See also

28.02.2025 02:12 PM

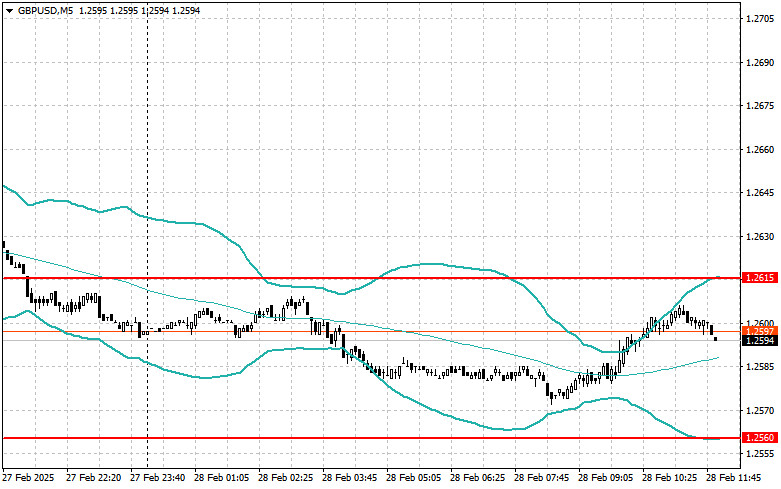

28.02.2025 02:12 PMDue to cautious market sentiment following yesterday's comments from Donald Trump and a major sell-off in risk assets, there was little notable activity in terms of trades during the first half of the day. The British pound nearly provided an entry point under the Mean Reversion strategy, but a reversal did not materialize.

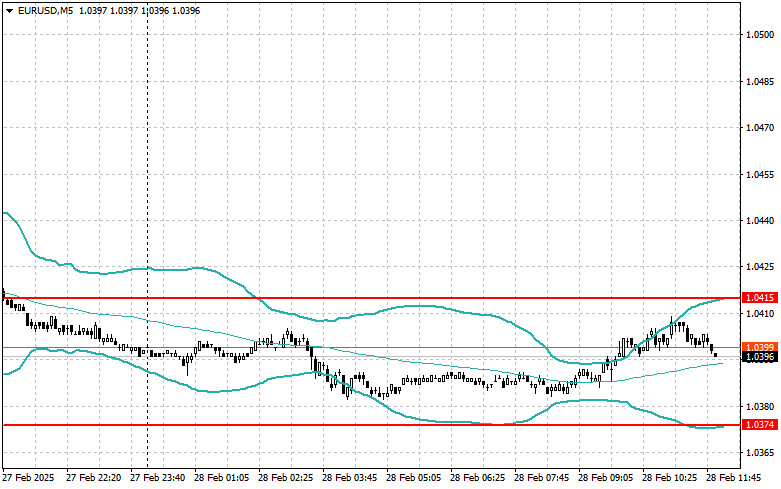

Disappointing economic data from Germany and France weighed on the euro earlier in the day. This negative trend highlights persistent weakness in consumer demand in the eurozone's largest economy, adding pressure on the single currency. Traders also fear that declining consumer activity could further delay the region's economic recovery, which, as reflected in yesterday's reports, is already struggling. Additionally, expectations of future ECB rate cuts continue to dampen enthusiasm among euro buyers.

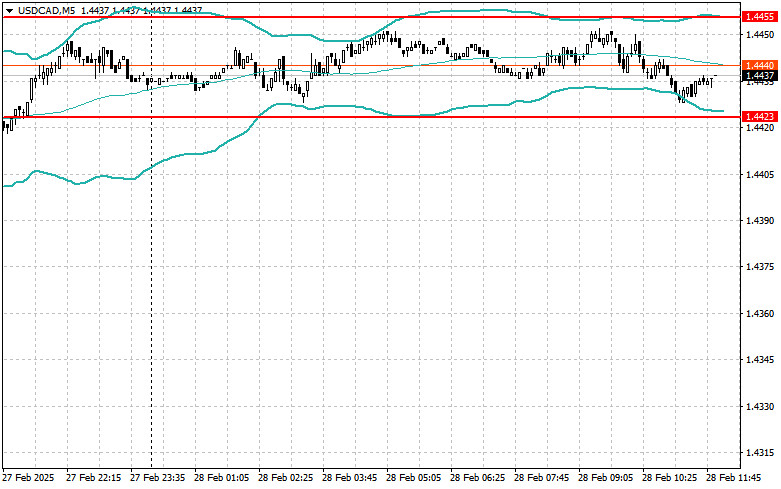

This afternoon, the focus will shift to the Core Personal Consumption Expenditures (PCE) Index, a key indicator for U.S. inflation trends. A higher-than-expected reading could trigger a strong rally in the U.S. dollar, as it would suggest that the Federal Reserve may delay interest rate cuts. Alongside this, data on consumer spending, personal income, trade balance, and the Chicago PMI index will serve as the final macroeconomic events of the week. Weak figures could erode the dollar's strength.

If the economic data is strong, I will focus on implementing the Momentum strategy. If the market fails to react decisively, I will continue using the Mean Reversion strategy.

Mean Reversion Strategy (Reversal Trading) for the Second Half of the Day:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 142.54 level in the second half of the day coincided with the MACD indicator just beginning to move downward from the zero line, confirming a correct

The test of the 1.3400 level in the second half of the day coincided with the MACD indicator just beginning to move upward from the zero line, confirming a correct

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.