Lihat juga

04.04.2025 11:50 AM

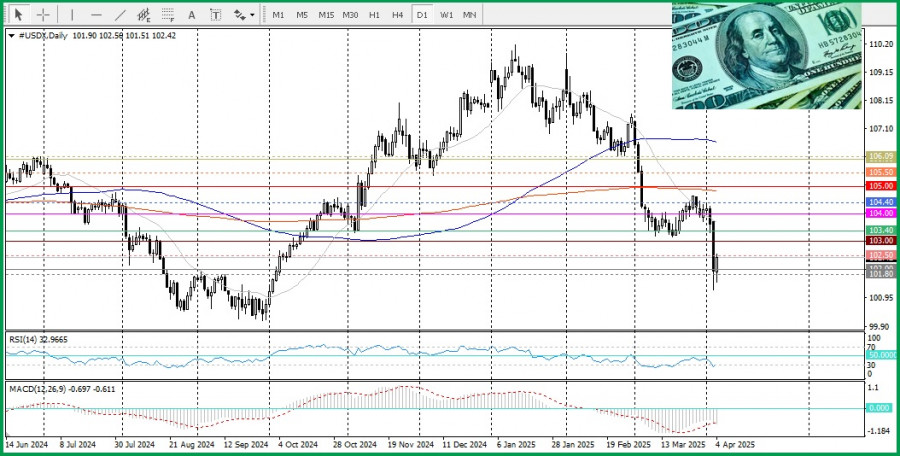

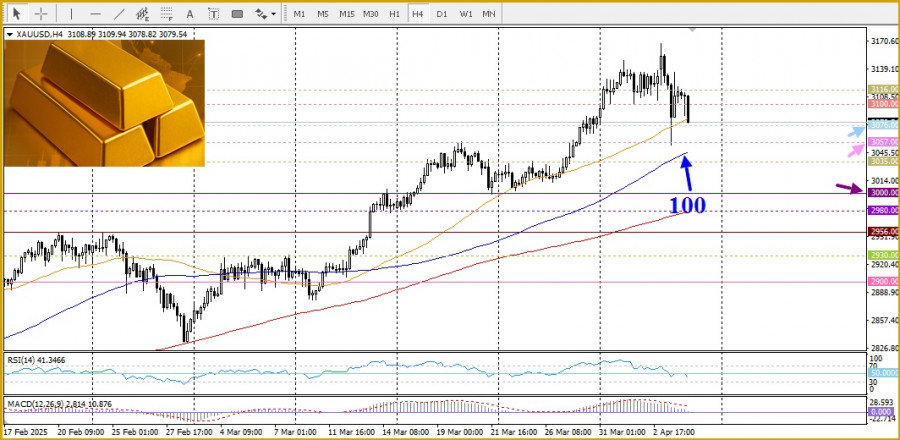

04.04.2025 11:50 AMGold is attracting some sellers for the second day in a row, despite the absence of any clear fundamental catalyst for a decline. Most likely, this is due to trading repositioning ahead of the key U.S. Nonfarm Payrolls (NFP) report, as well as a corrective move in the U.S. dollar driven by short-covering.

Recent actions by U.S. President Donald Trump—who announced reciprocal tariffs on imports—have shaken global financial markets and heightened concerns about potential negative impacts on the global economy. This has led to increased expectations that the Federal Reserve will resume its rate-cutting cycle, which in turn supports interest in gold as a safe-haven asset.

Interestingly, the yield on 10-year U.S. Treasury bonds has fallen below 4% for the first time in six months, preventing the dollar from recovering. At the same time, data on U.S. services sector activity indicated a slowdown, which further weighs on the dollar and supports the precious metal.

From a technical perspective, gold may find support near the $3057 area, which aligns with the 100-period simple moving average (SMA) on the 4-hour chart—a key reference point for short-term traders. A break below this level could trigger technical selling, making the metal vulnerable to a deeper corrective decline toward intermediate support at $3035, en route to the psychological level of $3000.

On the other hand, the resistance zone around $3116 will be key for the bulls. A breakout above this area could signal the continuation of the multi-month uptrend during which gold reached a new all-time high—especially now that oscillators on the daily chart have exited overbought territory.

For more actionable trading opportunities today, it is advisable to focus on the release of the NFP employment data, which could significantly impact market direction.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Seperti yang diantisipasi, ECB memangkas semua suku bunga utama sebesar seperempat poin, menurunkan suku bunga deposito menjadi 2,25%. Pada pertemuan ini, tidak ada proyeksi staf baru yang dirilis, dan mengingat

Gelombang euforia baru telah melanda pasar. Banyak yang percaya ini bukan kebetulan: ambil semuanya dari seseorang dan kemudian berikan mereka sedikit saja, dan mereka akan merasakan kebahagiaan. Jadi, apa yang

Sejumlah besar peristiwa makroekonomi dijadwalkan pada hari Rabu. Semua peristiwa tersebut adalah laporan Indeks Manajer Pembelian (PMI) untuk bulan April di sektor jasa dan manufaktur. Indeks-indeks ini akan dipublikasikan

Pada hari Selasa, pasangan mata uang GBP/USD diperdagangkan dengan lebih tenang, sekali lagi menunjukkan tanda-tanda pola "maxed-out flat". Seperti yang telah disebutkan sebelumnya, dolar AS belakangan ini hanya memiliki

Pada hari Selasa, pasangan mata uang EUR/USD diperdagangkan lebih tenang dibandingkan hari Senin. Dolar AS berhasil menghindari penurunan lebih lanjut, tetapi masih terlalu dini untuk merayakannya. Dolar bisa saja jatuh

Ketakutan dapat melumpuhkan, tetapi tindakan tetap berlanjut. Para investor perlahan-lahan mengatasi kekhawatiran mereka terhadap serangan Donald Trump terhadap independensi Federal Reserve dan mulai mengunci keuntungan pada posisi panjang EUR/USD

Pelan tapi pasti memenangkan perlombaan! Bitcoin diam-diam menembus level tertingginya sejak awal Maret di tengah serangan Donald Trump terhadap Jerome Powell. Ketika independensi Federal Reserve dipertaruhkan dan kepercayaan terhadap dolar

Setelah mencapai rekor tertinggi baru di $3500 dalam kondisi overbought, harga emas mengalami penurunan. Namun, sentimen bullish tetap kuat karena kekhawatiran yang terus-menerus mengenai potensi dampak ekonomi dari kebijakan tarif

Pada hari ini, pasangan EUR/GBP mengalami penurunan setelah dua hari berturut-turut mengalami kenaikan, diperdagangkan mendekati level psikologis 0,8600. Pound mendapatkan dukungan dari optimisme seputar negosiasi perdagangan yang sedang berlangsung antara

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.