CHFZAR (Swiss Franc vs South African Rand). Exchange rate and online charts.

Currency converter

29 Apr 2025 00:30

(0.02%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/ZAR is not popular currency pair on Forex market. CHF/ZAR can be considered as the cross rate against the U.S. dollar. The greenback greatly affects the CHF/ZAR currency pair, although it is not obviously represented in this trading instrument. If combine the USD/CHF and USD/ZAR charts, we can get an approximate CHF/ZAR price chart.

Both currencies are influenced by the greenback. That is why it is necessary to take into account the discount rate, GDP, unemployment, new created workplaces indicator and many other U.S. major economic indicators for the correct analysis of this financial instrument. However, it should be noted that the mentioned above currencies could respond with different speed to the changes in the U.S. economy, therefore, the CHF/ZAR currency pair may act as a specific indicator of changes within these currencies.

Switzerland economy remains strong for several centuries. As a consequence, the Swiss franc demonstrates its strength all over the world , being one of the most reliable and stable world currencies. The Swiss franc serves as a safe haven currency for capital investment during the crises. Therefore, during financial meltdown, when global capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against other currencies. This feature of Swiss economy should be taken into account when you trade this instrument.

This trading instrument is relatively illiquid compared to such major currency pairs as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a prognosis for the financial instrument, you should primarily focus on those currency pairs that include the U.S. dollar.

It is necessary to remember that brokers, as a rule, set a higher spread for cross rates rather than for more popular currency pairs. Thus, before you start working with the cross rates, read carefully the conditions offered by the broker to trade with specified instrument.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

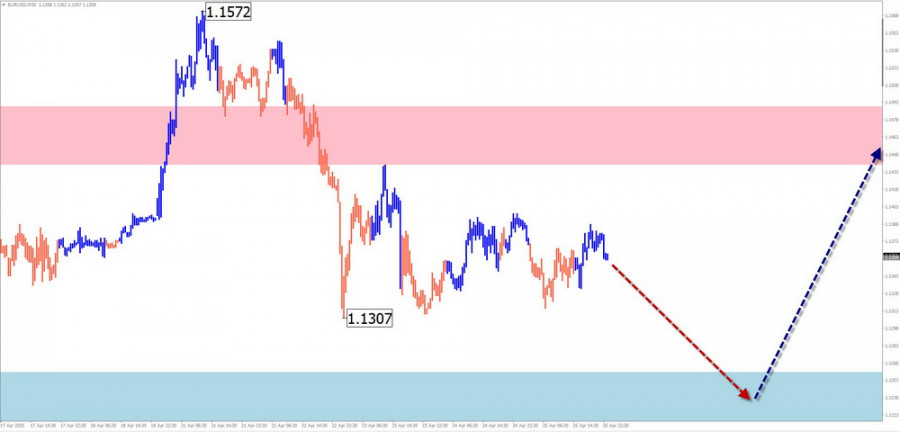

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1303

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1213

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

988

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

928

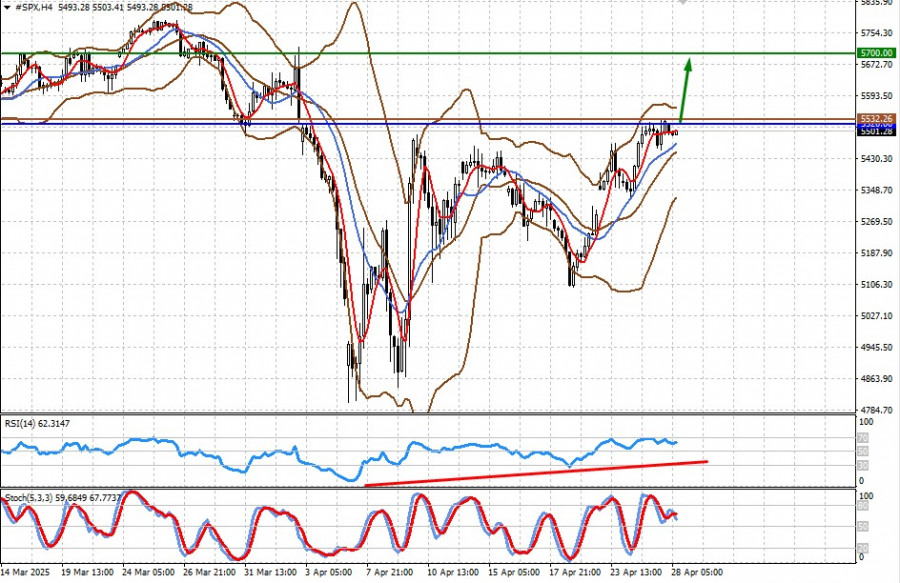

Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their AdvanceAuthor: Jakub Novak

09:06 2025-04-28 UTC+2

853

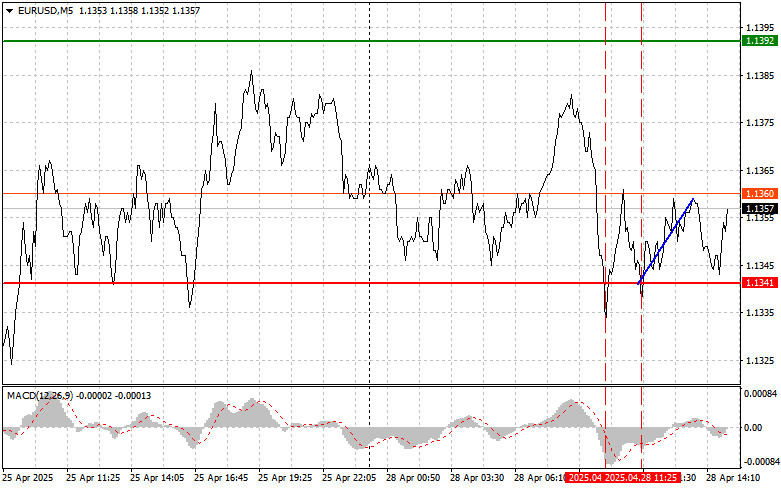

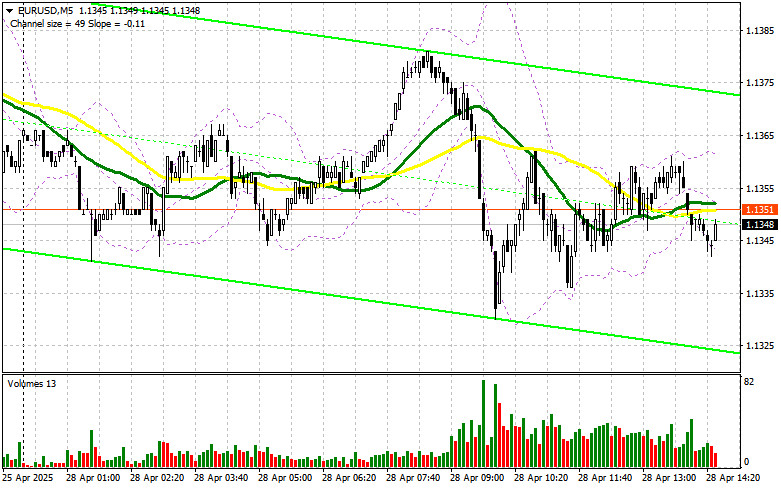

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

838

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

793

EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

778

Technical analysis / Video analyticsForex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

778

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1303

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1213

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

988

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

928

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

853

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

838

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

793

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

778

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

778