USDCZK (US Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

28 Apr 2025 22:24

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/CZK (US Dollar vs Czech Koruna)

USD/CZK is a currency pair traded on Forex. The behaviour of this financial instrument is very dependent on the U.S. economic situation. That is why, a trader should primarily focus on the economic indicators of the United States. Most trading activity occurs during the sessions at European and North American exchanges.

The Czech Republic is a highly developed industrial country in Central Europe; it is also one of the most prosperous and economically stable among all the countries of the region. The high rate of personal income in the Czech Republic is backed by its fast economic development.

The key sectors of the Czech Republic economy are machinery, iron and steel production, chemical industry, electronics, brewing as well as agriculture with the most developed of them being car manufacturing. Most part of the cars produced is exported. In addition, the Czech Republic is one of the leading exporters of beer and shoes. Moreover, significant portions of Czech exports are various chemical products: tires, synthetic fibers, etc. The main trade partners of the Czech Republic are Germany, Russia, Slovakia, and Austria. Because the Czech Republic has a wide range of possibilities to produce the electric power (nuclear, thermal, hydro, and solar and wind power), it is running at the forefront in electricity production in Europe.

If you trade USD/CZK, be sure to pay attention to the dynamics of other important trading instruments such as EUR/USD, GBP/USD, and USD/JPY. Since they have a great impact on the rate of the Czech national currency, they are the indicators of further USD/CZK price movement. If you trade USD/CZK, you should focus on economic indicators of the Czech Republic, as well as the oil world price and minerals that are crucial for the Czech Republic economy.

See Also

- Wave analysis

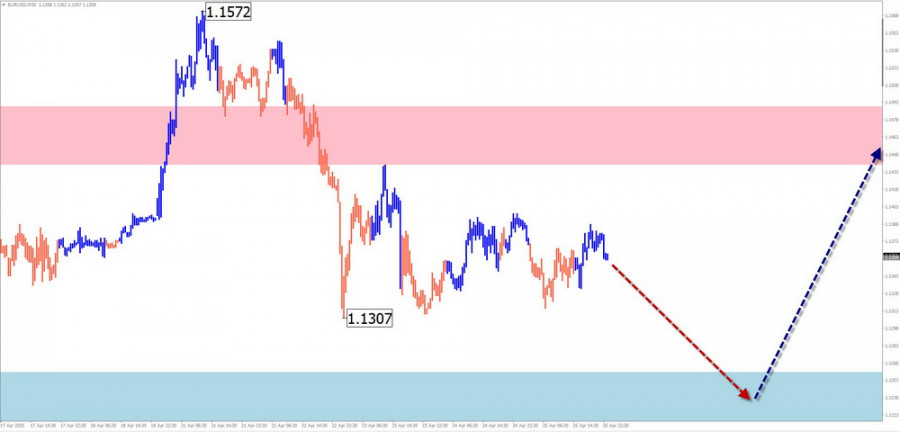

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1258

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1138

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

868

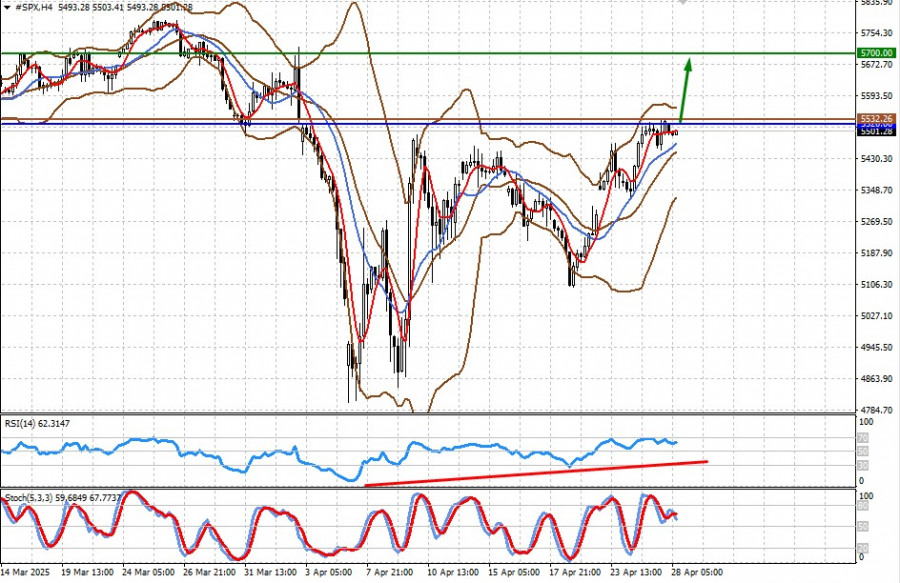

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

808

The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and AppleAuthor: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

748

Fundamental analysisThe Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

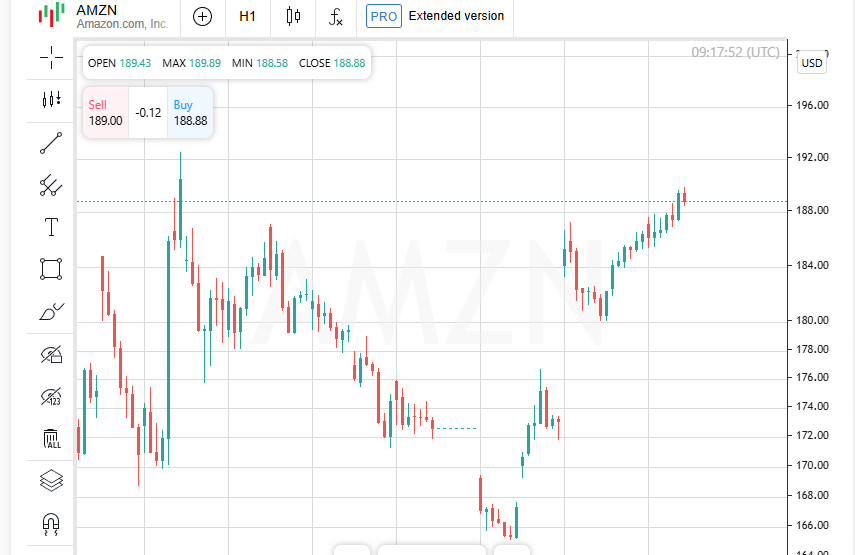

- Trump policy summaries European stocks rose on Monday after a second straight weekly gain Investors are eyeing tariff changes, as well as a busy week of earnings and economic data STOXX 600 index up 0.5% at 0709 GMT; other regional indexes also rose Majors Apple, Microsoft and Amazon to report.

Author: Thomas Frank

11:22 2025-04-28 UTC+2

748

Technical analysisTrading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

733

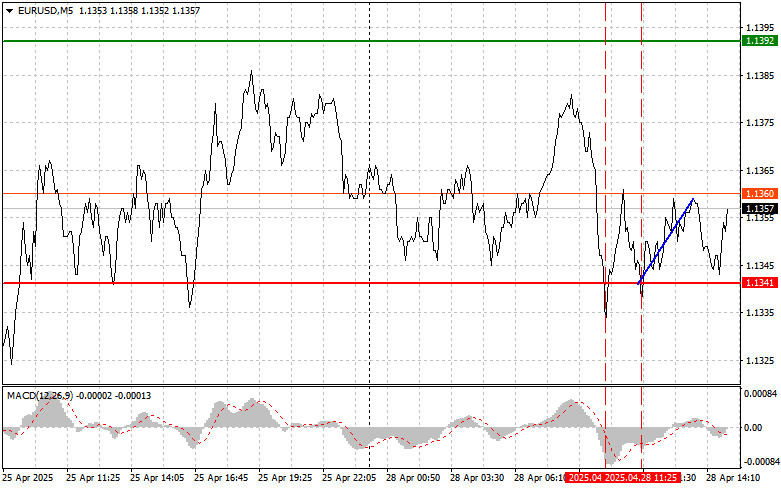

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

688

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1258

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1138

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

868

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

808

- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and Apple

Author: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

748

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

- Trump policy summaries European stocks rose on Monday after a second straight weekly gain Investors are eyeing tariff changes, as well as a busy week of earnings and economic data STOXX 600 index up 0.5% at 0709 GMT; other regional indexes also rose Majors Apple, Microsoft and Amazon to report.

Author: Thomas Frank

11:22 2025-04-28 UTC+2

748

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

733

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

688