See also

14.04.2025 07:31 AM

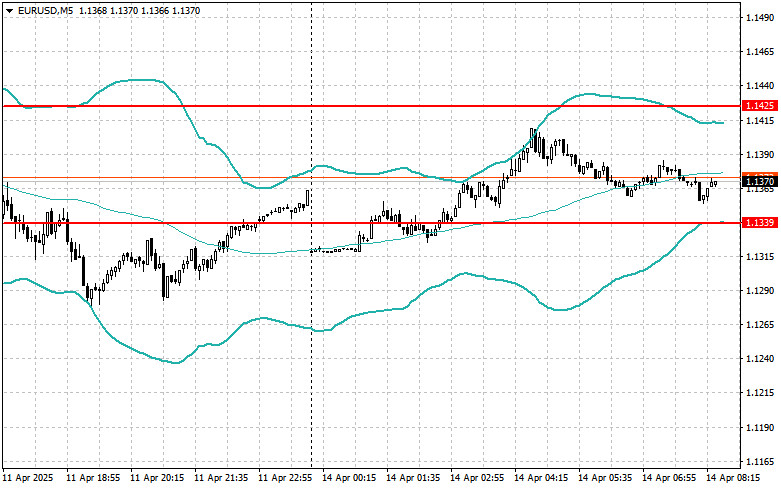

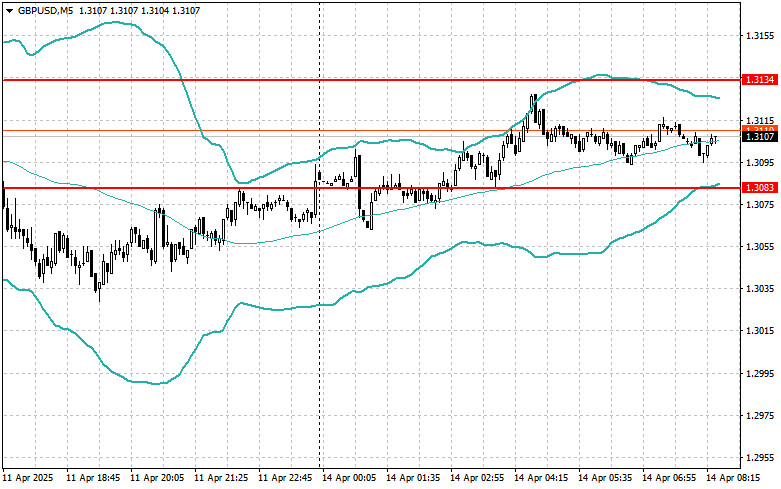

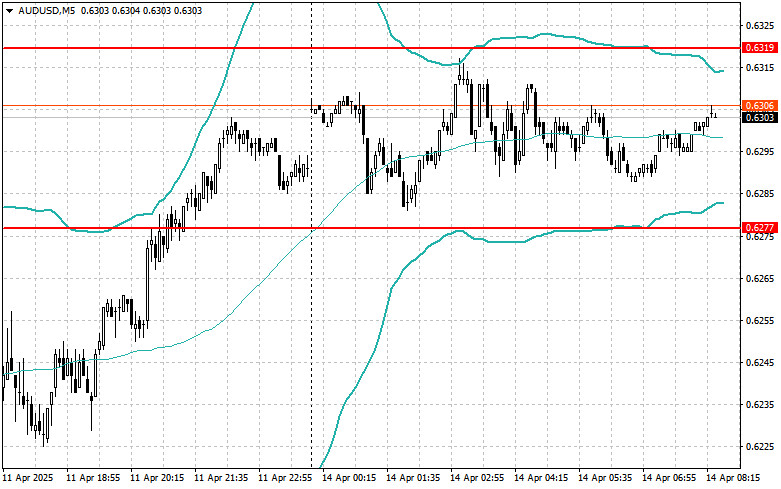

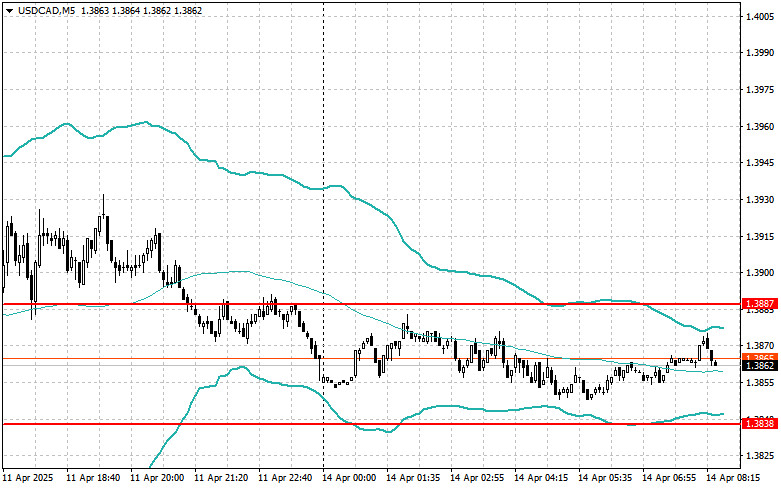

14.04.2025 07:31 AMThe euro and the pound held their positions against the U.S. dollar, rebounding after news that U.S. producer prices in March fell sharply—just like the previous day's core inflation data.

The March U.S. Producer Price Index (PPI) data surprised traders and the Federal Reserve, as the figure declined significantly rather than increasing. This unexpected drop strengthened hopes that inflation in the U.S. will continue to decelerate, although such a scenario remains unlikely given Donald Trump's policies. Nonetheless, the current data allows the Federal Reserve to take a more dovish stance regarding interest rates. Traders interpreted the news as a signal to buy risk assets, putting additional pressure on the U.S. dollar.

If the disinflation trend continues, the Fed may reconsider its policy strategy, potentially leading to further dollar weakness and supporting gains in other currencies. However, it's important to remember that financial markets remain highly volatile—especially under Trump—and any new economic statements from the White House or the Fed could shift current projections.

Today, the euro may continue to rise, as the only scheduled fundamental event is the meeting of EU finance ministers. Without key economic indicators, traders will likely pay close attention to any statements and signals from EU representatives. Their tone, particularly regarding economic stimulus and inflation control plans, could significantly impact the euro's dynamics.

As for GBP/USD, with no UK macroeconomic data on the calendar, buyers of the pair maintain a favorable opportunity to retain dominance. However, a noticeable drop in volatility is likely early in the European session.

The Mean Reversion strategy is preferred if the data matches economists' expectations. The Momentum strategy is more appropriate if the data significantly exceeds or falls short of expectations.

Buying on a breakout above 1.1393 could lead to a rise toward 1.1467 and 1.1562.

Selling on a breakout below 1.1322 could lead to a decline toward 1.1253 and 1.1167.

Buying on a breakout above 1.3139 could lead to a rise toward 1.3204 and 1.3262.

Selling on a breakout below 1.3084 could lead to a decline toward 1.3032 and 1.2986.

Buying on a breakout above 143.29 could lead to a rise toward 143.77 and 144.17.

Selling on a breakout below 142.86 could trigger a decline toward 142.32 and 141.82.

Look to sell after a failed breakout above 1.1425 with a return below that level.

Look to buy after a failed breakout below 1.1339 with a return to that level.

Look to sell after a failed breakout above 1.3134 with a return below that level.

Look to buy after a failed breakout below 1.3083 with a return to that level.

Look to sell after a failed breakout above 0.6319 with a return below that level.

Look to buy after a failed breakout below 0.6277 with a return to that level.

Look to sell after a failed breakout above 1.3887 with a return below that level.

Look to buy after a failed breakout below 1.3838 with a return to that level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Trade analysis and trading tips for the Japanese yen The test of the 142.51 price level occurred when the MACD indicator had already moved significantly below the zero mark, which

Trade analysis and trading tips for the British pound The test of the 1.3257 price level occurred when the MACD indicator had already moved significantly below the zero mark, which

The price test at 142.93 occurred when the MACD indicator had just started moving downward from the zero mark, confirming a valid entry point for selling the dollar

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.