See also

14.04.2025 09:45 AM

14.04.2025 09:45 AMDo you have a plan, Mr. Donald Trump? Some believe what's happening is masterful diplomacy — they hope that once serious proposals from other countries reach the White House, tariffs will be lifted, GDP will accelerate to 3%, and the S&P 500 will hit new record highs. Others are convinced that import tariffs will drive the U.S. economy into a recession, causing the broad stock index to resume its decline. One thing is clear: investors are tired of uncertainty and hope that clarity regarding the new trade regime will enable them to buy stocks. But not so fast.

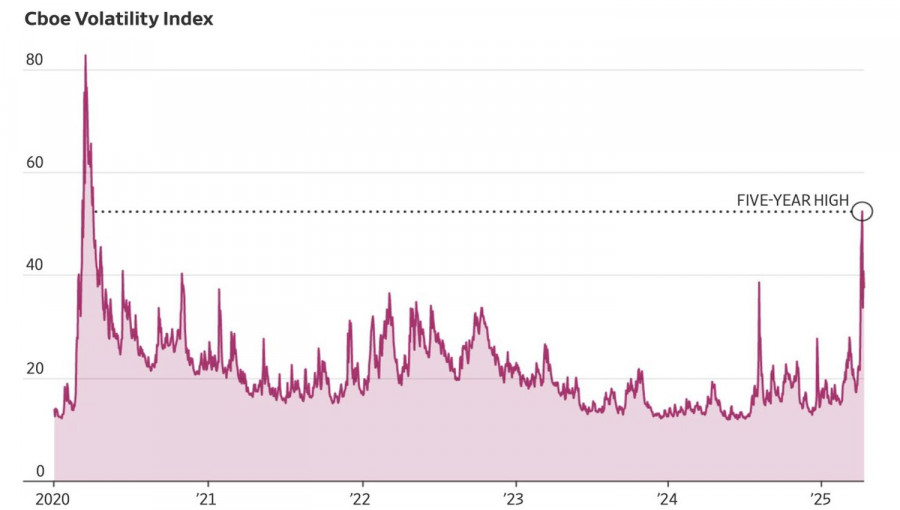

Following the announcement of sweeping tariffs, we witnessed ten days of historic turbulence in financial markets. The S&P 500's market cap plunged by $5.8 trillion only to surge again by $4 trillion. The White House alternated between imposing tariffs and announcing postponements. One day, it raised the stakes against Beijing to 145%; the next, it exempted $100 billion worth of popular Chinese electronics from duties — about 23% of total imports from China. Is it any surprise that the VIX surged to its highest levels since March 2020? Is fear still ruling the market?

Yes and no. There's an aversion to American assets due to the White House's constantly shifting tone and decisions. At the same time, we're seeing a resurgence of FOMO — the "buy or miss out" strategy. Indeed, the pullback in the S&P 500 has left investors stuck in a "tempted but cautious" state of mind.

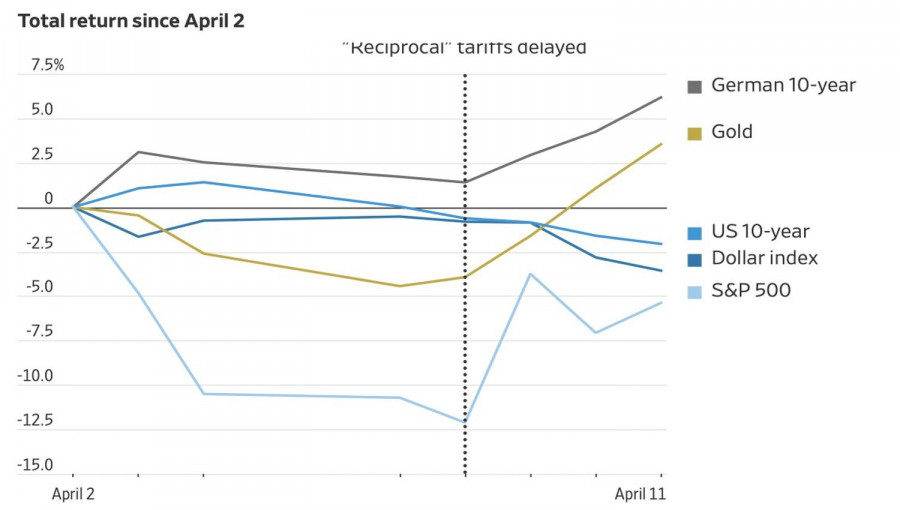

This historic volatility has made safe-haven assets the winners: gold, the Japanese yen, and the Swiss franc. At first glance, the euro's strength might seem illogical, but considering that German bonds have become beneficiaries of the White House's erratic decisions — as opposed to U.S. Treasuries — it all starts to make sense.

Investors are confident that Europe and China will stimulate their economies to counteract the negative impact of tariffs and trade wars. Meanwhile, Trump's loosening grip on the European Union has accelerated the outflow of capital from the US to the EU, putting pressure on the S&P 500.

Furthermore, Wall Street Journal experts have raised the probability of a U.S. recession within the next 12 months from 22% to 45%. The GDP forecast for 2025 has been downgraded from 2% to 0.8%, with some analysts expecting a 2% contraction this year. Others, however, are betting on a swift tariff rollback and GDP expansion to 3%. The first scenario appears more likely — suggesting the stock market is not out of the woods yet. The rough patch is far from over.

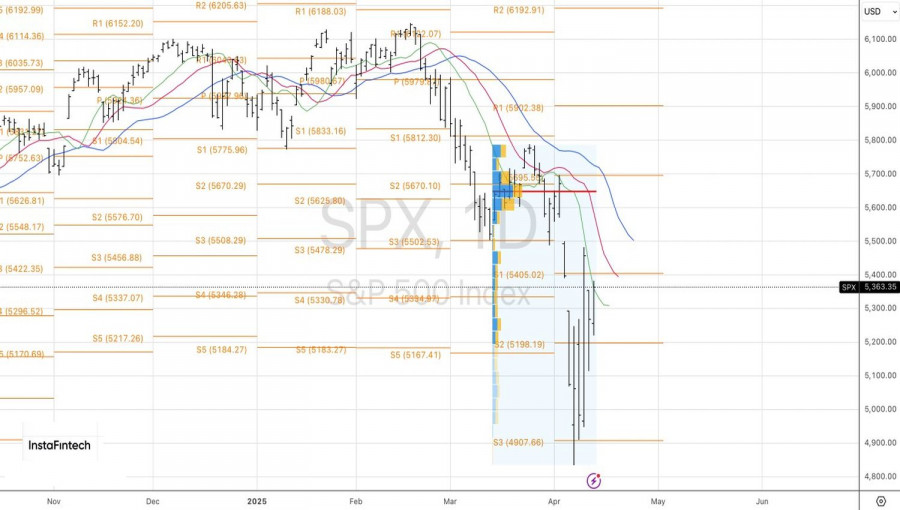

From a technical perspective, an inside bar was played out on the S&P 500's daily chart, allowing for the formation of long positions. Now it's time for the second phase of the previously announced strategy: profit-taking on long positions and selling on pullbacks from resistance at 5500 and 5600.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.