Lihat juga

01.04.2025 10:53 AM

01.04.2025 10:53 AMTrade Review and EUR Trading Advice

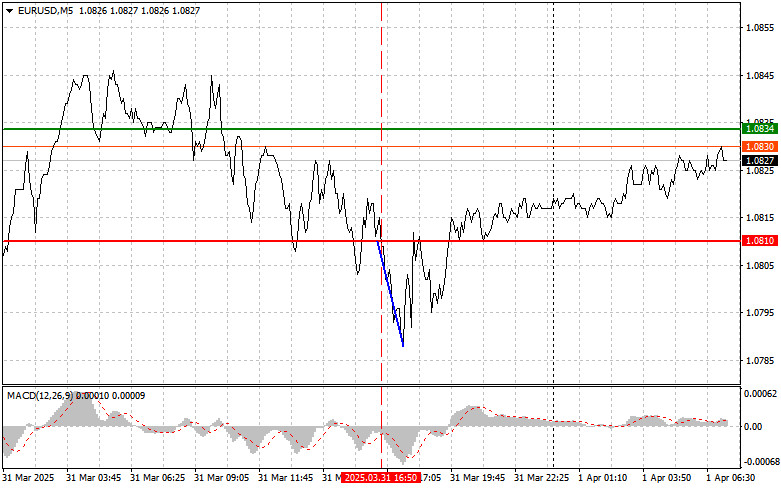

The test of the 1.0810 level occurred just as the MACD indicator began to move down from the zero mark, confirming a valid entry point for selling the euro and resulting in a decline of more than 20 points.

Today, the Eurozone is set to release several key data points that could significantly influence the direction of the EUR/USD pair. It begins with manufacturing PMI figures, which still reflect serious problems in the sector, so euro buyers may not respond positively. However, the main focus will be on the Consumer Price Index and core inflation data from the Eurozone. If a slowdown in inflation is recorded for March, it will be welcomed by the European Central Bank and could support continued rate cuts. On the other hand, if the core index rises, the ECB will likely delay its next rate cut until the summer.

The market's response will also depend on how much actual figures deviate from forecasts. If inflation is much lower than expected, the euro may weaken. Conversely, higher-than-expected inflation figures will strengthen the euro by reducing the chances of aggressive rate cuts. The Eurozone unemployment rate for February is not expected to affect the euro much, as it will likely match economist forecasts. Nonetheless, these numbers will provide a more complete picture of the Eurozone economy.

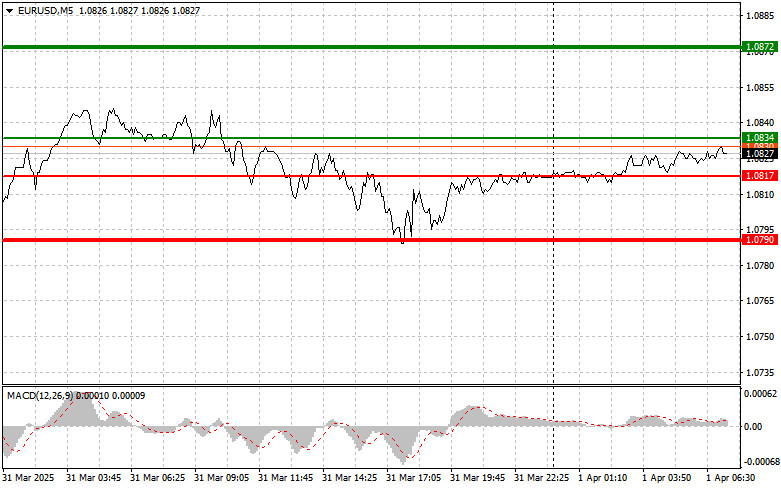

For the intraday strategy, I will focus mainly on implementing Scenarios #1 and #2.

Buy Scenarios

Scenario #1: Today, buying the euro is possible when the price reaches around 1.0834 (green line on the chart) with a target of rising to 1.0872. I plan to exit the market at 1.0872 and open short positions in the opposite direction, aiming for a 30–35 point retracement from the entry point. Buying the euro in the first half of the day is only advisable after strong Eurozone data. Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.0817 price level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and trigger a market reversal to the upside. A rise toward 1.0834 and 1.0872 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the euro after reaching the 1.0817 level (red line on the chart), with a target of 1.0790, where I'll exit short positions and immediately open long positions in the opposite direction (targeting a 20–25 point retracement from the level). Selling pressure could return today if the data is weak. Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0834 level while the MACD is in the overbought zone. This would limit the pair's upward potential and lead to a downward reversal. A decline toward 1.0817 and 1.0790 can be expected.

Chart Key:

Important: Beginner traders in the Forex market should be extremely cautious when deciding to enter a trade. It's best to stay out of the market ahead of important fundamental reports to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can lose your entire deposit very quickly, especially if you don't use proper money management and trade with large volumes. And remember: successful trading requires a clear trading plan, like the one presented above. Making impulsive trading decisions based on current market noise is an inherently losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Analisis dan Saran Trading untuk Pound Inggris Pengujian level 1,3294 pada paruh pertama hari terjadi ketika indikator MACD sudah bergerak jauh di bawah angka nol, yang membatasi potensi penurunan pasangan

Analisis dan Saran Trading untuk Euro Uji harga 1,1320 pada paruh pertama hari terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang membatasi potensi kenaikan pasangan

Uji level 144.79 terjadi pada saat indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar dan melewatkan

Pengujian level 1,3311 pada paruh kedua hari terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk pasar yang valid. Akibatnya, pound jatuh menuju level target

Uji level 1,1305 pada paruh kedua hari terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual

Uji level 142,54 pada paruh kedua hari itu bertepatan dengan indikator MACD yang baru mulai bergerak turun dari level nol, mengonfirmasi titik entri yang tepat untuk menjual dolar dan mengakibatkan

Pengujian level 1,3400 pada paruh kedua hari bertepatan dengan dimulainya pergerakan naik indikator MACD dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli pound dan menghasilkan kenaikan

Uji level 1.1398 pada paruh kedua hari terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli euro. Ini menghasilkan kenaikan

Kenaikan euro dan pound terhenti. Data kepercayaan konsumen AS yang lemah kemarin gagal memberikan tekanan serius pada dolar, yang mengakibatkan penguatan euro dan pound Inggris yang hanya sedikit. Namun, selama

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.