See also

23.04.2025 06:45 AM

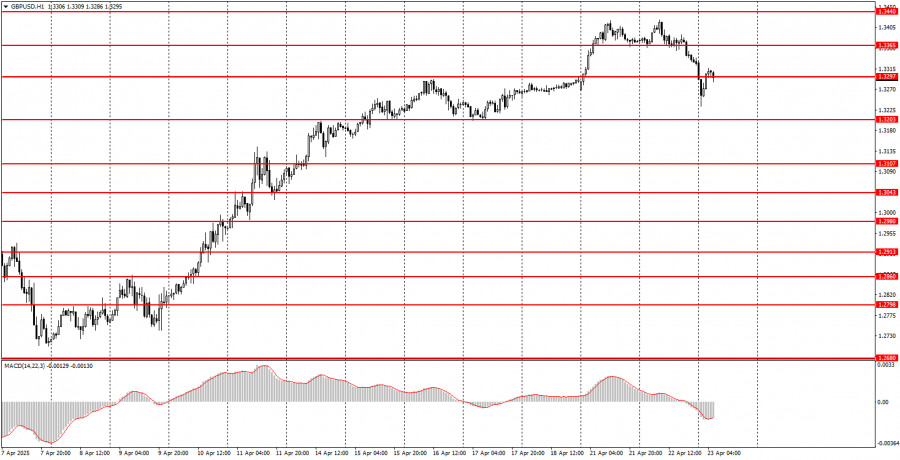

23.04.2025 06:45 AMThe GBP/USD pair declined rather significantly on Tuesday. While the pound's drop began somewhat sluggishly, in the evening, Donald Trump finally decided to help the U.S. dollar. The U.S. President stated that he no longer intended to fire Jerome Powell and did not plan to keep the 145% tariffs on China in place for an extended period. Presumably, Trump meant that the 145% tariffs would not remain in force if a trade agreement with China were signed. And as we know, negotiations have either not started or are being conducted in complete secrecy. We can only judge the progress of talks with all countries based on statements from the White House. And these statements often do not reflect reality. As a result, the dollar gained strength on Tuesday, but if it drops today, we won't be surprised.

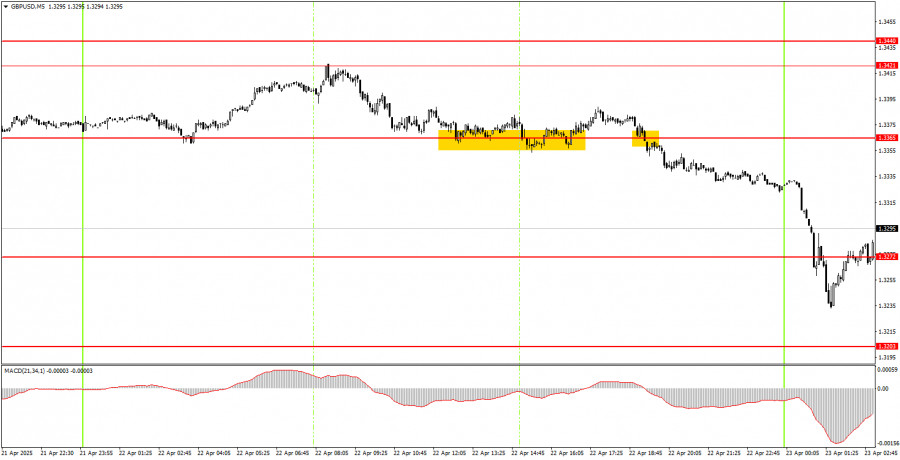

Two trading signals were formed in the 5-minute timeframe on Tuesday, but overall, market movements remain chaotic and driven by panic. In essence, all strong price swings we are currently observing are the result of statements and decisions made by Trump. No one can predict what the U.S. President will say today. Therefore, we can only draw conclusions based on the technical picture. However, the technical picture becomes highly ambiguous and overtly contradictory under Trump's influence.

In the hourly timeframe, the GBP/USD pair could have started a downtrend a long time ago, but the market continues to focus solely on Trump, so the British pound continues to crawl steadily upward. One day of decline is not a trend. Thus, the future movements of the pair depend solely on the American President and his decisions—and nothing else.

On Wednesday, the GBP/USD pair may trade south for a while as the first signs of easing tensions in the global trade war have started to emerge. However, a consistent flow of news about trade conflict de-escalation is required for the dollar to show substantial growth.

On the 5-minute timeframe, trading levels for Wednesday are 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3203, 1.3272, 1.3365, 1.3421–1.3440, 1.3488, 1.3537, 1.3580–1.3598. Business activity indices for April's services and manufacturing sectors are scheduled for release in both the UK and the U.S. on Wednesday, but these reports could introduce even more volatility into the pair's movements.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Tuesday's Trades 1H Chart of GBP/USD On Tuesday, the GBP/USD pair corrected downward after another surge on Monday. No fundamental or macroeconomic reasons supported such movements on either

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair continued to trade within a sideways channel, which is now visible on virtually any timeframe

On Tuesday, the GBP/USD currency pair failed to continue the upward movement it had started so vigorously on Monday. It is worth recalling that there were no solid reasons

The EUR/USD currency pair continued to trade within a sideways channel throughout Tuesday. The flat movement is visible in the chart above. Last week, the pair briefly broke

In my morning forecast, I highlighted the 1.3421 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and see what happened. The pound

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair rose by 130 pips. Such was the "boring Monday" without a macroeconomic report or important speech

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair showed somewhat mixed movements, no matter how you look. On the one hand, the pair demonstrated

On Monday, the GBP/USD currency pair once again traded higher despite having no fundamental reasons. However, by now, all traders should be accustomed to such developments. While the euro tends

On Monday, the EUR/USD currency pair showed a decent upward movement during the day but remained within the narrow sideways channel of 1.1312–1.1414 (Kijun-sen line). Recall that the euro

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.