AUDCZK (Australian Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

28 Apr 2025 21:03

(0.03%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The AUD/CZK pair is not in high demand among forex traders. This is a cross-rate pair. Thus, a trader buys USD for CZK at the current USD/CZK exchange rate, and buys AUD for dollars at the current AUD/USD exchange rate.

The US dollar has a significant impact on both currencies. So, when trading this instrument, speculators should take into account important US macroeconomic indicators such as GDP, the interest rate, unemployment rate, and labor market figures, etc. Notably, the Australian dollar and Czech koruna react to the release of US economic data at a different speed. This is why the AUD/CZK pair can serve as an indicator of the swings in the rate of both currencies.

Main features. How to trade AUD/CZK

The Czech Republic is one of the most industrially developed countries in Europe as well as one of the most prosperous and stable countries in the euro area. Besides, the country can boast of robust economic growth. This is why its population has a high per capita income.

The Czech Republic is on the list of the world's top car manufacturers. Most of the produced cars are exported. In addition, the country is the main exporter of beer and shoes. The Czech Republic is one of the leaders when it comes to the production of electronics. The country generates electricity in various ways: at nuclear power plants, thermal power plants, hydroelectric power plants as well as with the help of solar and wind power plants.

The AUD/CHF pair has rather low liquidity compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this instrument, it is necessary to focus on the pairs traded against the US dollar.

If you want to start trading cross-rates, please carefully read the trading conditions of your broker. Usually, spreads for these instruments are higher than for the main currency pairs.

See Also

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1228

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1078

ECB Ready to Cut Rates FurtherAuthor: Jakub Novak

09:24 2025-04-28 UTC+2

853

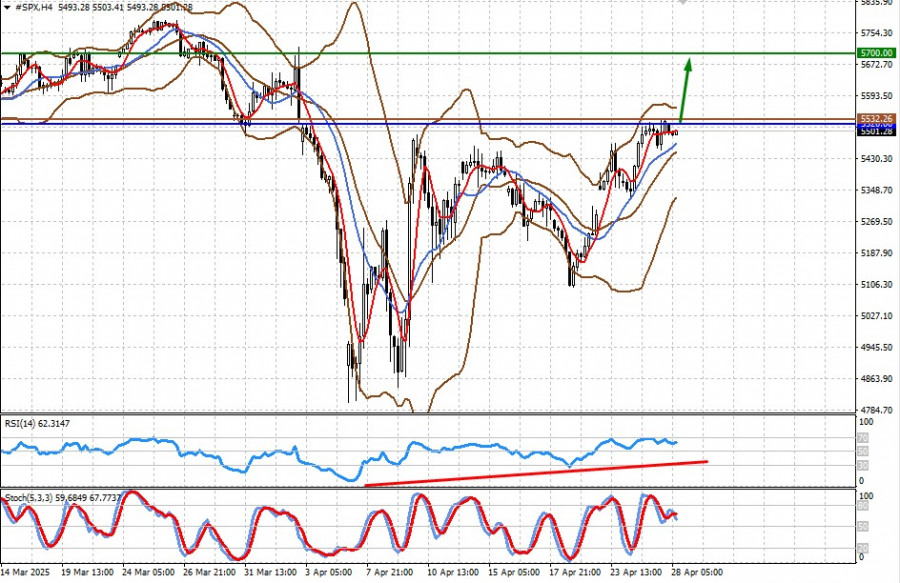

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

793

The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and AppleAuthor: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

748

Fundamental analysisThe Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

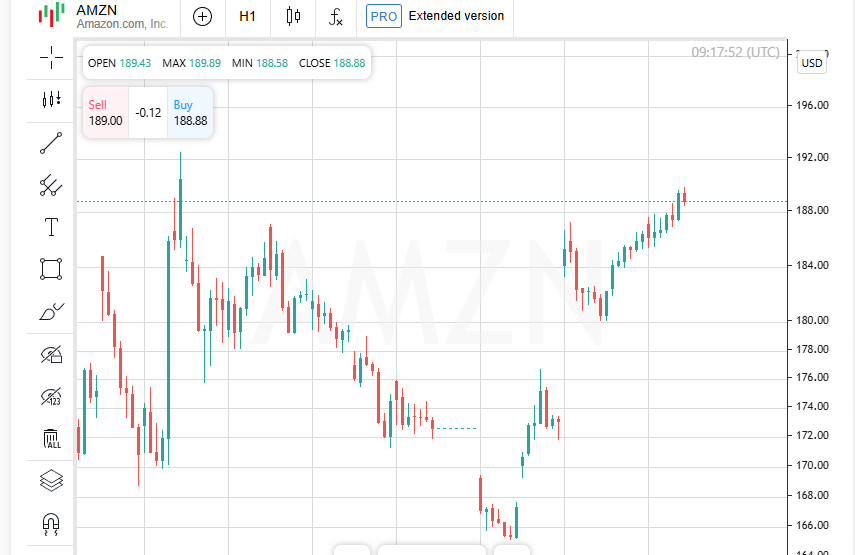

- Trump policy summaries European stocks rose on Monday after a second straight weekly gain Investors are eyeing tariff changes, as well as a busy week of earnings and economic data STOXX 600 index up 0.5% at 0709 GMT; other regional indexes also rose Majors Apple, Microsoft and Amazon to report.

Author: Thomas Frank

11:22 2025-04-28 UTC+2

748

Technical analysisTrading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

673

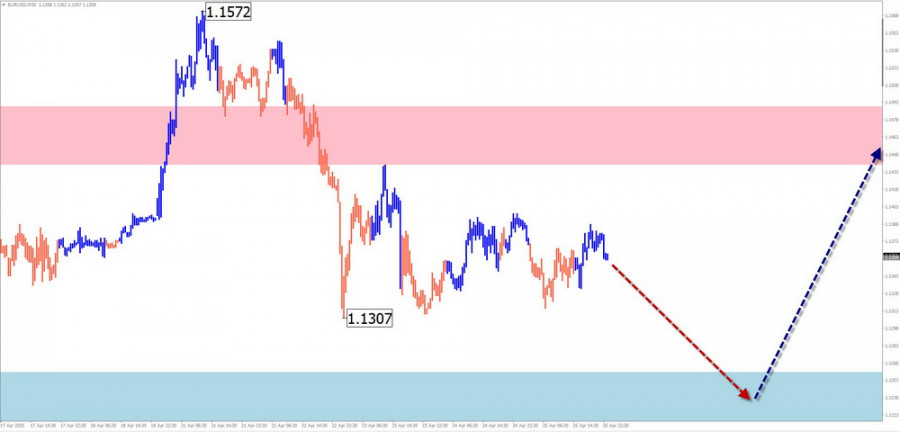

Technical analysisTrading Signals for EUR/USD for April 28-30, 2025: sell below 1.1370 (21 SMA - 7/8 Murray)

On the other hand, if bearish pressure prevails and the euro consolidates below 1.1370, it could be seen as a sell signal with targets at the 6/8 Murray located at 1.1230 and ultimately at the bottom of the downtrend channel around 1.1135.Author: Dimitrios Zappas

16:29 2025-04-28 UTC+2

628

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

1228

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility is likely to increase, and the price may return to an upward trend, potentially coinciding with the release of.Author: Isabel Clark

09:32 2025-04-28 UTC+2

1078

- ECB Ready to Cut Rates Further

Author: Jakub Novak

09:24 2025-04-28 UTC+2

853

- Stock Market Update for April 28th: S&P 500 and NASDAQ Pause Their Advance

Author: Jakub Novak

09:06 2025-04-28 UTC+2

793

- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings reports from tech giants such as Microsoft and Apple

Author: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

748

- Fundamental analysis

The Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to?Author: Pati Gani

09:12 2025-04-28 UTC+2

748

- Trump policy summaries European stocks rose on Monday after a second straight weekly gain Investors are eyeing tariff changes, as well as a busy week of earnings and economic data STOXX 600 index up 0.5% at 0709 GMT; other regional indexes also rose Majors Apple, Microsoft and Amazon to report.

Author: Thomas Frank

11:22 2025-04-28 UTC+2

748

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 28-30, 2025: buy above $3,270 (21 SMA - 7/8 Murray)

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level of $3,500.Author: Dimitrios Zappas

16:25 2025-04-28 UTC+2

673

- Technical analysis

Trading Signals for EUR/USD for April 28-30, 2025: sell below 1.1370 (21 SMA - 7/8 Murray)

On the other hand, if bearish pressure prevails and the euro consolidates below 1.1370, it could be seen as a sell signal with targets at the 6/8 Murray located at 1.1230 and ultimately at the bottom of the downtrend channel around 1.1135.Author: Dimitrios Zappas

16:29 2025-04-28 UTC+2

628