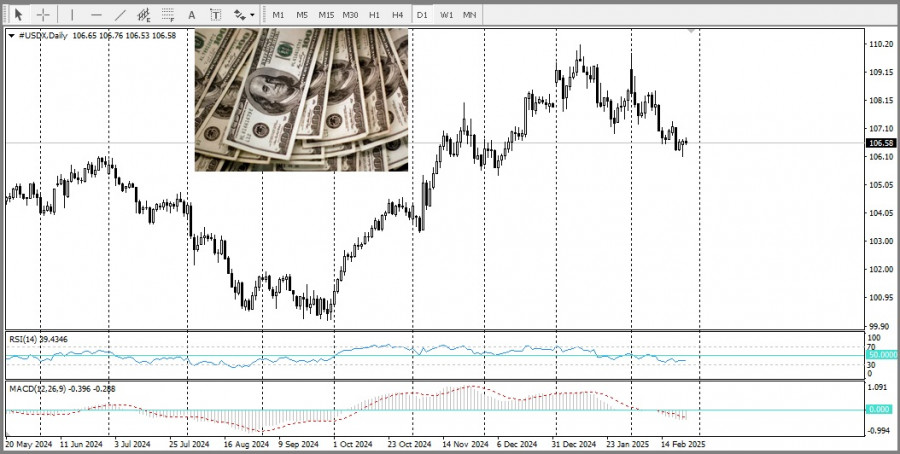

This decline comes amid a slight weakening of the U.S. dollar.

Recent weak macroeconomic data from the U.S., particularly preliminary PMI indices, showed that private sector business activity in February fell to a 17-month low. This reinforced expectations of potential Federal Reserve rate cuts later this year, weighing on the U.S. dollar index.

Additionally, the recovery in crude oil prices is supporting the Canadian dollar, exerting further downward pressure on USD/CAD.

The increase in consumer inflation in Canada has led investors to reconsider their expectations regarding a potential rate cut by the Bank of Canada at its next March 12 meeting. This factor bolsters the Canadian dollar and contributes to the bearish sentiment surrounding USD/CAD.

However, concerns over the economic impact of the tariffs imposed by U.S. President Donald Trump may limit aggressive buying of the Canadian dollar. Trump confirmed that tariffs on imports from Canada and Mexico will take effect on March 4, adding a layer of uncertainty to market sentiment.

Traders should focus on the release of the U.S. Consumer Confidence Index, which, along with speeches from FOMC members, could influence the U.S. dollar and provide new momentum for USD/CAD.

Additionally, crude oil price movements could create short-term trading opportunities during the U.S. session.

From a technical perspective, oscillators on the daily chart remain firmly in negative territory, suggesting that the path of least resistance for USD/CAD is to the downside.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets are already fatigued by the chaos unfolding in Donald Trump's mind and among his followers. Everything remains extremely unclear, so market participants are now fully focused on today's important

A considerable number of macroeconomic events are scheduled for Wednesday, but we doubt they will have any meaningful impact on currency pair movements. The market continues to ignore most macroeconomic

The GBP/USD currency pair saw a slight downward correction after Monday's rise, which came out of nowhere. However, it's difficult to call this minor move a "dollar recovery." The U.S

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.