Vea también

25.03.2025 07:29 AM

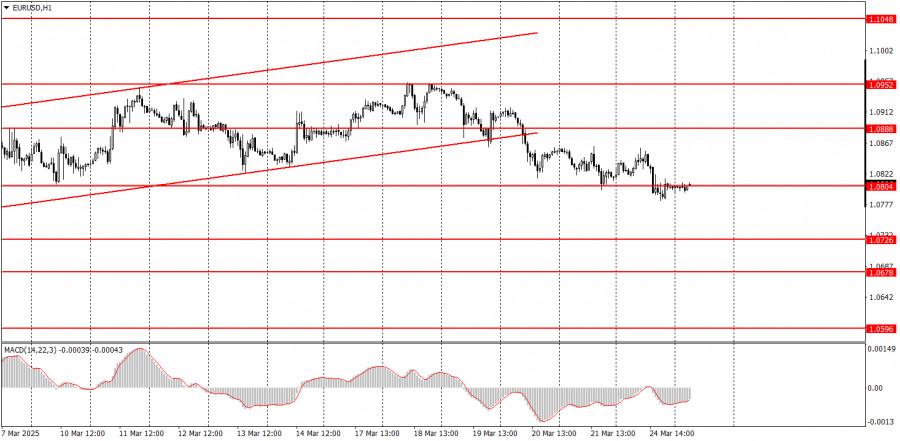

25.03.2025 07:29 AMThe EUR/USD currency pair continued its weak downward movement on Monday. The dollar failed to show any significant gains by the end of the day, and the macroeconomic backdrop didn't help much either. Six business activity indices in the services and manufacturing sectors were published throughout the day, and all six contradicted each other. In each country, if one index rose, the other declined. If one beat expectations, the other fell short. As a result, neither the dollar nor the euro could count on firm growth. However, the U.S. currency still has a few advantages, allowing it to at least show a corrective rebound. First, the dollar had fallen too long and sharply – a correction is needed. Second, the long-term trends remain bearish. Third, Trump hasn't introduced new tariffs yet, and rumors suggest he may significantly soften his stance. Fourth, the price has settled below the ascending channel on the hourly timeframe. Therefore, for now, we continue to favor movement to the downside.

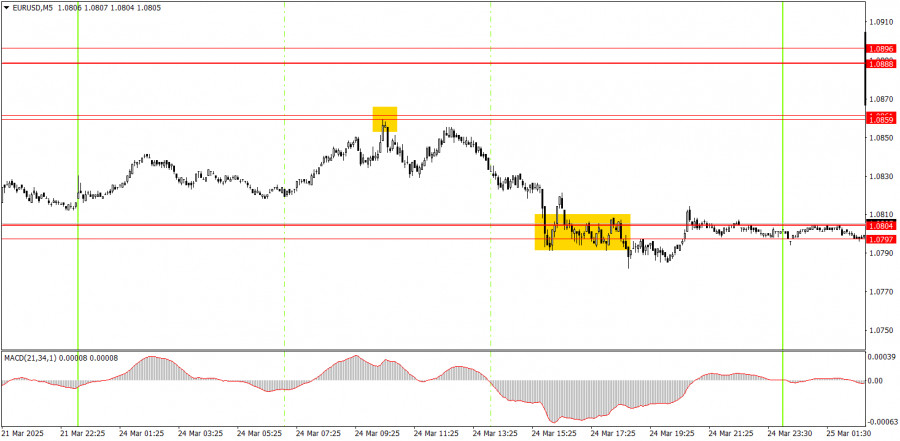

On the 5-minute timeframe on Monday, two trading signals were formed. First, the pair rebounded from the 1.0859–1.0861 area and then declined to the 1.0797–1.0804 area. Around the second area, short positions could be closed since the price initially bounced from it. And in general, that was the extent of Monday's movement. The trade was profitable, yielding about 30–40 pips.

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, but the chances of that trend continuing are decreasing. Since the fundamental and macroeconomic background supports the U.S. dollar much more than the euro, we still expect further decline. However, Donald Trump continues to push the dollar into the abyss with his ongoing tariff decisions and statements about reshaping the global order for America. Fundamentals and macroeconomic data remain overshadowed by politics and geopolitics, so we do not yet anticipate strong growth in the dollar.

On Tuesday, the euro may continue to decline, as for the first time in a while, the market has responded to fundamentals as expected (Federal Reserve meeting), and technically, the price has broken out of the ascending channel. The dollar has been oversold and undervalued without justification recently. It is reasonable to expect a correction.

On the 5-minute timeframe, the following levels should be considered: 1.0433–1.0451, 1.0526, 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1048. On Tuesday, Germany will release the business climate index, and the U.S. will publish new home sales data. Both are considered secondary reports. We believe that nothing will interfere with the current correction.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.3282

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.1320

GBP/USD: plan para la sesión europea del 30 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra se prepara para un nuevo salto, pero

Ayer se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió allí. En mi pronóstico de a mañana presté atención

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.3342

Ayer no se formaron puntos de entrada al mercado. Propongo echar un vistazo al gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico matutino, presté atención

GBP/USD: plan para la sesión europea del 28 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra formó un nuevo canal, manteniendo las posibilidades

El pasado viernes no se formaron puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos qué ocurrió. En mi pronóstico matutino presté atención al nivel 1.1391

Ayer se formaron varios puntos excelentes de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel

Ayer no se formaron puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos qué pasó allí. En mi pronóstico matutino presté atención al nivel de 1.1358

Nuestra nueva app para su verificación rápida y cómoda

Nuestra nueva app para su verificación rápida y cómoda

Video de entrenamiento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.