See also

23.04.2025 06:40 PM

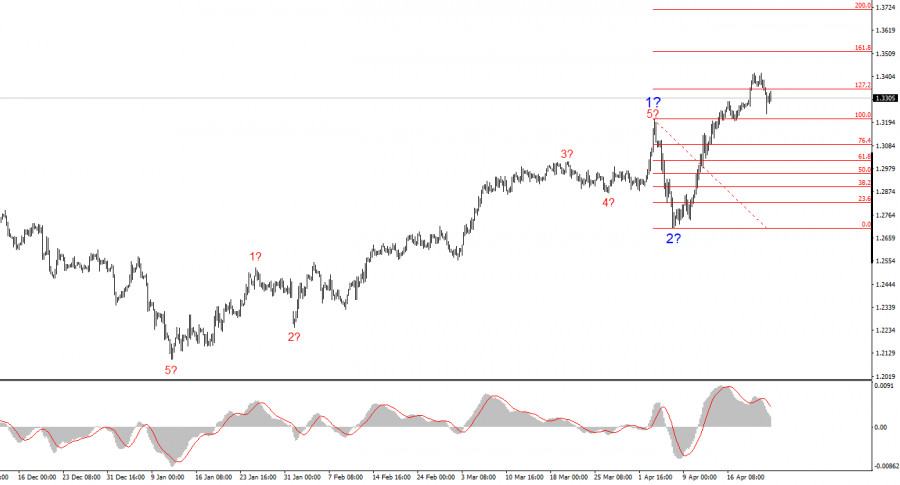

23.04.2025 06:40 PMThe wave structure on the GBP/USD chart has also shifted to a bullish, impulsive form — "thanks" to Donald Trump. The wave pattern is nearly identical to that of EUR/USD. Until February 28, we observed the development of a convincing corrective structure that raised no concerns. However, then demand for the US dollar began to decline sharply. The result was the formation of a five-wave upward structure. Wave 2 took the form of a single wave and is now complete. Therefore, we should expect a strong upward movement of the pound within wave 3 — a movement we've already been witnessing for more than a week.

Taking into account the fact that the UK news flow has had no impact on the strong rise of the pound, we can conclude that currency markets are being driven solely by Donald Trump. If (theoretically) Trump's trade policy stance changes, it's entirely possible that the trend will change too — this time to a downward one. Therefore, in the coming months (or possibly years), close attention should be paid to every action coming from the White House.

On Wednesday, the GBP/USD pair saw almost no change during the European session. Overnight, however, the pound first fell sharply and then rose just as strongly. These movements were triggered by contradictory statements from Trump, who initially fired Jerome Powell, only to then decide to keep him as Fed Chair. As a result, the market first sold the dollar, then bought it again — temporarily forgetting about the Trade War altogether.

This morning in the UK, PMI reports for the services and manufacturing sectors were released, but they had no real impact on market sentiment. Both indices slowed in April, with the services PMI falling from 52.5 to 48.9. Now both sectors are trending downward, and the UK economy will likely continue to slow. This data could have triggered a drop in demand for the pound — but to sell the pound, the market would have to buy the dollar. And right now, the dollar is like a red flag to a bull. No one wants to buy it, nor American stocks or bonds. A recession is forecast for the US economy — and while the same is likely true for the UK, the focus remains on Trump and the dollar.

It's worth noting that investors value stability — something the world's #1 economy can no longer boast. No one knows how the trade battles will end, which deals will be signed, or how China and the US will eventually come to terms. This lack of clarity discourages investors from buying the US dollar.

The wave structure of GBP/USD has shifted. We are now dealing with a bullish, impulsive trend segment. Unfortunately, with Donald Trump in charge, markets may experience many more shocks and reversals that defy wave analysis and any other form of technical forecasting. The presumed wave 2 is complete since prices have already surpassed the peak of wave 1. Therefore, wave 3 is in progress, with initial targets at 1.3345 and 1.3541. Of course, it would be ideal to see a corrective wave 2 within wave 3 — but that would require the dollar to rise and for that to happen, someone needs to start buying it.

On the higher wave scale, the structure has also shifted to bullish. We can now anticipate the development of an upward trend phase. The nearest targets: 1.2782 and 1.2650.

Key Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.