See also

15.04.2025 07:03 PM

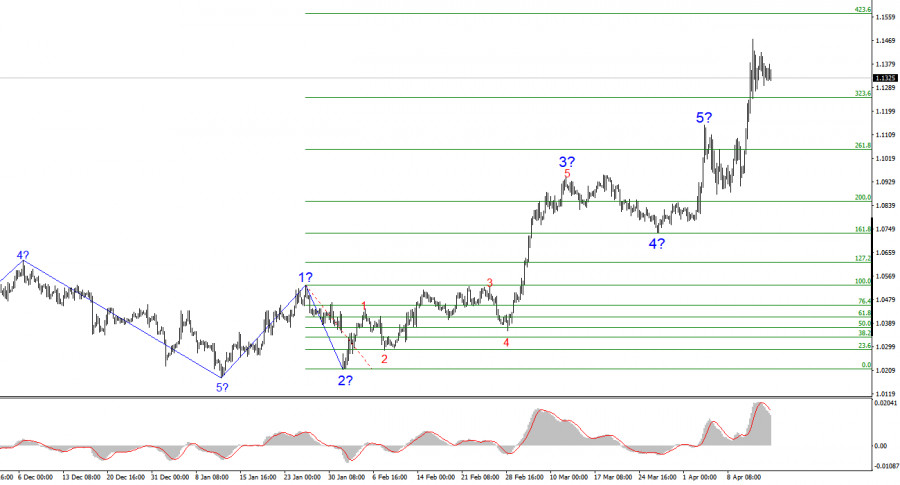

15.04.2025 07:03 PMThe wave structure on the 4-hour chart for EUR/USD has shifted into a bullish formation. I believe there's little doubt that this transformation is entirely due to the new U.S. trade policy. Until February 28 — when the sharp decline in the U.S. dollar began — the entire wave pattern resembled a clear downward trend. A corrective wave 2 was in progress. However, weekly announcements by Donald Trump about new tariffs had their effect. Demand for the U.S. dollar began to plummet, and the entire trend segment that began on January 13 has now taken the shape of a five-wave impulse.

Moreover, the market didn't even manage to form a convincing wave 2 as part of the new bullish trend segment. We only saw a minor pullback, smaller than the corrective waves within wave 1. Nevertheless, the U.S. dollar may continue to decline — unless Donald Trump completely reverses his current trade policy. We've already witnessed one instance where the news backdrop reshaped the wave pattern. A second such occurrence is entirely possible.

The EUR/USD exchange rate barely moved on Tuesday — a rarity in recent forex trading. Admittedly, the U.S. session (the most active one) is still ahead, but overall market activity today has been extremely low. It's clear that traders have already priced in Trump's tariffs, the repeated escalation of the trade war between the U.S. and China, and the president's latest announcement of new tariffs targeting semiconductors. Now, everyone is waiting for further developments in the trade war.

As I previously mentioned, the current wave pattern is highly dependent on the news background — specifically that relating to the global trade conflict. We haven't seen a proper wave 2 in the new upward trend segment, and wave 3 can only develop into a convincing and extended formation if Trump continues to impose tariffs. That's been a necessary condition for the dollar's recent weakness. If no new tariffs are introduced — or if they are minor and final — the market will no longer dump the dollar like it has in recent months. In such a case, how can the pair climb another 500–700 points to give wave 3 its full shape? Unfortunately, right now it is the news flow that drives the market, while the wave patterns only visualize the underlying developments.

Today, industrial production data from the Eurozone came out better than expected — 1.2% vs. a forecast of -0.8% on a monthly basis. As we can see, this report had no impact on the market. Traders are still focused solely on trade war news.

Based on the EUR/USD analysis, I conclude that the pair is continuing to build a new bullish trend segment. Donald Trump's actions reversed the previous downtrend. Consequently, in the near future, the wave pattern will remain entirely dependent on the U.S. president's decisions and policies — something that traders must keep in mind at all times.

Based solely on the wave pattern, I was expecting the development of a three-wave correction forming wave 2. However, wave 2 now appears complete and has taken the form of a single wave. Therefore, wave 3 of the bullish trend segment has begun. Its potential targets could stretch as high as the 1.2500 area, but reaching those goals depends entirely on Trump.

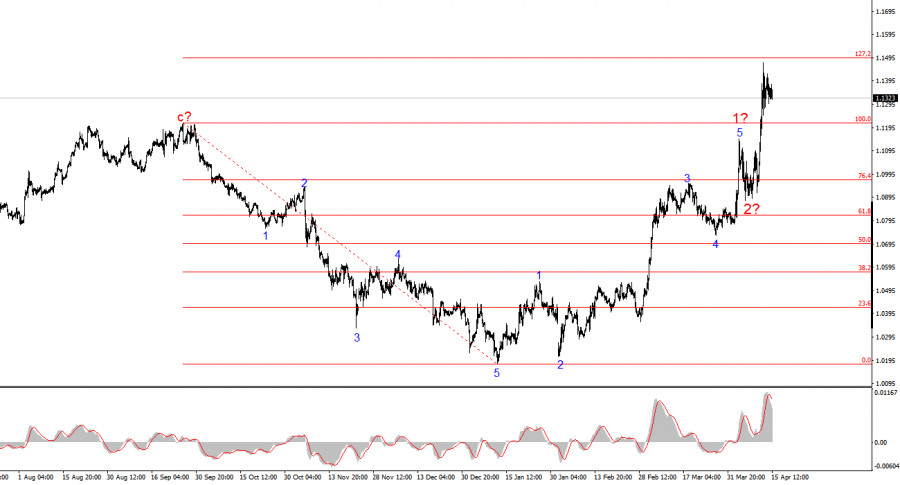

On the higher wave scale, the structure has turned bullish. A long-term uptrend may be forming — but again, Trump's news flow has the power to flip the market upside down at any moment.

My Core Analysis Principles:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

GBP/USD Analysis: On the higher time frame of the pound sterling's major pair, a bullish trend has been forming since July last year. Over the past month, an extended corrective

EUR/USD Analysis: On the 4-hour chart of the euro major pair, an upward trend has been developing since early February. The structure of the wave has been forming its final

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.