Lihat juga

04.04.2025 08:00 PM

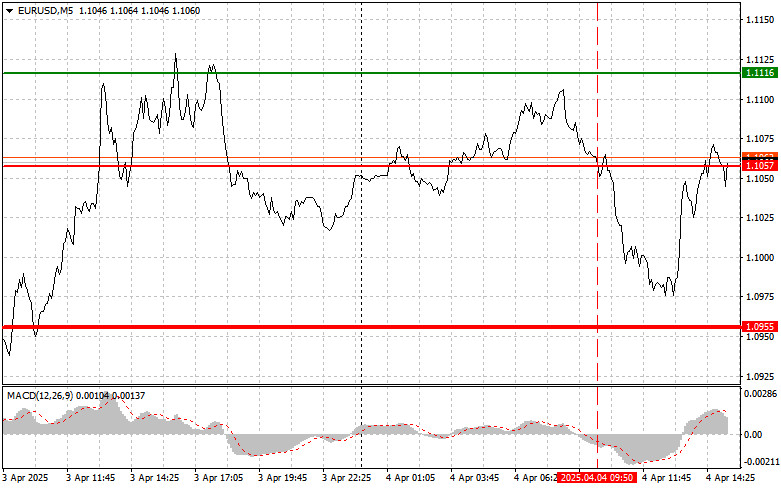

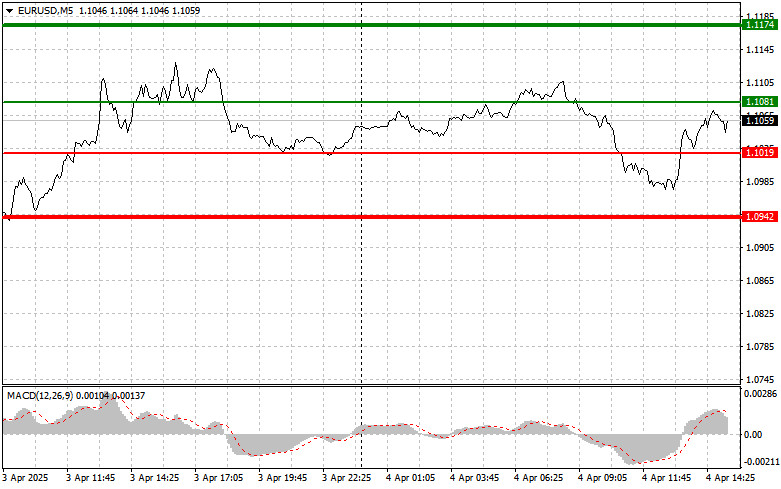

04.04.2025 08:00 PMThe price test of 1.1050 occurred at a time when the MACD indicator had already moved significantly below the zero line, limiting the pair's downward potential. For this reason, I did not sell the euro and missed the downward movement.

The euro showed a noticeable correction against the U.S. dollar, although such a sharp decline was hardly expected. This immediately drew the attention of large market participants, who promptly increased their long positions ahead of key economic data releases from the United States.

Two major economic releases — Nonfarm Payrolls for March and the unemployment rate — will have a decisive impact on the future trajectory of the currency pair. Market participants and analysts are closely watching these figures as important indicators of the U.S. economy's health. It is expected that the employment report will point to a slowdown in job growth, which could potentially weaken the U.S. dollar. The unemployment rate is unlikely to have a major impact on market sentiment, as it is forecasted to remain unchanged.

As for the intraday strategy, I will rely more on the execution of Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the euro today if the price reaches the 1.1081 level (green line on the chart), with a target of rising to 1.1174. I plan to exit the market at 1.1174 and open sell positions in the opposite direction, expecting a 30–35 point movement from the entry point. Euro growth today can be expected as part of the ongoing upward trend, and also in case of weak U.S. data and dovish comments from Jerome Powell. Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1019 price level when the MACD indicator is in the oversold zone. This will limit the downward potential and trigger a market reversal to the upside. One can then expect growth toward the opposite levels of 1.1081 and 1.1174.

Scenario #1: I plan to sell the euro after reaching the 1.1019 level (red line on the chart), with a target at 1.0942, where I will exit the market and open long positions in the opposite direction (expecting a 20–25 point movement from the level). Selling pressure on the pair is likely to return in case of strong U.S. data. Important: Before selling, make sure the MACD is below the zero line and just beginning to fall from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1081 level, when the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. One can expect a decline toward the opposite levels of 1.1019 and 1.0942.

On the Chart:

Important:

Beginner Forex traders should be extremely cautious when making entry decisions. It is best to stay out of the market ahead of major economic reports to avoid sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the one outlined above. Making spontaneous decisions based on current market conditions is an inherently losing strategy for intraday traders.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian level 144,86 terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli dolar dan menghasilkan kenaikan lebih dari

Uji level 1,3342 pada paruh kedua hari terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua level ini terjadi

Uji harga pada 1.1312 di paruh kedua hari itu bertepatan dengan indikator MACD yang sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Uji kedua pada

Euro dan pound kembali mengalami penurunan segera setelah kepercayaan pasar terhadap tercapainya kesepakatan dagang AS dengan mitra utama meningkat. Setelah menandatangani perjanjian dagang dengan Inggris, komentar lembut Donald Trump mengenai

Analisis dan Tips Trading untuk Pound Inggris Uji harga di 1.3330 pada paruh pertama hari ini bertepatan dengan indikator MACD yang baru mulai bergerak turun dari level nol, mengonfirmasi titik

Analisis dan Tips Trading untuk Euro Uji harga di 1.1321 terjadi tepat saat indikator MACD mulai bergerak turun dari titik nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya

Uji harga di 143,18 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual dolar. Situasi serupa terjadi dengan

Pengujian level harga 1,3359 pada paruh kedua hari itu bertepatan dengan indikator MACD yang sudah naik secara signifikan di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Tak lama

Pengujian level harga 1,1348 pada paruh kedua hari itu bertepatan dengan indikator MACD yang baru mulai bergerak ke bawah dari garis nol, mengonfirmasi kebenaran titik masuk jual untuk euro. Akibatnya

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.