See also

15.04.2025 06:46 PM

15.04.2025 06:46 PMTrade Review and Euro Trading Tips

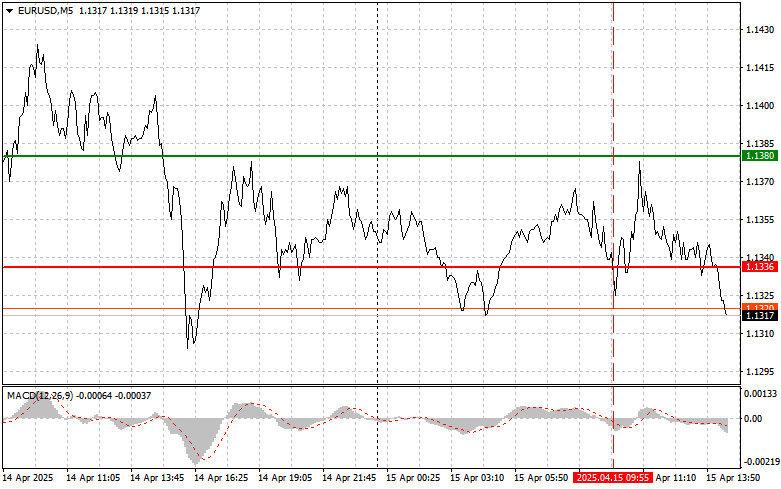

The test of the 1.1336 price level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the downward potential of the pair. For this reason, I didn't sell the euro. I didn't receive any other entry signals either.

Despite weak IFO figures from Germany and the eurozone, which failed to support EUR/USD's upward movement, the market managed to avoid significant losses. In the near term, EUR/USD could continue rising, but this depends heavily on upcoming economic reports and statements from European Central Bank (ECB) officials. Any signals of tighter monetary policy or positive changes in the eurozone economy could push EUR/USD higher. However, one shouldn't ignore the risks tied to global economic instability and Donald Trump's geopolitical agenda, with his daily threats of new tariffs.

Today's Empire Manufacturing Index and U.S. Import Price Index releases may influence the market. Only significantly strong readings could spark increased demand for the dollar. If the figures disappoint, pressure on the dollar will resume, and the euro may continue climbing.

As for the intraday strategy, I will rely primarily on the implementation of Scenario #1 and #2.

Buy Signal

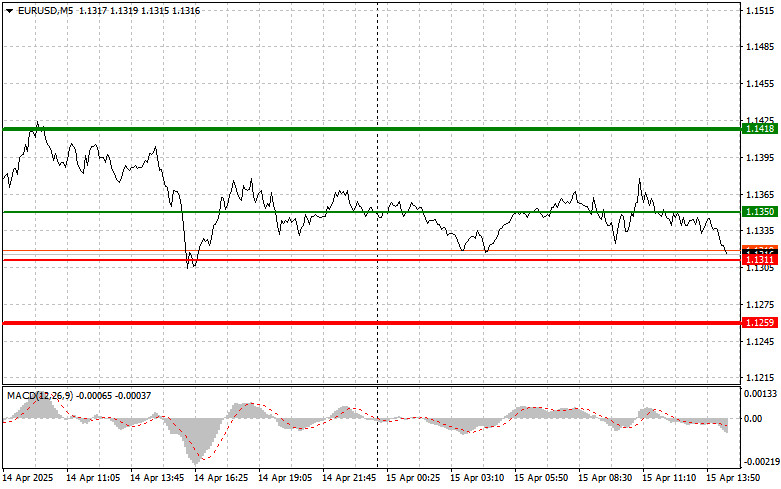

Scenario #1: Today, I plan to buy the euro at around 1.1350 (green line on the chart), aiming for a rise to 1.1418. At 1.1418, I plan to exit the market and open short positions in the opposite direction, expecting a 30–35 point move from the entry point. This trade is in line with the continuation of the bullish trend.Important: Before buying, make sure the MACD is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the euro if there are two consecutive tests of the 1.1311 level while MACD is in the oversold zone. This will limit the pair's downward potential and signal a reversal upward. A rise to the 1.1350 and 1.1418 levels can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after the price reaches 1.1311 (red line on the chart), with a target at 1.1259. There, I'll exit the market and immediately open long positions in the opposite direction, aiming for a 20–25 point rebound. Selling pressure will return if U.S. economic data is strong.Important: Before selling, ensure the MACD is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro if there are two consecutive tests of the 1.1350 level while MACD is in the overbought zone. This will limit the upward potential of the pair and signal a downward reversal. A drop to the 1.1311 and 1.1259 levels can be expected.

Chart Legend:

Important Notice for Beginners:

Beginner Forex traders must be extremely cautious when entering the market. It's best to stay out of trades before the release of key fundamental reports to avoid sudden price swings. If you choose to trade during news events, always set stop-loss orders to minimize losses. Trading without stop-losses can lead to rapid account depletion, especially if you don't practice proper money management and trade with large volumes.

And remember: to trade successfully, you need a well-defined trading plan—just like the one provided above. Making impulsive trading decisions based on current market conditions is an inherently losing strategy for intraday traders.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Trade analysis and trading tips for the Japanese yen The test of the 142.51 price level occurred when the MACD indicator had already moved significantly below the zero mark, which

Trade analysis and trading tips for the British pound The test of the 1.3257 price level occurred when the MACD indicator had already moved significantly below the zero mark, which

The price test at 142.93 occurred when the MACD indicator had just started moving downward from the zero mark, confirming a valid entry point for selling the dollar

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.