See also

08.04.2025 11:49 AM

08.04.2025 11:49 AMThe world is a stage, and people are its actors. Tragicomedies happen every day in financial markets, but what happened at the start of the second week of April is mesmerizing. In just a few minutes, the capitalization of the US stock market surged by $2.4 trillion thanks to a false message on social media. Its denial by the White House caused the S&P 500 to plummet. What's the message? What did the rollercoaster ride on Wall Street reveal? The nerves of investors, stretched like strings? Or was it the time to buy American stocks?

If you want to make money, use your imagination. If you're thinking about how to make big money, come up with something that will make your hair stand on end.

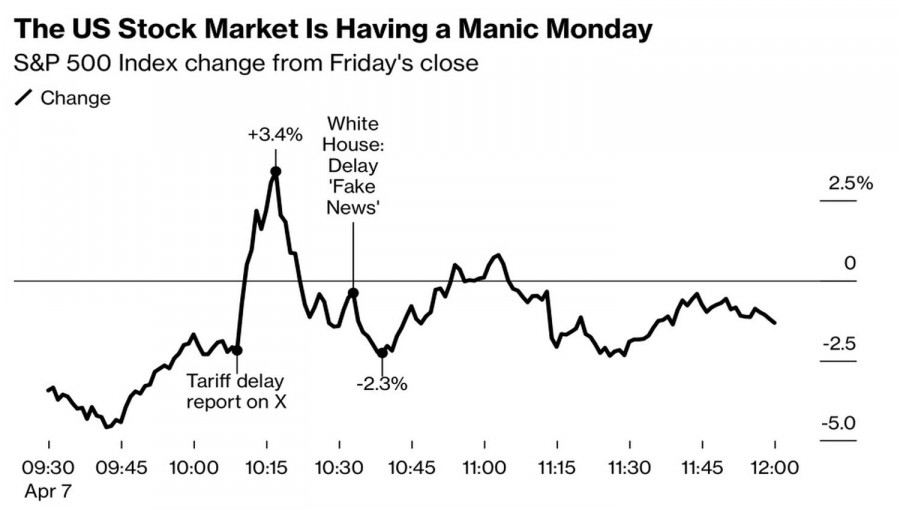

Someone created a fake Bloomberg account on social media, posted news from the popular media agency for a long time, and gained millions of followers with one goal. On one spring day, they posted information that Hassett was considering a 90-day pause in tariffs against all countries except China. The news was so hot that it was immediately picked up by CNBC and Reuters. The S&P 500 surged, only to fall again.

The S&P 500's reaction to the White House's tariff pause news

No doubt, investors are unnerved. They are worried about what the White House's protectionist policies might do to the US economy. Tariffs on imports and trade wars threaten a global recession. When fear rules market sentiment, no one wants to buy stocks.

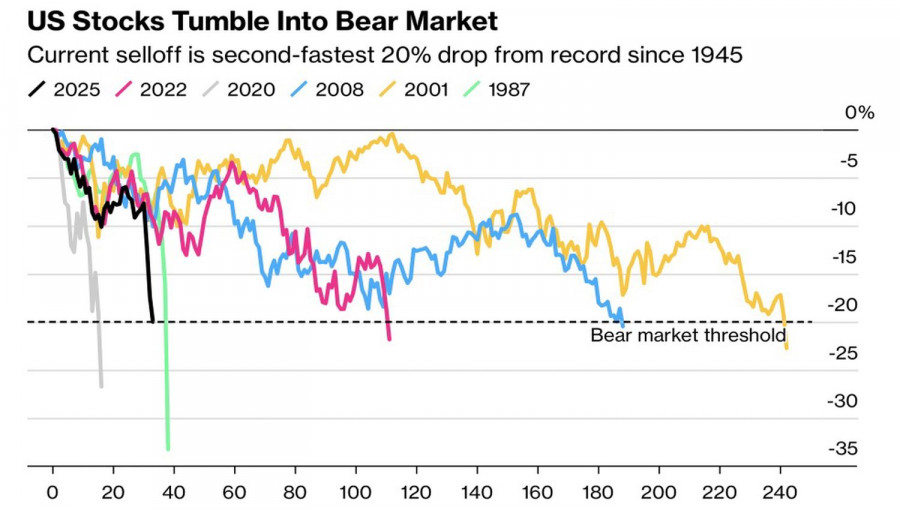

On the other hand, the S&P 500 fell by 20% from its February peak, entering the bear market. This was the second-fastest slump since 1945. The first occurred during the COVID-19 pandemic, forcing the Federal Reserve to throw a lifeline to the US economy with mind-boggling monetary stimuli.

The dynamics of the S&P 500's transitions into a bear market

In such conditions, investors are trying to puzzle out whether the worst has already happened and it is now time for negotiations and tariff rollbacks. Following this logic, is it the right time to buy stocks? If fear shifts to greed, the S&P 500 rally could be so fast that it will take your breath away. The fake news on social media is proof of that. What is needed is one good piece of news to enable the broad stock index to rise from the ashes.

I don't think the tough times are behind us. At least one trade war, between the US and China, has already started. According to UBS, a recession in the US economy could result in zero corporate profit growth, as every 1 percentage point drop in GDP subtracts 6.9 percentage points from this indicator.

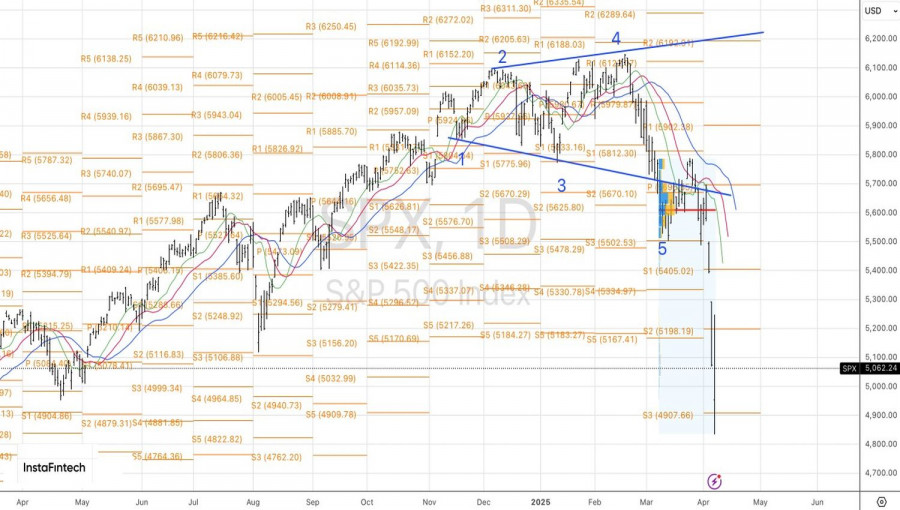

Technically, on the Daily Chart of the S&P 500, a bounce from the support level at 4,905 suggests that the broad stock index may have found a bottom.

There is a high probability of consolidation in the range of 4,900 to 5,200 or 4,900-5,330. It makes sense to sell during a rise to its upper border and buy during a drop to the lower border. In the latter case, you need to think three times, as catching falling knives is extremely dangerous.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets remain tense. The U.S. Dollar Index and the cryptocurrency market are stagnating, caught between opposing forces. Investors are tensely awaiting the outcome of the Federal Reserve's monetary policy meeting

There are very few macroeconomic events scheduled for Tuesday. In the Eurozone and Germany, the second estimate of April's services PMI will be published, but these are unlikely to attract

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.