EURNOK (Euro vs Norwegian Krone). Exchange rate and online charts.

Currency converter

29 Apr 2025 05:48

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The EUR/NOK currency pair is a popular one on Forex market. Since Norway has an active trade with the European Union, the experienced traders choose this trading instrument because of high stability and predictability of the eurozone and the Norway's economies. The most intense EUR/NOK bidding is observed during the European session.

This pair is the cross rate against the U.S. dollar. There is no the U.S. dollar in this currency pair, but it extends an enormous influence over both currencies. To make it clear just combine the EUR/USD and USD/NOK charts in the same price chart, and you will get the approximate EUR/NOK chart.

The U.S. dollar affects the euro and the Norwegian krone deeply. So for a better forecast of the future rate movement of this currency pair, you need to keep in mind the main economic indicators of the United States. There are such indicators as the interest rate, GDP, unemployment, new workplaces indicator, and many others. Do not forget that the currencies listed above may react differently to the changes in the U.S. economy.

Norway is one of the world's most advanced countries with developed industry and agriculture. The country's leading positions are ensured the high levels of such indices as quality of life and income per capita. Norway is considered as the third largest producer and exporter of oil and gas. The energy export provides the main part of this Scandinavian country's revenue. The largest industrial sectors of Norway are electrometallurgy, mining, electrical and mechanical engineering. Moreover, the country sells abroad a great amount of its offshore drilling platforms for oil and gas. Norway is also the major supplier of seafood in the world.

If you trade EUR / NOK, you should pay attention not only to the economic indicators of Norway, but also to the world's price movement of oil and other mineral resources needed to support the Norway's economy.

Comparing to the major currency pairs such as EUR/USD, USD/CHF, GBP/USD and USD/JPY, this one is relatively illiquid. So when you make a prognosis of the future pair movement, you should pay special attention to the currency pairs that consist of the euro and the Norwegian krone in tandem with the U.S. dollar.

Remember, the spread for the cross rates can be higher than for the more popular currency pairs. Thus, before you start dealing with cross currency pairs, study carefully the broker's conditions for this specified trade instrument.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

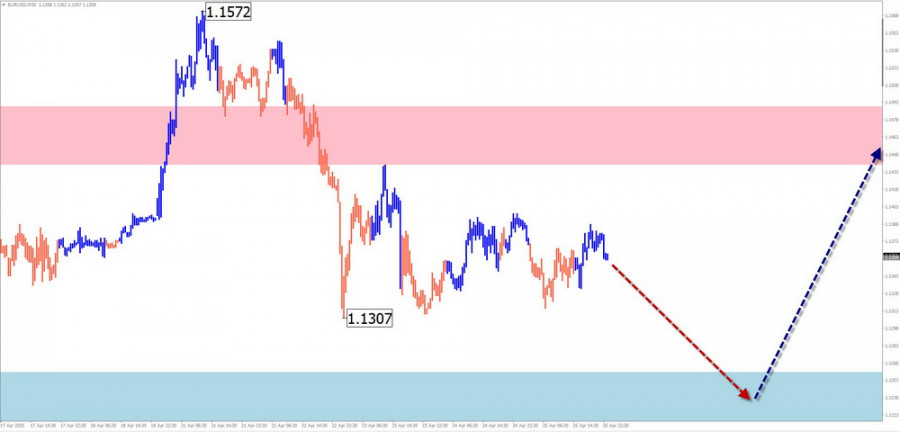

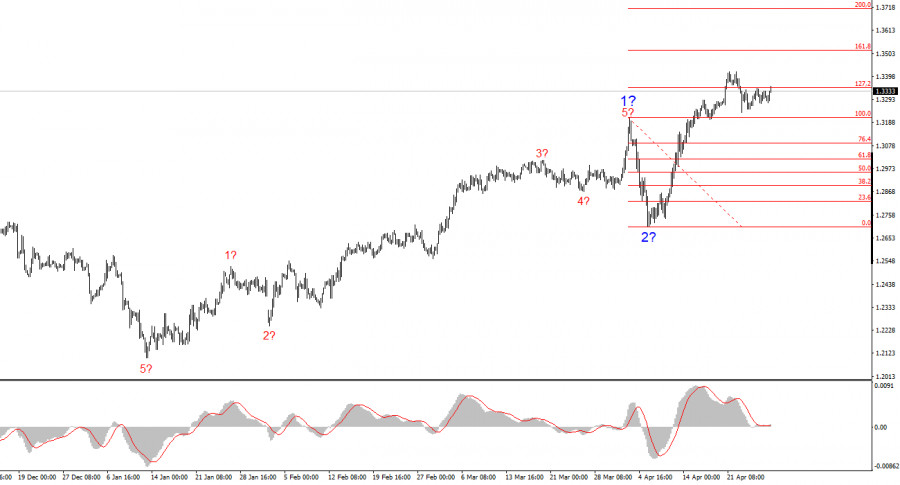

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1438

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1333

Technical analysisTrading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

1108

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

1108

The GBP/USD pair rose by 30 basis points on MondayAuthor: Chin Zhao

19:42 2025-04-28 UTC+2

1003

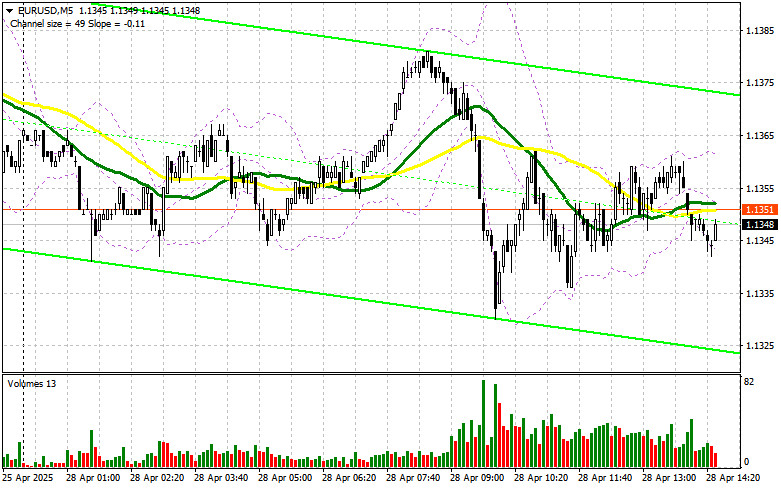

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

1003

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

913

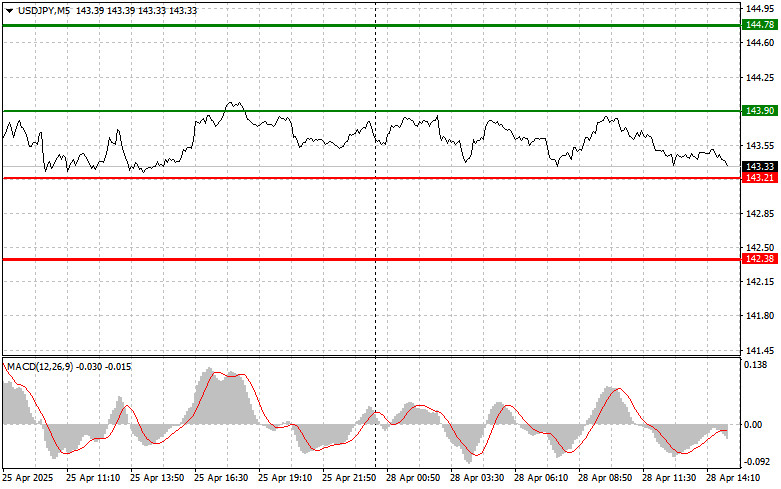

USDJPY: Simple Trading Tips for Beginner Traders for April 28th (U.S. Session)Author: Jakub Novak

19:36 2025-04-28 UTC+2

898

The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and AppleAuthor: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

898

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1438

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1333

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

1108

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

1108

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

1003

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

1003

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

913

- USDJPY: Simple Trading Tips for Beginner Traders for April 28th (U.S. Session)

Author: Jakub Novak

19:36 2025-04-28 UTC+2

898

- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and Apple

Author: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

898