EURCHF (Euro vs Swiss Franc). Exchange rate and online charts.

Currency converter

29 Apr 2025 22:30

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/CHF is the cross rate against the US dollar. Although the US Dollar is not present in this currency pair, it still has significant impact upon it. This can be seen if you combine two charts ― EUR/USD and USD/CHF. By combining these two charts in the same price chart, you will get an approximate EUR/CHF chart.

The U.S. dollar influences both currencies. For this reason, it is necessary to take into account major U.S. economic indicators to correctly predict a future behaviour of this financial instrument. These indicators include the discount rate, GDP, unemployment, new vacancies and many others. It is worth noting that the discussed currencies could respond to U.S. economic changes with different speed. Therefore, the EUR/CHF pair may be a specific indicator of changes in these currencies.

The EUR/CHF chart tends to remain unchanged for a long time. That is why this financial instrument is not so popular with traders, who cannot earn enough on such a market. However, when the currency pair moves from a passive into an active state, trends can be observed. Opening a deal makes sense. At the same time, the trader must first learn the spread size for this currency pair and the margin size for the deal otherwise the deal can be very expensive.

Switzerland is a highly developed and rich country. Goods produced in this country are mostly directed to foreign markets, but the most progressive economic sector of Switzerland is banking system with major banks being UBS and Credit Suisse.

The economic situation in Switzerland has been stable for several centuries. For this reason, the Swiss franc enjoys great confidence worldwide as one of the most reliable currencies. The Swiss franc is also a kind of a safe haven for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc surges against its counterparts. This feature of Swiss economy should be taken into account when you trade this instrument.

Speaking about Switzerland’s monetary policy, announcement by the National Bank of Switzerland meeting outcomes is of great importance. However, information about the state of the Swiss economy is rarely advertised. Therefore, any information concerning the economic situation in Switzerland absorbs attention of traders around the world.

The main feature of the Swiss banking system is the complete confidentiality of customer accounts allowing clients to evade taxes. The European Union has repeatedly urged Switzerland to make its banking system more open, but the country is still not able to do it. The franc can fall in price at reducing exports in Western Europe.

See Also

- Fundamental analysis

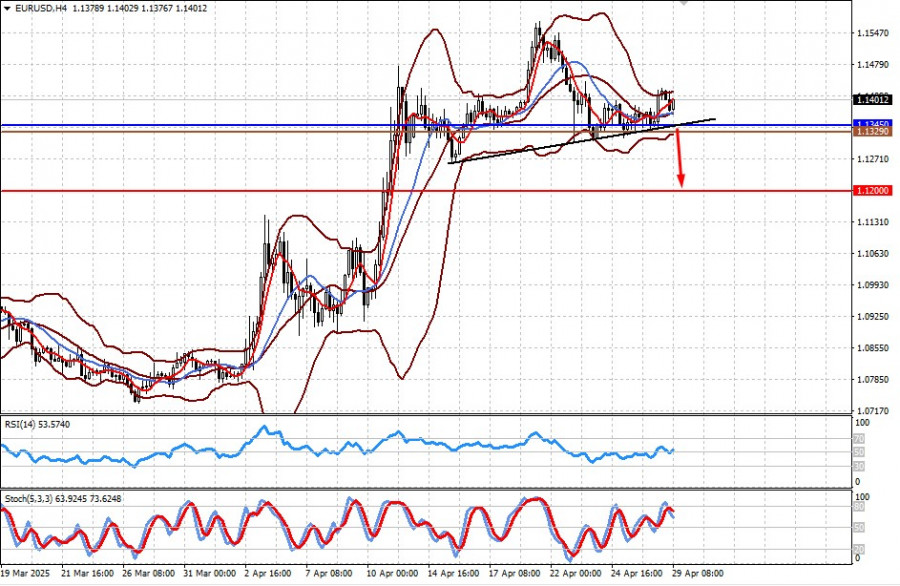

Trade Negotiations Between China and the U.S. Are Ongoing. Markets Await Results (There Is a Risk of Local Declines in EUR/USD and GBP/USD Pairs)

Markets have once again paused amid uncertainty over whether a trade agreement between the U.S. and China will be reached anytime soonAuthor: Pati Gani

10:04 2025-04-29 UTC+2

1318

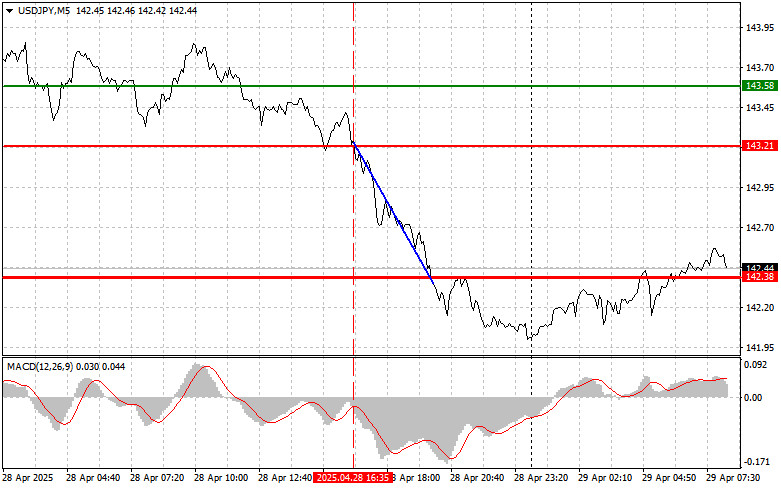

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on April 29. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 29. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:22 2025-04-29 UTC+2

1048

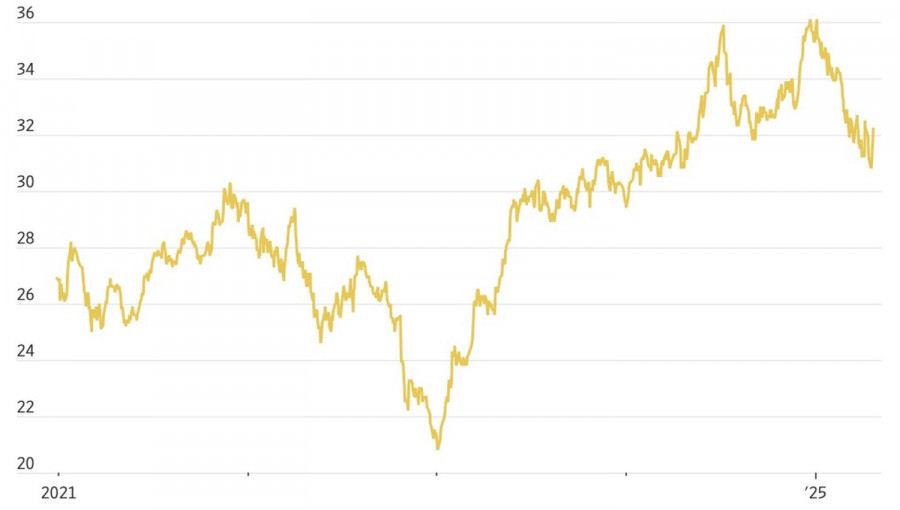

The BTC/USD price has significantly increased in recent weeksAuthor: Chin Zhao

11:30 2025-04-29 UTC+2

838

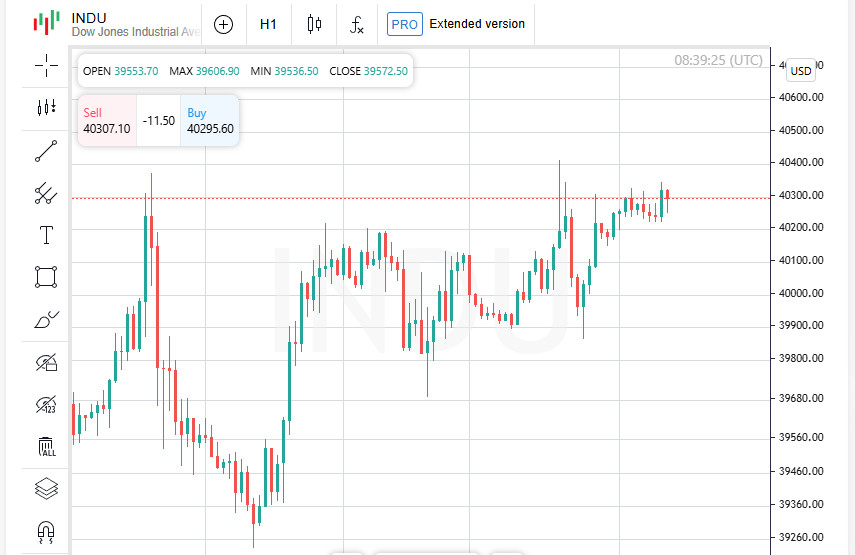

- The bearish drivers behind the S&P 500 correction are gradually fading into the background

Author: Marek Petkovich

09:10 2025-04-29 UTC+2

808

European stocks rose amid hopes for a reduction in trade tensions between the US and China. WTI oil fell by 1.54% to $62.05, Brent by 1.51% to $65.86 due to expectations of increased OPEC+ supplies. Dow Jones rose by 0.28%, S&P 500 by 0.06%, Nasdaq fell by 0.10%. STOXX 600 added 0.53%,.Author: Thomas Frank

10:42 2025-04-29 UTC+2

808

Stock Market for April 29th: S&P 500 and NASDAQ Still Have Growth PotentialAuthor: Jakub Novak

10:59 2025-04-29 UTC+2

808

- European stocks rise; oil prices decline, mixed performance in US markets

Author: Gleb Frank

12:42 2025-04-29 UTC+2

793

$200,000 for Bitcoin by Year-EndAuthor: Jakub Novak

11:09 2025-04-29 UTC+2

778

Trading Recommendations for the Cryptocurrency Market on April 29Author: Miroslaw Bawulski

08:51 2025-04-29 UTC+2

778

- Fundamental analysis

Trade Negotiations Between China and the U.S. Are Ongoing. Markets Await Results (There Is a Risk of Local Declines in EUR/USD and GBP/USD Pairs)

Markets have once again paused amid uncertainty over whether a trade agreement between the U.S. and China will be reached anytime soonAuthor: Pati Gani

10:04 2025-04-29 UTC+2

1318

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on April 29. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on April 29. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:22 2025-04-29 UTC+2

1048

- The BTC/USD price has significantly increased in recent weeks

Author: Chin Zhao

11:30 2025-04-29 UTC+2

838

- The bearish drivers behind the S&P 500 correction are gradually fading into the background

Author: Marek Petkovich

09:10 2025-04-29 UTC+2

808

- European stocks rose amid hopes for a reduction in trade tensions between the US and China. WTI oil fell by 1.54% to $62.05, Brent by 1.51% to $65.86 due to expectations of increased OPEC+ supplies. Dow Jones rose by 0.28%, S&P 500 by 0.06%, Nasdaq fell by 0.10%. STOXX 600 added 0.53%,.

Author: Thomas Frank

10:42 2025-04-29 UTC+2

808

- Stock Market for April 29th: S&P 500 and NASDAQ Still Have Growth Potential

Author: Jakub Novak

10:59 2025-04-29 UTC+2

808

- European stocks rise; oil prices decline, mixed performance in US markets

Author: Gleb Frank

12:42 2025-04-29 UTC+2

793

- $200,000 for Bitcoin by Year-End

Author: Jakub Novak

11:09 2025-04-29 UTC+2

778

- Trading Recommendations for the Cryptocurrency Market on April 29

Author: Miroslaw Bawulski

08:51 2025-04-29 UTC+2

778