See also

14.04.2025 09:12 AM

14.04.2025 09:12 AMOver the past weekend, Bitcoin and Ethereum demonstrated decent resilience, maintaining a chance for further recovery. While from a technical standpoint, those chances may appear rather slim, trading within a sideways channel certainly looks more appealing than initiating new sell-offs. In any case, the future direction of the cryptocurrency market will largely depend on the behavior of the U.S. stock market, with which crypto has recently shown a high correlation.

On Sunday, Senator Tim Scott, Chairman of the Senate Banking Committee, said he expects a cryptocurrency market structure bill to become law by August. He also noted that the committee introduced a bill on comprehensive stablecoin regulation, the GENIUS Act, in March 2025, identifying crypto policy as a priority.

The bill is expected to clarify the legal framework governing cryptocurrencies, define the roles and responsibilities of various regulators, and establish consumer protection standards. The long-standing lack of clear regulation has hampered industry development, creating uncertainty and deterring institutional capital. The bill's successful passage could catalyze further growth and innovation in the crypto space, fostering the evolution of new technologies and business models. Many experts believe a clear regulatory framework will attract more retail and institutional investors, increasing market liquidity and stability.

Earlier, Trump stated that he wanted stablecoin regulation in the U.S. to be finalized by August.

I will continue to trade based on major dips in Bitcoin and Ethereum, betting on a continuation of the intact mid-term bullish trend.

Below are the strategies and conditions for short-term trading.

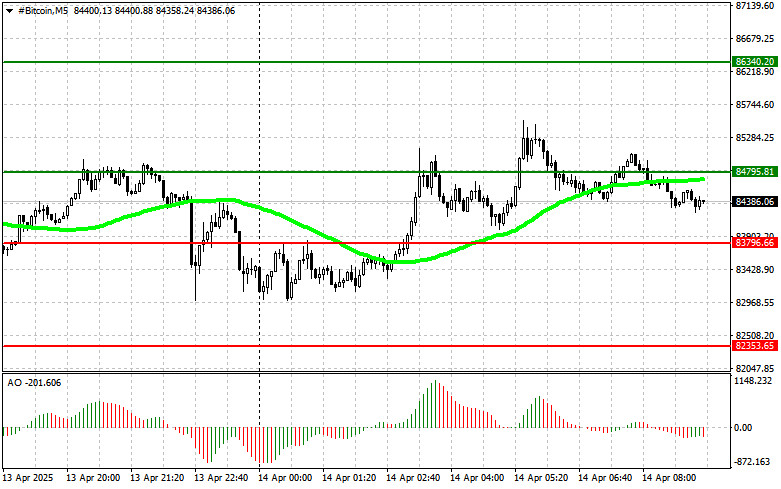

Scenario #1: I plan to buy Bitcoin today at the entry point around $84,800, targeting a rise to $86,300. I will exit long positions around $86,300 and sell immediately on the pullback.Precondition: The 50-day moving average must be below the current price, and the Awesome Oscillator should be in positive territory.

Scenario #2: Bitcoin can also be bought from the lower boundary at $83,800 if there's no market reaction to its breakout, with targets at $84,850 and $86,300.

Scenario #1: I plan to sell Bitcoin today at the entry point around $83,800, targeting a drop to $82,500. I will exit short positions at $82,500 and buy immediately on the bounce.Precondition: The 50-day moving average must be above the current price, and the Awesome Oscillator should be in negative territory.

Scenario #2: Bitcoin can also be sold from the upper boundary at $84,850 if there's no market reaction to its breakout, with targets at $83,800 and $82,300.

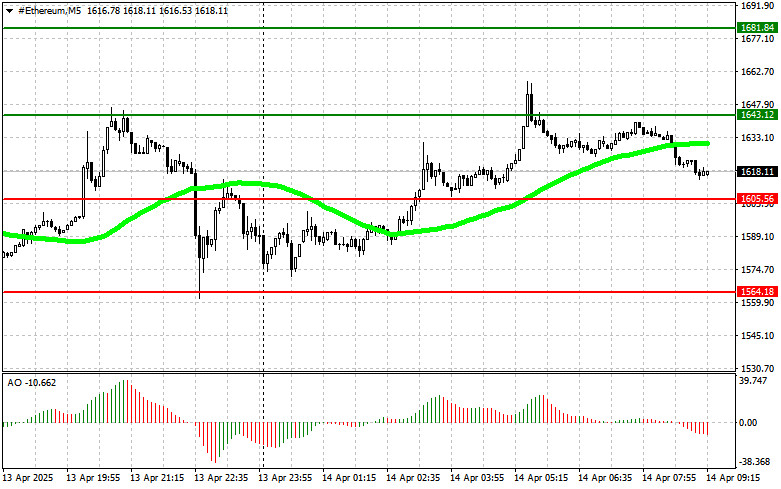

Scenario #1: I plan to buy Ethereum today at the entry point around $1,643, targeting a rise to $1,681. I will exit long positions at $1,681 and sell immediately on the pullback.Precondition: The 50-day moving average must be below the current price, and the Awesome Oscillator should be in positive territory.

Scenario #2: Ethereum can also be bought from the lower boundary at $1,605 if there's no market reaction to its breakout, with targets at $1,643 and $1,681.

Scenario #1: I plan to sell Ethereum today at the entry point around $1,605, targeting a drop to $1,564. I will exit short positions at $1,564 and buy immediately on the bounce.Precondition: The 50-day moving average must be above the current price, and the Awesome Oscillator should be in negative territory.

Scenario #2: Ethereum can also be sold from the upper boundary at $1,643 if there's no market reaction to its breakout, with targets at $1,605 and $1,564.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

While financial mainstream market participants are mulling over recession risks and interest rates, Bitcoin is steadily gaining ground. April has turned out to be the strongest month for the leading

Bitcoin is being pressured, but it still holds up quite confidently. After rebounding from the $92,000 mark, the first cryptocurrency returned to the $94,000 area, maintaining good growth prospects

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.