See also

23.04.2025 12:08 AM

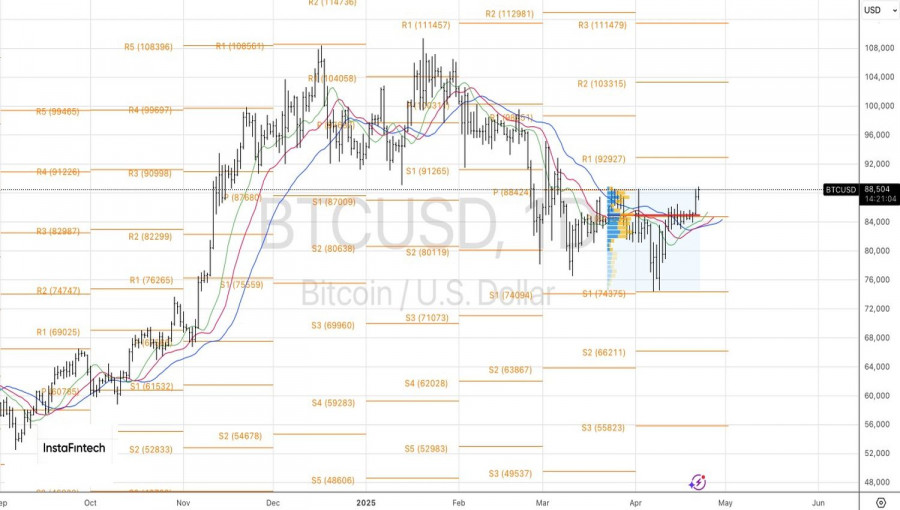

23.04.2025 12:08 AMSlow and steady wins the race! Bitcoin quietly broke through to its highest levels since early March amid Donald Trump's attacks on Jerome Powell. When the independence of the Federal Reserve is at stake and confidence in the U.S. dollar starts to erode—prompting investors to rethink their portfolios—cryptocurrency stands to benefit over other risky assets. BTC/USD has outpaced U.S. stock indices and continues to push north.

While April may become the worst second month of spring for the Dow Jones since 1932, and the S&P 500 hasn't fared this poorly after the inauguration of any U.S. president since 1928, Bitcoin is capitalizing on the investor exodus from U.S. assets. The catalyst for the BTC/USD rally came from Trump's accusations against the Fed Chair. According to him, Powell is always late and "a major loser."

The Republican demands that the Fed immediately lower the federal funds rate, citing a cooling economy and slowing inflation. However, various financial assets react differently to Trump's attempt to make Powell the scapegoat. U.S. stock indices are falling, as Fed independence has long symbolized American exceptionalism. If that's dismantled, investors will no longer feel safe. Accelerating capital outflows from the U.S. would put further pressure on the S&P 500.

Bitcoin, however, is a different story. It strengthens when trust in fiat currencies—particularly the U.S. dollar—declines. Furthermore, the Fed serves as a lender of last resort, assisting creditors in crisis. If that safety net is removed, depositors could be shaken. Meanwhile, as some crypto companies seek banking licenses and aim to offer payment services, the shift of capital into digital assets looks increasingly logical.

Still, it's too early to fall into euphoria. U.S. stock markets were closed on Friday, and markets in many other countries remained shut on Monday. Liquidity is low, which raises the risk of sharp swings in asset prices. There's no guarantee that technical factors don't drive BTC/USD's rally.

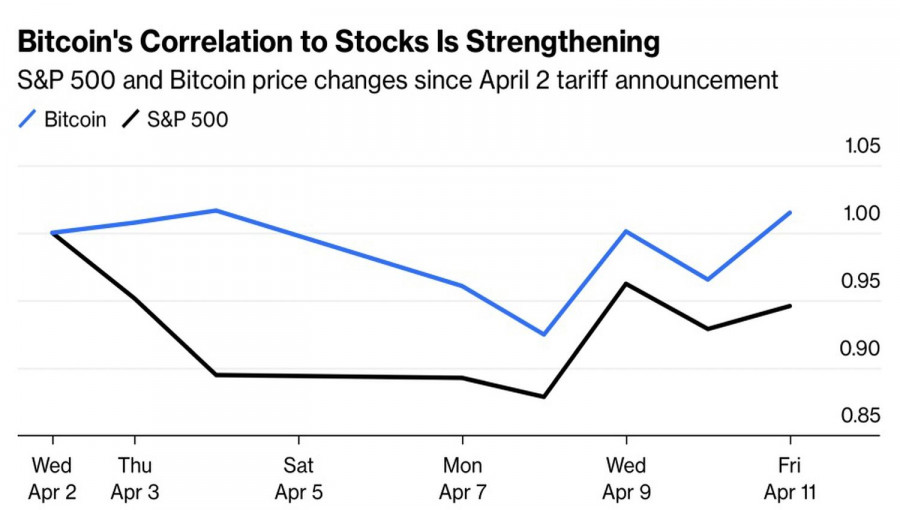

I believe the primary driver of the plunge in U.S. stocks is the capital outflow driven by the White House's uncertain policy and recession fears. Bitcoin can benefit from this, find its niche, and gradually reduce its correlation with the S&P 500, especially now that the crypto industry is receiving increasing support from Donald Trump. This is a man who moves trillions of dollars with social media posts—why shouldn't digital assets capitalize on his loyalty?

Technically, on the daily chart, BTC/USD forms a reversal pattern known as Anti-Turtles with a breakout above fair value—indicating strong bullish intent. Long positions entered from the $83,170 level should be held as long as the price remains above $85,000.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets are already fatigued by the chaos unfolding in Donald Trump's mind and among his followers. Everything remains extremely unclear, so market participants are now fully focused on today's important

A considerable number of macroeconomic events are scheduled for Wednesday, but we doubt they will have any meaningful impact on currency pair movements. The market continues to ignore most macroeconomic

The GBP/USD currency pair saw a slight downward correction after Monday's rise, which came out of nowhere. However, it's difficult to call this minor move a "dollar recovery." The U.S

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.