Lihat juga

07.04.2025 07:13 PM

07.04.2025 07:13 PMOn Friday, it's difficult to define what exactly the EUR/USD pair accomplished. The decline is undeniable, signaling a strengthening of the U.S. dollar. But who can confidently say the dollar is truly rising? On Friday, the dollar strengthened, but on Thursday, it collapsed, and the new week started with another drop. Levels are being ignored, and traders are panicking, running from one side to the other. Chart analysis doesn't work anymore.

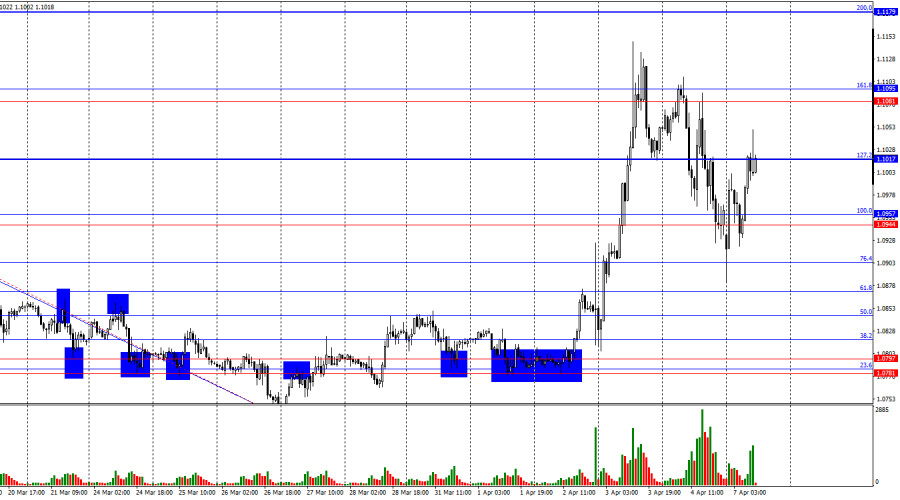

The wave structure on the hourly chart has changed. The last completed downward wave broke through the low of the previous wave, but the last upward wave also broke through the previous peak. Thus, waves currently indicate a potential trend reversal toward the bullish side. Donald Trump continues to impose new import tariffs, and panic and chaos persist in the markets. The bulls became active again last week, but it's difficult to say who really holds the initiative right now.

The news background on Friday undoubtedly helped the dollar and the bears. The Nonfarm Payrolls report showed 228,000 new jobs, while traders had expected significantly less. However, at the same time, the unemployment rate increased, and wage growth slowed from 4% to 3.8%. It's worth remembering that wage growth can reflect future inflation trends: if wages grow quickly, inflation may accelerate; if the pace slows, inflation may also decelerate. Therefore, only the Nonfarm report supported the dollar— the other two did not. Based on this, the following can be said. First, one should not interpret Friday's dollar strength as the end of its decline. Trump is still here, no impeachment has been filed, and he's ready to escalate the trade war further. And as we can see, not all countries are willing to blindly follow Washington's lead. In my view, the trade war will only expand, and the dollar may well continue to collapse on this wave.

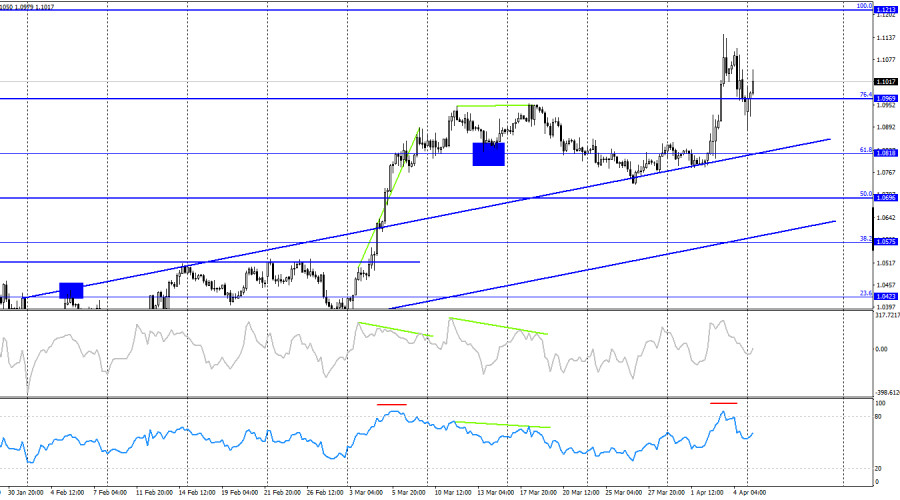

On the 4-hour chart, the pair completed a new reversal in favor of the euro and consolidated above the 76.4% retracement level – 1.0969. The euro's growth, which hasn't been supported by any EU data, could have ended long ago. However, Trump continues to exert intense pressure on the dollar. A close above 1.0969 allows for further growth toward the next Fibonacci level of 100.0% – 1.1213. The RSI indicator is overbought, but the news background is more important.

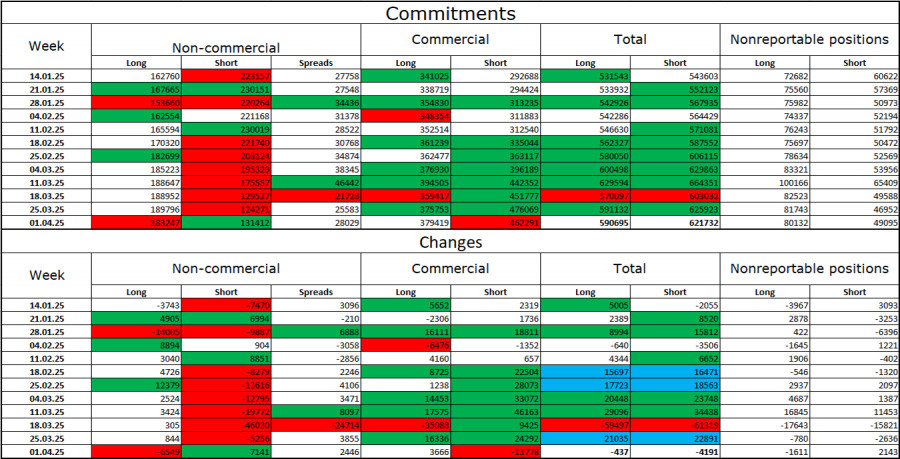

Commitments of Traders (COT) Report:

Over the last reporting week, professional traders closed 6,549 Long positions and opened 7,141 Short positions. The "Non-commercial" group sentiment has recently turned bullish again — thanks to Donald Trump. The total number of Long positions held by speculators now stands at 183,000, while Short positions number 131,000.

For twenty weeks, major players were getting rid of the euro, but for the past eight weeks, they've been reducing Short positions and increasing Long positions. The divergence in monetary policy between the ECB and the Fed still favors the U.S. dollar due to the widening rate differential, but Donald Trump's policies are becoming a more influential factor for traders, as they may exert a dovish influence on the Fed's policy and potentially lead to a recession in the U.S. economy.

News calendar for the U.S. and the Eurozone:

Eurozone – German Industrial Production (06:00 UTC) Eurozone – Retail Sales (09:00 UTC)

April 7 contains two scheduled events in the economic calendar. Their impact on market sentiment may be weak. However, it's worth remembering that tariff-related news is more important right now. If any party to the trade war introduces new tariffs or retaliatory measures over the weekend, Monday's market movements will not depend on these two Eurozone reports.

EUR/USD Forecast and Trading Tips:

Selling the pair is possible today on a rebound from the 1.1017 level on the hourly chart, with a target of 1.0957. Buying is possible on a close above 1.1017 on the hourly chart, targeting 1.1081. Given current volatility, avoiding risk may be the best strategy.

Fibonacci levels are plotted from 1.0957–1.0733 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Harga emas terus mendapatkan dukungan di tengah ketidakpastian yang menyelimuti masa depan perang tarif yang diprakarsai oleh Donald Trump. Harga emas telah naik hampir secara vertikal selama empat bulan. Pendorong

Dari apa yang Kita lihat di chart 4 jamnya indeks Nasdaq 100, nampak terlihat beberapa hal yang menarik, yaitu yang pertama, pergerakan harganya bergerak dibawah MA (100), kedua, munculnya pola

Pada awal sesi Amerika, emas trading sekitar 3,312 dengan bias bullish setelah menembus segitiga simetris. Emas kemungkinan akan terus naik dalam beberapa jam ke depan, mencapai level 7/8 Murray

Dengan kondisi Stochastic Oscillator yang tengah menuju ke level Oversold (20) pada chart 4 jam dari pasangan mata uang silang AUD/JPY, maka dalam waktu dekat ini AUD/JPY berpotensi untuk melemah

Pada chart 4 jamnya, pasangan mata uang komoditi USD/CAD nampak terlihat bergerak dibawah EMA (100) serta munculnya pola Bearish 123 serta posisi indikator Stochastic Oscillator yang sudah berada diatas level

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.