NZDHKD (New Zealand Dollar vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

29 Apr 2025 02:00

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The NZD/HKD pair is a cross rate against the US dollar, which means that the two currencies in the pair are valued against USD. Although the US dollar is not present in this trading instrument, it has a significant impact on the pair. This can be seen by combining the trading charts of the two currency pairs, NZD/USD and USD/HKD.

Principal features

New Zealand is a country with a fairly strong economy. It is one of the world's largest exporters of agricultural products, wool, and wool products. The main trading partners of the country are the United States, Australia, and the Asia-Pacific region. Therefore, when analyzing the NZD/HKD pair, do not forget to monitor the economic indicators of these regions.

Hong Kong (a special administrative region of China) has a highly developed free-market economy characterized by low taxation. It is governed under the principle of positive non-interventionism. Hong Kong ranks among the top global financial hubs. In Asia, it has no equal in this regard. Besides, one of the world’s largest stock exchanges is based in Hong Kong.

Hong Kong's economy is services-oriented. Its main source of income is services as well as re-exports from China. In addition, the tourism industry is one of the major pillars of its economy. However, Hong Kong is not blessed with abundant mineral and food resources.

The Hong Kong dollar is pegged to the US currency and trades at a tight band at around 7.78 HKD per USD.

How to trade NZD/HKD

In comparison to such major currency pairs as EUR/USD, USD/CHF, GBP/USD, and USD/JPY, this trading instrument is relatively illiquid. Therefore, when making projections, you should primarily focus on currency pairs that include the US dollar along with each currency under consideration.

When trading cross rates, you should remember that brokers tend to set higher spreads on them (when compared to major currency pairs). Therefore, before starting to work with cross rates, you should thoroughly review all the terms and conditions a broker offers.

Trading the NZD/HKD pair requires taking into account the economic indicators of both New Zealand and Hong Kong. Besides, it is necessary to monitor the economic situation in the countries that are New Zealand's main trading partners, especially in the United States.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

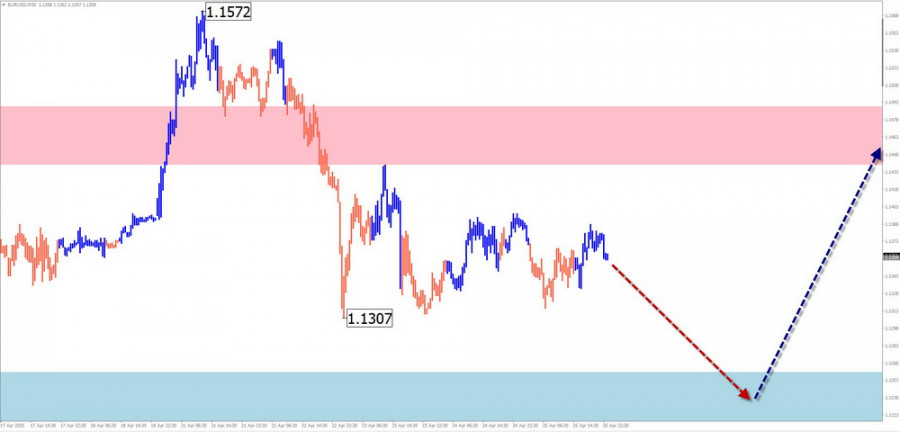

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1363

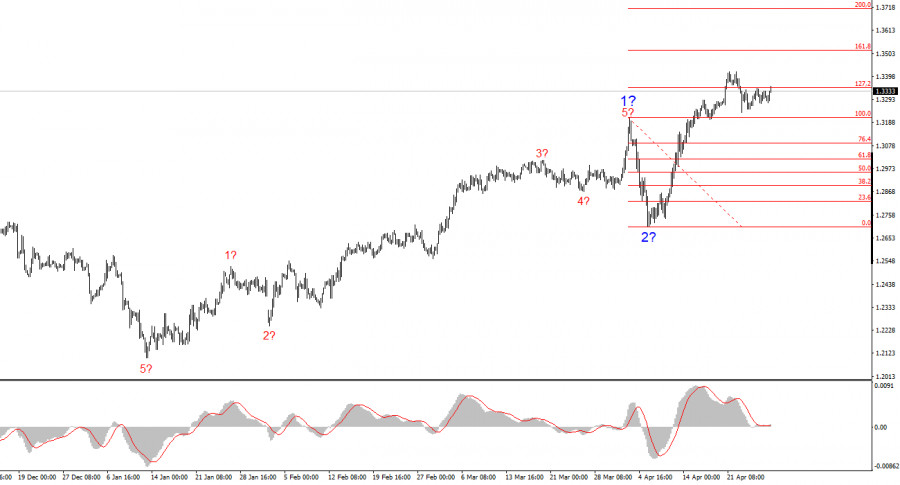

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1243

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

1048

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

958

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

898

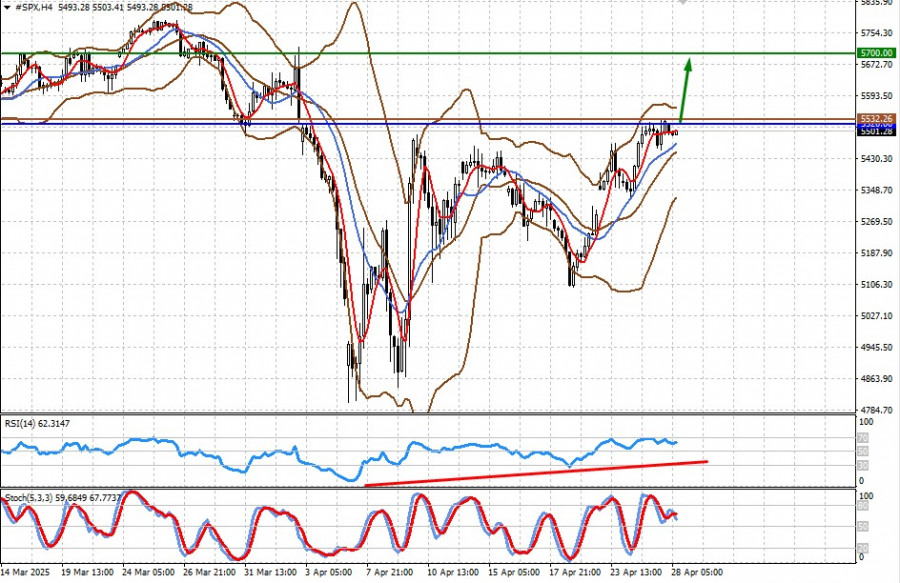

Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their AdvanceAuthor: Jakub Novak

09:06 2025-04-28 UTC+2

883

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

853

Technical analysis / Video analyticsForex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

838

Fundamental analysisThe Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

823

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1363

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1243

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

1048

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

958

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

898

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

883

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

853

- Technical analysis / Video analytics

Forex forecast 28/04/2025: EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USDX, Gold and Bitcoin.Author: Sebastian Seliga

18:34 2025-04-28 UTC+2

838

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

823