See also

22.04.2025 07:19 PM

22.04.2025 07:19 PMTrade Breakdown and Tips for Trading the Euro

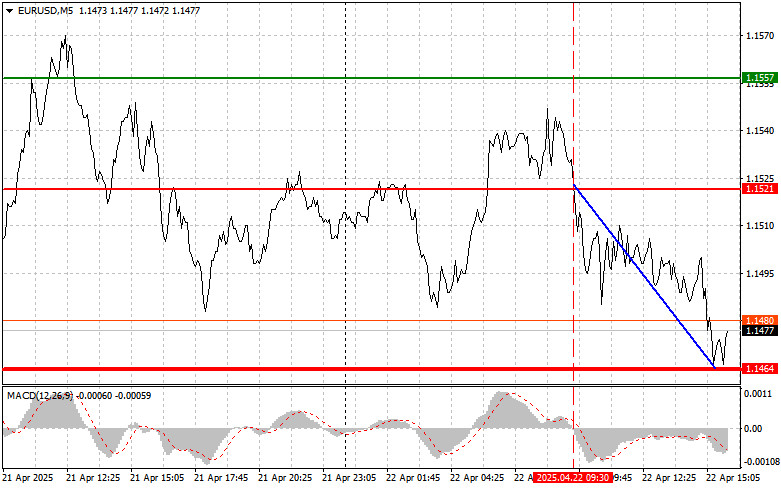

The test of the 1.1521 level occurred when the MACD indicator had just started moving down from the zero line, confirming a valid entry point for short positions on the euro, which resulted in a decline to the target level of 1.1464.

During the U.S. session today, public speeches by FOMC members Philip N. Jefferson and Patrick T. Harker are scheduled. Simultaneously, the Richmond Fed Manufacturing Index will be released. Investors will closely follow these events in hopes of gaining insights into the Federal Reserve's future monetary policy stance. Jefferson's and Harker's statements may reveal their individual views on inflation, the labor market, and growth prospects, potentially shifting market expectations regarding further rate hikes or a pause.

The Richmond Fed Manufacturing Index, while regional, often reflects national trends, as it tracks changes in orders, production volumes, and employment at businesses. Better-than-expected data may support the U.S. dollar. Overall, this combination of factors is likely to increase market volatility during the U.S. session. Market participants are advised to monitor news and analyze the incoming data carefully to make sound decisions in a high-uncertainty environment.

Regarding the intraday strategy, I will continue relying primarily on the implementation of scenarios #1 and #2.

Buy Signal

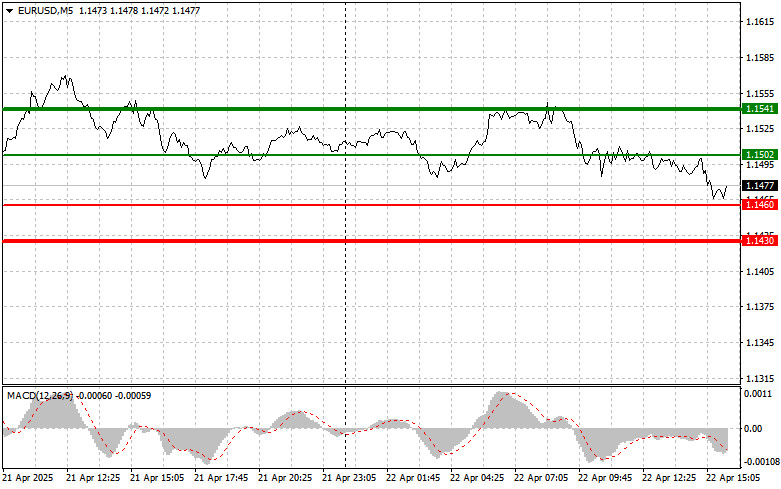

Scenario #1: Buy the euro today after a decline to the area of 1.1502 (green line on the chart) with the target of rising to 1.1541. I plan to exit at 1.1541 and also open short positions from that level, expecting a reversal of 30–35 points. Continued growth of the euro within the current bullish trend is likely. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro if the price tests the 1.1460 level twice, while the MACD is in the oversold zone. This will limit the pair's downward potential and may result in a market reversal upward. In this case, a rise toward 1.1502 and 1.1541 can be expected.

Scenario #1: I plan to sell the euro after the price reaches 1.1460 (red line on the chart). The target will be the 1.1430 level, where I'll close the short and open a long position in the opposite direction (anticipating a 20–25 point rebound). Selling pressure will likely return in the case of strong U.S. data. Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro if the price tests 1.1502 twice, while the MACD is in the overbought zone. This will limit the pair's upward potential and result in a reversal downward. A decline toward 1.1460 and 1.1430 can then be expected.

Chart Explanation

Important: Beginner Forex traders should exercise great caution when entering the market. It is best to stay out of the market before the release of important fundamental reports to avoid getting caught in sharp price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Trading without stop-losses can quickly lead to losing the entire deposit, especially if you do not use money management and trade with large volumes.

And remember, successful trading requires a clear plan, like the one outlined above. Spontaneous trade decisions based on the current market situation are inherently a losing strategy for an intraday trader.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 142.54 level in the second half of the day coincided with the MACD indicator just beginning to move downward from the zero line, confirming a correct

The test of the 1.3400 level in the second half of the day coincided with the MACD indicator just beginning to move upward from the zero line, confirming a correct

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.