GBPDKK (British Pound vs Danish Krone). Exchange rate and online charts.

Currency converter

29 Apr 2025 05:32

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

GBP/DKK is a currency pair traded on Forex. Traders choose this trading instrument for high stability and predictability of the eurozone and Denmark economies. The most intense bidding on GBP/DKK occurs during trading sessions at European stock exchanges.

GBP/DKK is a cross rate against the U.S. dollar. Even though the U.S. dollar is not obviously present in this currency pair, it still considerably influences it. It is easy to see combining the GBP/USD and USD/DKK charts. The result of the combination is an approximate GBP/DKK chart.

Because the U.S. dollar has a significant influence on both currencies, for the correct forecast of a future GBP/DKK course it is essential to take into account the major U.S. economic indicators (discount rate, GDP, unemployment, new vacancies, etc.). It should be noted that the discussed currencies could respond to changes in the U.S. economy with different speed, so the GBP/DKK currency pair may be a specific indicator of change in these currencies.

Denmark is actively trading with the UK, its largest business partner. Denmark is a highly developed industrial-agrarian country with one of the best economic indicators in the world. This nation is rich in oil reserves that are mainly concentrated in the southern part of Jutland and on the shelves of the North Sea. However, the country is poor in minerals, which makes it reliant on imports. Denmark enjoys a durable economic relationship with all the developed countries of the world. It actively trades machinery, electronics, agriculture, mining, etc. Denmark's main trading partners are the EU countries.

Denmark has one of the most powerful economies in the world, which allows its currency to remain stable in pairs with other majors. The strong points of Denmark's economy are low inflation and unemployment, the presence of major oil and gas reserves on the North Sea shelf and in the south of Jutland, the high level of high technology development and competent professionals in all sectors of the economy.

Although Denmark has one of the most robust economies, its weaknesses are high taxes and decreasing competitiveness on world markets. If you trade GBP/DKK, you should focus on economic indicators of Denmark, as well as on the prices of oil and minerals needed to sustain Denmark's production.

If you trade cross rates, you should remember that brokers tend to set a higher spread for this currency pair, than for more popular currency instruments. That is why before you start working with cross rates, carefully learn the conditions offered by the broker you chose to trade with.

See Also

- Wave analysis

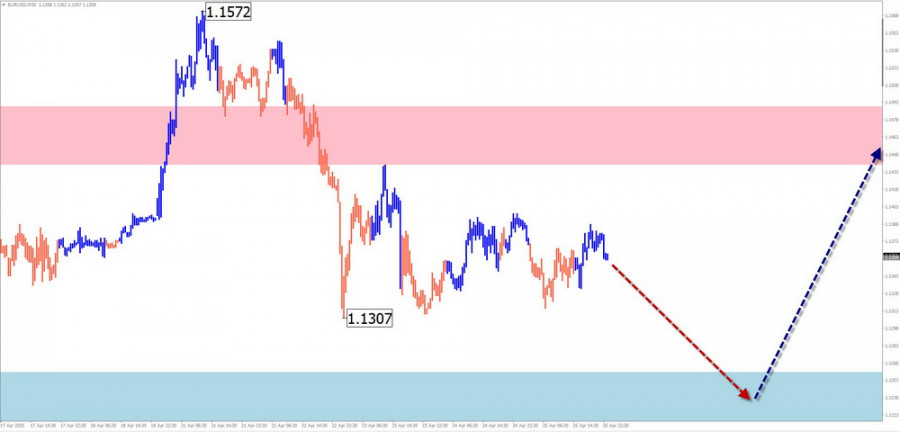

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1438

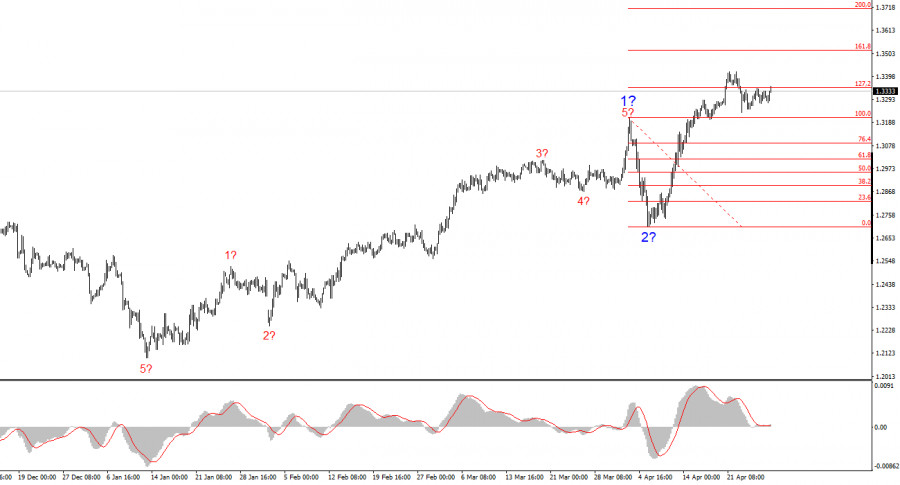

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1333

Technical analysis / Video analyticsForex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

1108

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

1093

The GBP/USD pair rose by 30 basis points on MondayAuthor: Chin Zhao

19:42 2025-04-28 UTC+2

988

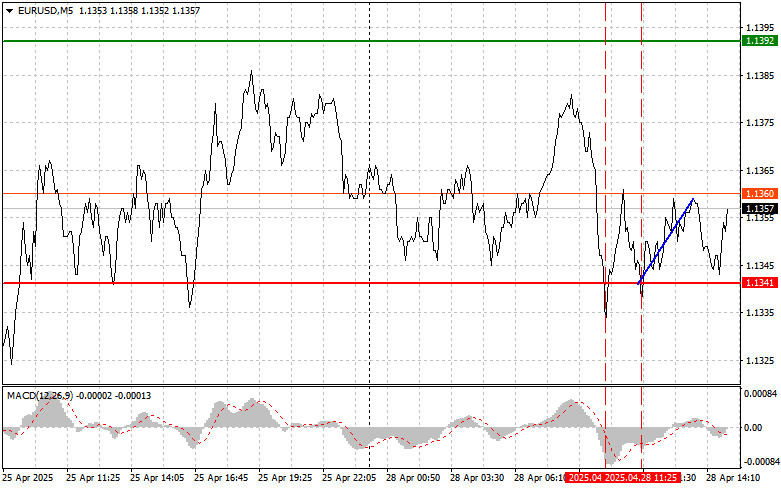

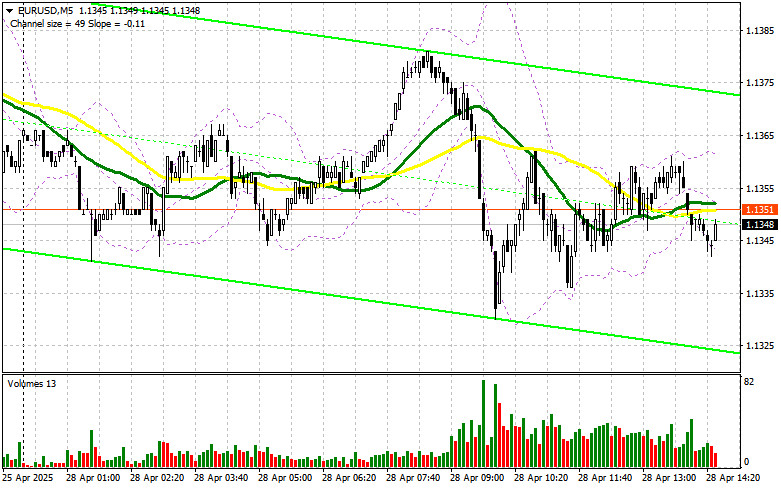

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

988

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

898

USDJPY: Simple Trading Tips for Beginner Traders for April 28th (U.S. Session)Author: Jakub Novak

19:36 2025-04-28 UTC+2

883

The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and AppleAuthor: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

883

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1438

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1333

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

1108

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

1093

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

988

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

988

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

898

- USDJPY: Simple Trading Tips for Beginner Traders for April 28th (U.S. Session)

Author: Jakub Novak

19:36 2025-04-28 UTC+2

883

- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and Apple

Author: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

883