CADJPY (Canadian Dollar vs Japanese Yen). Exchange rate and online charts.

Currency converter

29 Apr 2025 01:08

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

For the CAD/JPY pair, the Canadian dollar is the base currency while the Japanese yen is the quote currency. This instrument is one of the most unpredictable currency pairs which dynamics is hard to forecast by technical analysis.

Due to the high sensitivity of the aforesaid currencies to different political and economic events, the use of the CAD/JPY trading instrument is not recommended for beginner traders.

Each currency of the pair above is influenced by oil prices; it sets a strong dynamics for the instrument. Both currencies respond to a hike of oil price antithetically. For example, while the Canadian dollar rises, the yen falls – in such case, a strongly pronounced uptrend arises.

The Canadian dollar, also known as 'loonie', is the seventh world currency by the trade volume; and it depends highly on the economic indicators of the USA and on raw material cost.

The Japanese yen is the third world currency by the trade volume. Due to the low inflation and high stability of the Japanese economy, the yen is regarded as a safe haven currency. Low interest rates make up contribute to the low value of the yen against other major currencies.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1333

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1213

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

1018

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

943

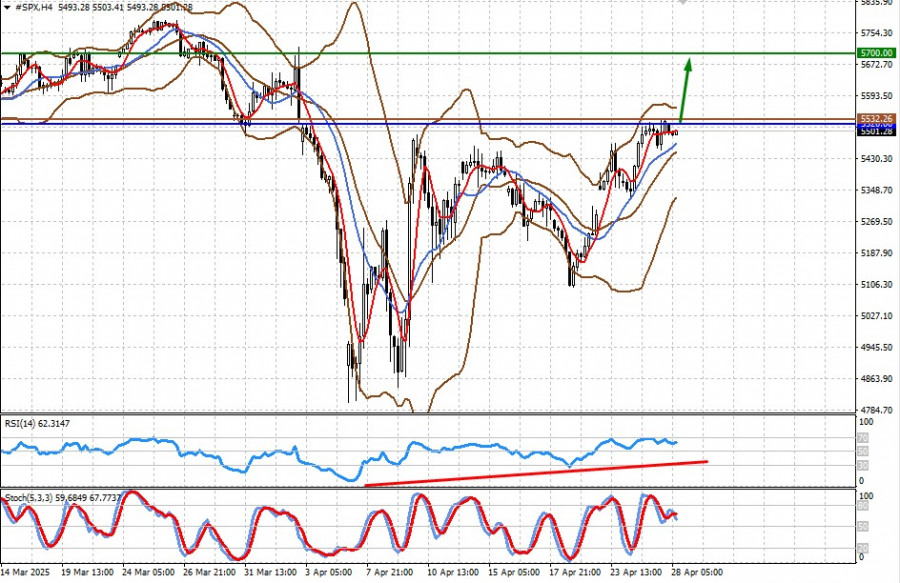

Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their AdvanceAuthor: Jakub Novak

09:06 2025-04-28 UTC+2

883

EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)Author: Jakub Novak

19:23 2025-04-28 UTC+2

883

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

823

The GBP/USD pair rose by 30 basis points on MondayAuthor: Chin Zhao

19:42 2025-04-28 UTC+2

823

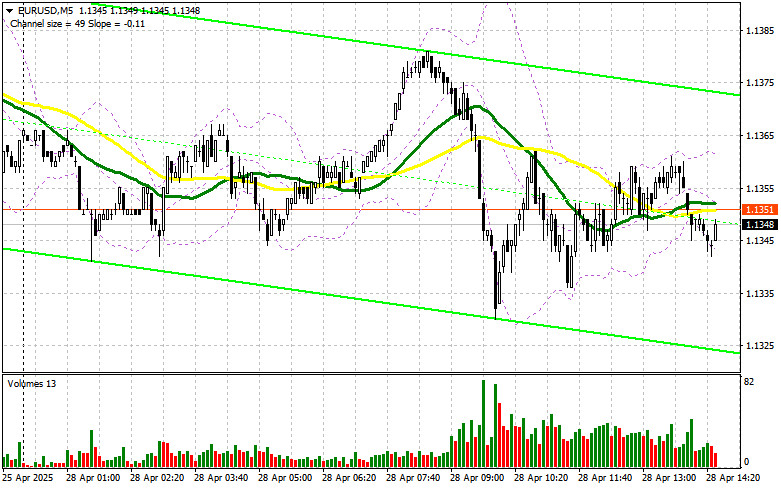

EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

808

- Wave analysis

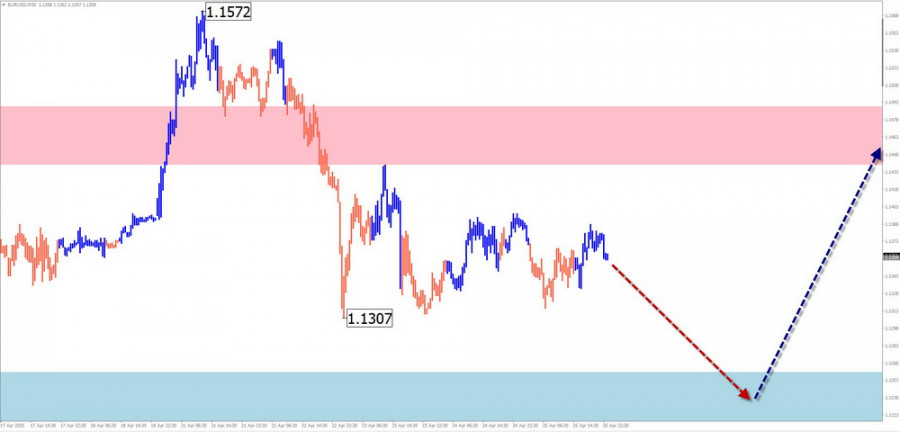

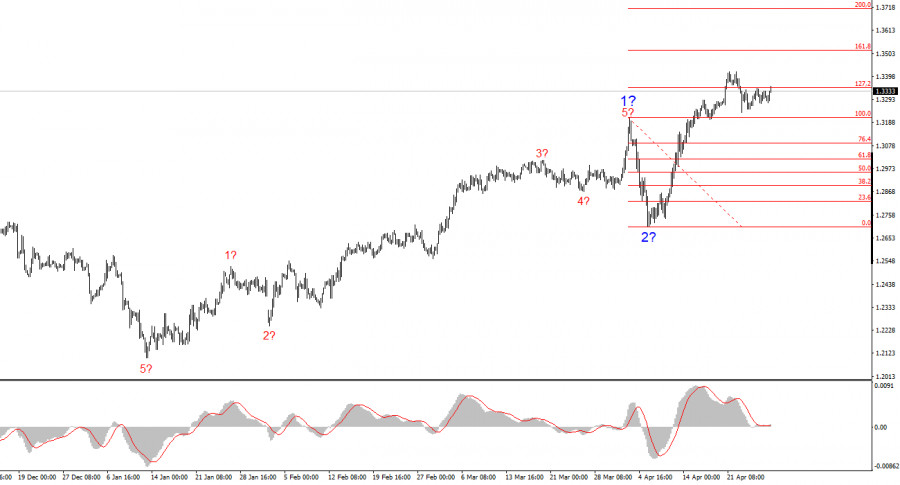

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1333

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1213

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

1018

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

943

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

883

- EUR/USD: Simple Trading Tips for Beginner Traders on April 28th (U.S. Session)

Author: Jakub Novak

19:23 2025-04-28 UTC+2

883

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

823

- The GBP/USD pair rose by 30 basis points on Monday

Author: Chin Zhao

19:42 2025-04-28 UTC+2

823

- EUR/USD: Trading Plan for the U.S. Session on April 28th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:07 2025-04-28 UTC+2

808