Lihat juga

27.11.2023 09:25 PM

27.11.2023 09:25 PMOverview :

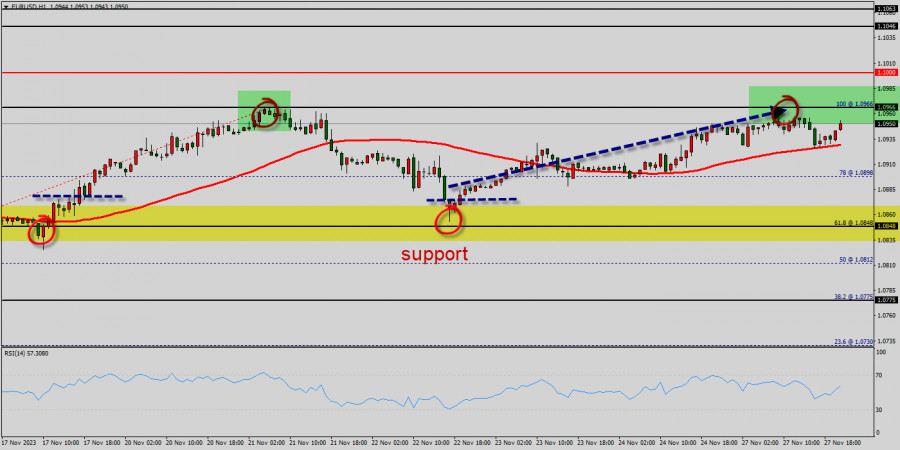

The trend of EUR/USD pair movement was controversial as it took place in a narrow sideways channel, the market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.0848 and 1.0966. Also, the daily resistance and support are seen at the levels of 1.0966 and 1.0848 respectively.

Therefore, it is recommended to be cautious while placing orders in this area. So, we need to wait until the sideways channel has completed. Last week, the market moved from its bottom at 1.0848 and continued to rise towards the top of 1.0966. Today, in the one-hour chart, the current rise will remain within a framework of correction.

The Relative Strength Index (RSI) is considered overbought because it is below 60. The RSI is still signaling that the trend is downward, but it is still strong above the moving average (100). This suggests the pair will probably go down in coming hours. Accordingly, the market is likely to show signs of a bearish trend.

However, if the pair fails to pass through the level of 1.0966, the market will indicate a bearish opportunity below the strong resistance level of 1.0966 (the level of 1.0966 coincides with the double top too). Since there is nothing new in this market, it is not bullish yet. Sell deals are recommended below the level of 1.0966 with the first target at 1.0848.

If the trend breaks the support level of 1.0848, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.0725 in order to test the daily support 2 (horizontal balck line).

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pertukaran mata wang sedang mengukuh dalam julat sempit di bawah tahap rintangan 1.1345 sementara menunggu keputusan mesyuarat dasar monetari Fed, yang akan berakhir pada hari Rabu, 7 Mei. Jika

Pada hari Jumaat, pasangan EUR/USD meningkat ke tahap 1.1374, melantun semula, dan berbalik memihak kepada dolar A.S. Pemain pasaran menurun menyerang lagi, tetapi hanya seketika, dan secara keseluruhannya mereka masih

Dengan munculnya corak Wedge Gagal pada carta 4 jam, ia memberikan petunjuk bahawa dalam masa terdekat ia berpotensi untuk menuju ke tahap 3297.43 dan jika momentum serta volatiliti menyokong, Emas

Dengan merujuk kepada carta 4 jam bagi pasangan silang mata wang EUR/JPY, dapat diperhatikan bahawa dalam masa terdekat EUR/JPY berpotensi untuk mengukuh. Ini disahkan oleh kemunculan corak Penumpuan antara pergerakan

Daripada apa yang dilihat pada carta 4-jam indeks Nasdaq 100, penunjuk Pengayun Stochastic berada dalam keadaan 'Crossing SELL' dan terdapat kemunculan corak 'Rising Wedge' jadi berdasarkan dua keadaan ini dalam

Harga logam kuning dijangka bergerak antara 3,203 dan boleh mencapai bahagian bawah saluran menurun sekitar 3,181 dalam beberapa hari akan datang, satu tahap yang bertepatan dengan 200 EMA pada 3,173

pada awal sesi Amerika, pasangan EUR/USD didagangkan sekitar 1.1378 dalam saluran aliran menurun yang terbentuk pada 17 April dan menunjukkan tanda-tanda keletihan kekuatan menaik. Pembetulan teknikal berkemungkinan berlaku dalam beberapa

Pada awal sesi dagangan Amerika, emas didagangkan sekitar 3,384 — berada di atas paras sokongan utama dan menunjukkan lantunan selepas menyentuh paras rendah 3,267. Sekiranya harga berjaya membuat penyatuan kukuh

Dengan kemunculan pola Divergent dan Descending Broadening Wedge pada carta 4 jam bagi pasangan mata wang silang AUD/JPY, walaupun pergerakan harganya berada di bawah EMA (21) yang mempunyai cerun menurun

Pada carta 4 jam pasangan mata wang utama USD/JPY, dapat dilihat bahawa penunjuk Pengayun Stochastic membentuk corak Gandaan Bawah (Double Bottom) manakala pergerakan harga USD/JPY membentuk corak Higher High, justeru

Video latihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.