See also

23.04.2025 06:45 AM

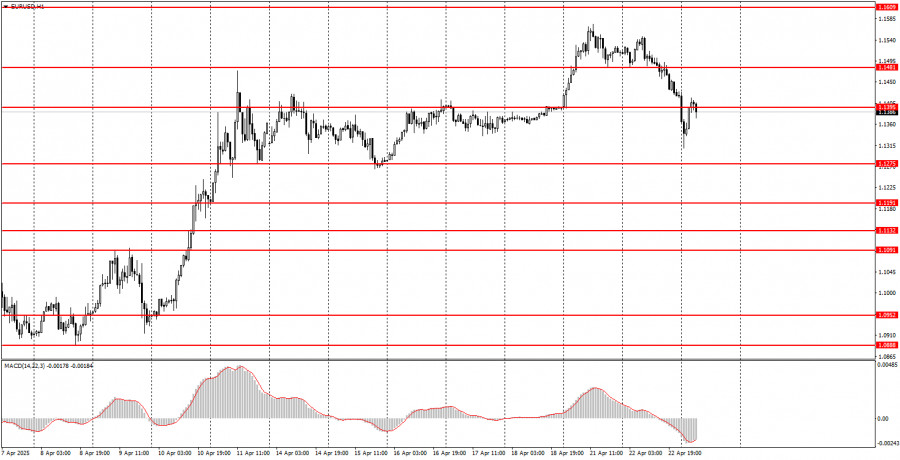

23.04.2025 06:45 AMThe EUR/USD currency pair showed a relatively substantial decline on Tuesday. Euro quotes fell almost throughout the day, with the move intensifying overnight. The drop accelerated after a new round of controversial statements from Donald Trump. This time, the U.S. president said he had changed his mind about firing Federal Reserve Chair Jerome Powell, though he still blamed him for being too slow. Recall that Trump wants the Fed's key interest rate to be lower, while Powell bases his decisions on macroeconomic data when setting rates and other monetary policy programs. Trump also stated that he does not intend to keep tariffs against China at the 145% level. These two headlines sparked a sharp strengthening of the U.S. dollar. However, we are dealing with Donald Trump—if he announces tomorrow that Powell should be fired, it wouldn't come as a surprise. Strong overnight movements were rare in the past, but now they are becoming routine since Trump often conducts interviews at night (from our time zone perspective).

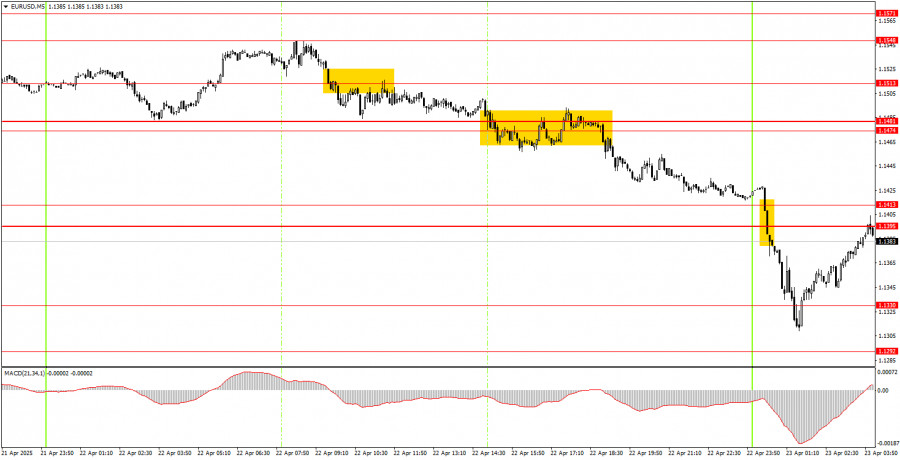

On Tuesday's 5-minute timeframe, several trade signals were generated, but they again left much to be desired. There is currently more chaos than consistency in the market. Quotes declined throughout the day but did so very slowly. Technical levels are reacting very poorly. The intensity of movement constantly changes, as Trump regularly provokes "storms" in the markets with his contradictory statements. Unfortunately, this is the current reality.

On the hourly timeframe, EUR/USD still maintains an upward trend. The new week started with another surge, but Trump triggered a pullback on Tuesday. Overall, the market remains extremely negative toward the U.S. dollar and everything related to the U.S., but if Trump shifts toward de-escalating the trade conflict—which he initiated—then the dollar may regain demand soon.

The pair may move in either direction on Wednesday, as all current market movements still depend on Trump's statements and decisions. No one can know what the U.S. president will say today. In the first half of the day, we would expect some dollar strengthening.

On the 5-minute timeframe, consider the following levels: 1.0940–1.0952, 1.1011, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292, 1.1330, 1.1395–1.1413, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622, 1.1666, 1.1689. On Wednesday, business activity indices in the services and manufacturing sectors will be released in Germany, the Eurozone, and the U.S. These data could add even more volatility to currency market movements. Later in the evening, new statements from Trump may emerge, potentially triggering another market "storm."

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Tuesday's Trades 1H Chart of GBP/USD On Tuesday, the GBP/USD pair corrected downward after another surge on Monday. No fundamental or macroeconomic reasons supported such movements on either

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair continued to trade within a sideways channel, which is now visible on virtually any timeframe

On Tuesday, the GBP/USD currency pair failed to continue the upward movement it had started so vigorously on Monday. It is worth recalling that there were no solid reasons

The EUR/USD currency pair continued to trade within a sideways channel throughout Tuesday. The flat movement is visible in the chart above. Last week, the pair briefly broke

In my morning forecast, I highlighted the 1.3421 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. The pound

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair rose by 130 pips. Such was the "boring Monday" without a macroeconomic report or important speech

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair showed somewhat mixed movements, no matter how you look. On the one hand, the pair demonstrated

On Monday, the GBP/USD currency pair once again traded higher despite having no fundamental reasons. However, by now, all traders should be accustomed to such developments. While the euro tends

On Monday, the EUR/USD currency pair showed a decent upward movement during the day but remained within the narrow sideways channel of 1.1312–1.1414 (Kijun-sen line). Recall that the euro

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.