Lihat juga

03.04.2025 03:53 AM

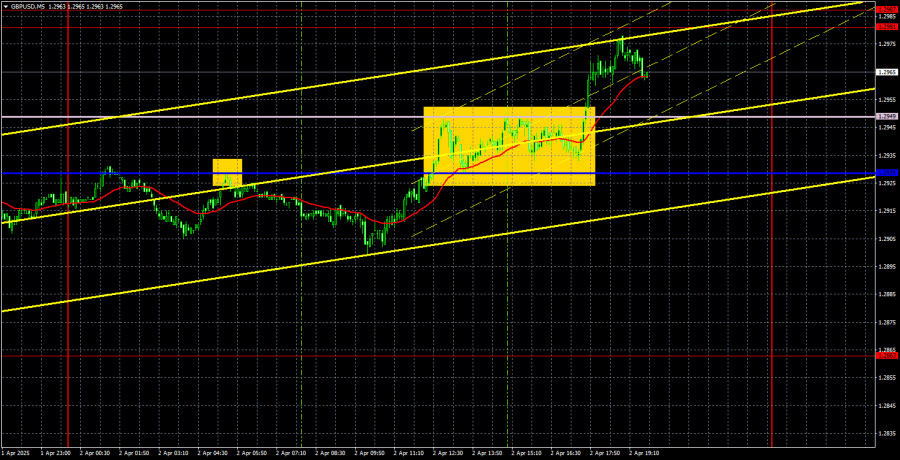

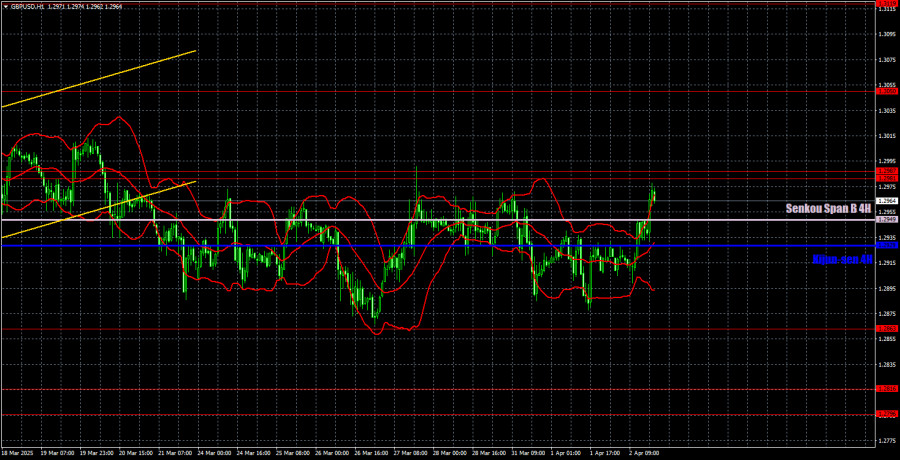

03.04.2025 03:53 AMThe GBP/USD currency pair continued to trade within a sideways channel on Wednesday. Over the past two weeks, all price movement has occurred between the 1.2863 and 1.2981 levels. The Ichimoku indicator lines are being ignored during this range-bound phase. The macroeconomic backdrop is irrelevant because the price is moving sideways. As a result, the technical picture of the pound appears "super-attractive." Of course, the market occasionally reacts to individual reports, but these moves are so weak that they're practically useless to trade—and predicting which report will spark a reaction is impossible.

There were no notable events in the UK yesterday, and in the U.S., the ADP employment report (the "little brother" of NonFarm Payrolls) was released. As we warned, the market paid no attention to this report. According to ADP, 155,000 new jobs were created in March, compared to a forecast of 105,000. How much has the U.S. dollar increased? Correct—there has been no change at all. The market spent the entire day awaiting Donald Trump's speech, but no information was released by the end of the day. As a reminder, we do not recommend trading on "super-important" news or events and not leaving positions open overnight. Of course, everyone has their trading strategy, and trades are not only open during the day. However, in any case, we wouldn't trade "on Trump"—the risk is just too high.

Technically, two trading signals were formed during the day. The price bounced back from the critical line overnight and fell by 20 pips, which was at least enough to set a Stop Loss to breakeven. Later in the day, the price crossed the Senkou Span B and Kijun-sen lines and eventually reached the 1.2981 level. Nonetheless, all daily movements still occurred within the flat range.

The COT reports for the British pound show that commercial traders' sentiment has constantly shifted in recent years. The red and blue lines, which reflect the net positions of commercial and non-commercial traders, frequently cross and usually stay close to the zero line. They are again near each other, indicating a roughly equal number of long and short positions.

On the weekly timeframe, the price first broke through the 1.3154 level and then dropped to the trendline, which it successfully breached. Breaking the trendline suggests a high probability of further GBP decline. However, the bounce from the previous local low on the weekly timeframe is also worth noting. We may be looking at a broad flat.

According to the latest COT report for the British pound, the "Non-commercial" group opened 13,000 new long contracts and closed 1,800 short contracts. As a result, the net position of non-commercial traders rose again—by 14,800 contracts.

The fundamental background still provides no grounds for long-term GBP purchases, and the currency remains vulnerable to continuing the global downtrend. The pound has risen significantly recently, and the primary reason for this increase is Donald Trump's policy.

In the hourly timeframe, GBP/USD remains completely flat (sideways market), and the upward correction on the daily chart is long overdue for completion. We still don't see what would support the British pound in a long-term uptrend. The only thing still working in favor of the pound is Donald Trump, who's imposing tariffs and sanctions left and right. Even though that factor is starting to wear thin with the market, the flat must end before a new trend can be determined on the hourly chart.

For April 3, we highlight the following key levels: 1.2331–1.2349, 1.2429–1.2445, 1.2511, 1.2605–1.2620, 1.2691–1.2701, 1.2796–1.2816, 1.2863, 1.2981–1.2987, 1.3050, 1.3119. The Senkou Span B line (1.2949) and Kijun-sen line (1.2929) can also serve as signal levels. A Stop Loss should be moved to breakeven once the price moves 20 pips in the desired direction. Ichimoku indicator lines can shift during the day, so this must be considered when identifying signals.

On Thursday, service sector activity indices will be published in the UK and the U.S., with the S&P and ISM versions being released in the U.S. Honestly if the market couldn't break out of the sideways channel "on Trump," we don't expect Thursday's macroeconomic data to break the flat either. There might be a small intraday reaction, but it's unlikely to have any practical impact.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dalam 24 jam terakhir, pasangan GBP/USD naik sebanyak 170 pip. Pada malam menjelang Jumat, pound sterling terus menguat. Beberapa hari yang lalu, kami mencatat bahwa dolar telah menguat secara signifikan

Pada hari Kamis, pasangan mata uang EUR/USD melanjutkan pergerakan naiknya dan mencatat kenaikan lebih dari 300 pip. Saat hari Jumat dimulai, pasangan ini terus mengalami pertumbuhan tanpa henti. Alasan

Pada hari Kamis, pasangan mata uang EUR/USD menunjukkan pertumbuhan yang sangat kuat—sebuah pergerakan yang mungkin tidak mengejutkan siapa pun saat ini. Tepat ketika kami melaporkan bahwa tarif terhadap Tiongkok telah

Dalam prediksi pagi saya, saya menyoroti level 1,2871 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Kenaikan

Dalam prediksi pagi, saya menyoroti level 1,1019 dan merencanakan untuk membuat keputusan masuk pasar berdasarkan level tersebut. Mari kita lihat grafik 5 menit untuk memahami apa yang terjadi. Harga memang

Pada pasangan GBP/USD, selama 24 jam terakhir, terjadi kenaikan, kemudian penurunan, dan kemudian kembali naik. Seperti sebelumnya, sulit untuk mengidentifikasi tren yang jelas pada kerangka waktu per jam. Berita tentang

Pada hari Rabu, pasangan mata uang EUR/USD menunjukkan pertumbuhan dan penurunan yang kuat. Belakangan ini, kedua pergerakan tersebut dipicu oleh Donald Trump. Pertama, muncul berita bahwa AS memberlakukan tarif tambahan

Pada hari Rabu, pasangan mata uang GBP/USD menunjukkan pergerakan campuran sepanjang hari tetapi umumnya mempertahankan tren penurunan — jika kita bahkan bisa menyebut perilaku saat ini sebagai "tren." Tidak

Pada hari Rabu, pasangan mata uang EUR/USD bergerak persis seperti yang diharapkan — dalam beberapa aspek. Pertama, mari kita mulai dengan pola "segitiga" yang kita bahas kemarin. Kami memperingatkan bahwa

Pada hari Selasa, pasangan GBP/USD trading dengan sedikit kecenderungan naik. Tidak ada berita besar sepanjang hari, dan hanya pada malam hari muncul berita tentang peningkatan tarif pada China, yang memicu

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.