Lihat juga

31.03.2025 09:34 AM

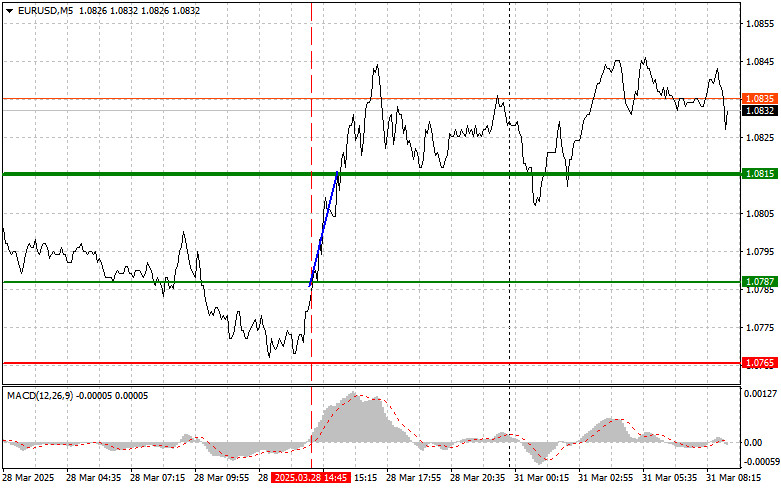

31.03.2025 09:34 AMThe price test at 1.0787 occurred at a moment when the MACD indicator had just begun to move upward from the zero mark. This confirmed a correct entry point for buying the euro, which resulted in a rise toward the target level of 1.0815.

Despite the strong growth of the euro, it's too early to relax. The rise was primarily driven by relatively muted U.S. data and inflation figures. However, it's worth noting that the data only reflect one month, making it premature to talk about a long-term trend. From now on, market participants will be watching closely for further signals from the Federal Reserve and monitoring the progress of trade negotiations between the U.S. and several partners facing new tariffs. In the coming months, the key factor influencing U.S. inflation will be the price dynamics of imported goods. If trade tariffs continue to rise, the costs will inevitably be passed on to consumers, accelerating inflation.

Germany's retail sales and consumer price index (CPI) figures are due today. These data points are important because they help assess current consumer demand and inflationary pressures. A decline in German retail sales could indicate a weakening economy, while a rise in CPI would point to stronger inflation. Both outcomes could weigh negatively on the euro and influence ECB monetary policy. The ECB may reconsider its intention to cut interest rates if inflation remains high.

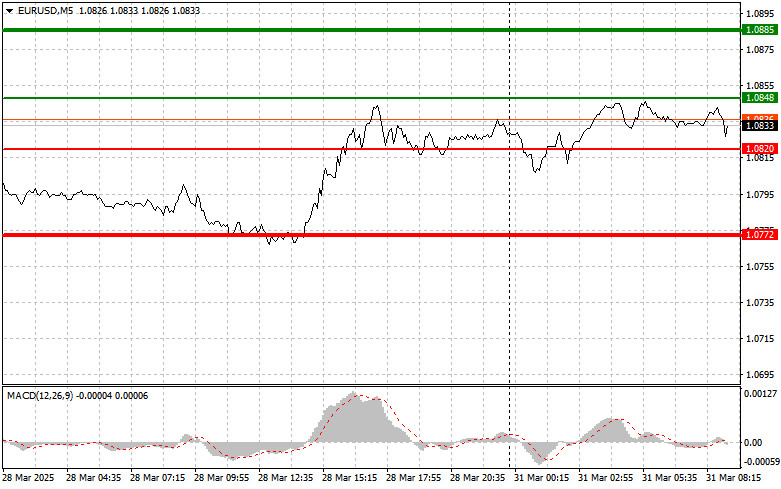

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: Buy the euro today upon reaching the entry point at 1.0848 (green line on the chart) with a target of 1.0885. At 1.0885, I plan to exit the market and open short positions in the opposite direction, expecting a move of 30–35 pips from the entry point. A bullish outlook for the euro in the first half of the day is valid only if German and Italian data are substantial. Important: Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of 1.0820 while MACD is in oversold territory. This will limit the downside potential and trigger a reversal to the upside. A rise toward the opposite levels, 1.0848 and 1.0885, can be expected.

Scenario #1: Sell the euro after it reaches 1.0820 (red line on the chart). The target will be 1.0772, where I plan to exit the market and immediately open long positions in the opposite direction (expecting a 20–25 pip bounce). Selling pressure is likely to return in case of weak data. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of 1.0848 while MACD is in overbought territory. This will limit the upside potential and trigger a reversal downward. A decline toward the opposite levels, 1.0820 and 1.0772, can be expected.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Analisis Dagangan dan Petua Dagangan untuk Yen Jepun Ujian paras 144.79 berlaku apabila penunjuk MACD telah pun bergerak jauh melepasi garis sifar, yang mengehadkan potensi kenaikan pasangan ini. Oleh demikian

Analisis Dagangan dan Petua Dagangan untuk Pound British Ujian paras 1.3311 pada separuh kedua hari semalam berlaku tepat apabila penunjuk MACD mula bergerak menurun dari garis sifar, mengesahkan titik kemasukan

Analisis Dagangan dan Petua Dagangan untuk Euro Ujian paras 1.1305 pada separuh kedua hari semalam berlaku apabila penunjuk MACD telah pun berada jauh di bawah garis sifar, yang mengehadkan potensi

Euro dan Pound Sambung Penurunan Berbanding Dolar AS Semalam, Dipacu oleh Asas Ekonomi Kukuh dari Amerika Syarikat Dalam sesi dagangan AS, euro dan pound kembali menyambung pergerakan menurun berbanding dolar

Analisis Dagangan dan Tip untuk Berdagang Pound British Ujian pada tahap harga 1.3304 dalam separuh hari pertama bertepatan dengan penunjuk MACD yang baru sahaja mula bergerak ke atas dari garis

Analisis Dagangan dan Tip untuk Berdagang Euro Ujian tahap harga 1.1319 dalam separuh pertama hari ini bertepatan dengan penunjuk MACD yang baru sahaja mula bergerak ke atas dari tanda sifar

Analisis Dagangan dan Tip untuk Berdagang Yen Jepun Ujian pada tahap harga 142.82 berlaku ketika penunjuk MACD sudah bergerak secara signifikan di atas paras sifar, yang menghadkan potensi kenaikan dolar

Analisis Dagangan dan Tips untuk Berdagang Pound British Ujian pada tahap harga 1.3377 berlaku ketika penunjuk MACD telah pun bergerak jauh di bawah paras sifar, yang menghadkan potensi penurunan pasangan

Analisis Dagangan dan Tip untuk Dagangan Euro Ujian harga 1.1386 pada separuh hari pertama selari dengan penunjuk MACD yang sudah bergerak jauh di atas tanda sifar, yang menghadkan potensi kenaikan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.