Vea también

09.04.2025 10:36 AM

09.04.2025 10:36 AM104%! Who's next? The stakes in the U.S.–China trade war are skyrocketing, causing the S&P 500 to slide deeper and deeper. And this came right after a strong opening and a 4% intraday rally on rumors that the White House was ready to negotiate with other countries—except China. Donald Trump has named his main adversary, and Beijing's readiness to go all the way unnerves U.S. stock fans.

When the White House introduced a 10% tariff on imports from China and later added another 10%, China remained silent. But an additional 34% crossed the line. Beijing responded symmetrically, which provoked Trump's wrath and threats to raise tariffs by another 50%. The announcement that the U.S. administration was moving in that direction sent the S&P 500 plunging.

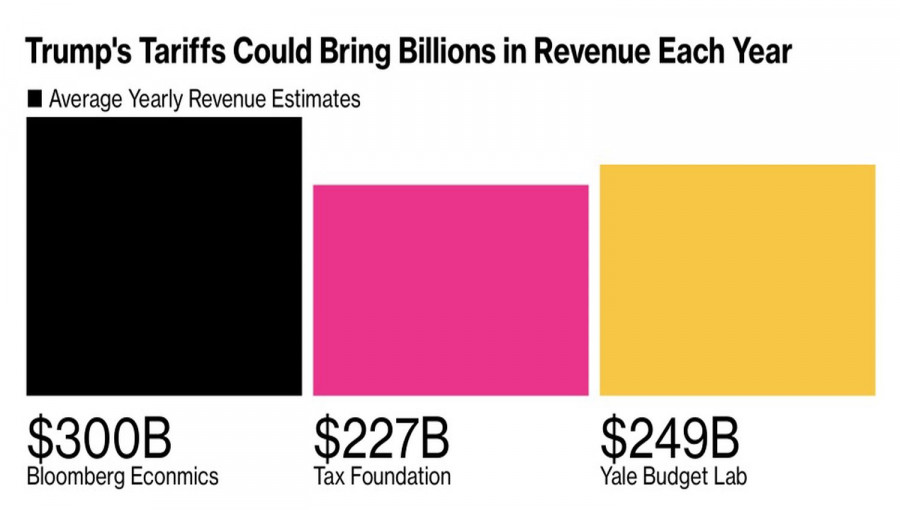

According to Treasury Secretary Scott Bessent, the U.S. intends to raise around 600 billion dollars in its first year of tariff implementation. However, Bloomberg analysis suggests that the figure will likely be half at best and decline as U.S. imports shrink by a third due to the tariffs.

The benefits of protectionism appear negligible compared to the disruption of supply chains, slowdown in global trade, declining global GDP, weaker U.S. economy, and rising inflation. The stock market is sending a clear signal that the downside outweighs the upside. The S&P 500's drop is the result of a dramatic shift in sentiment—from denial of recession to sudden belief in it.

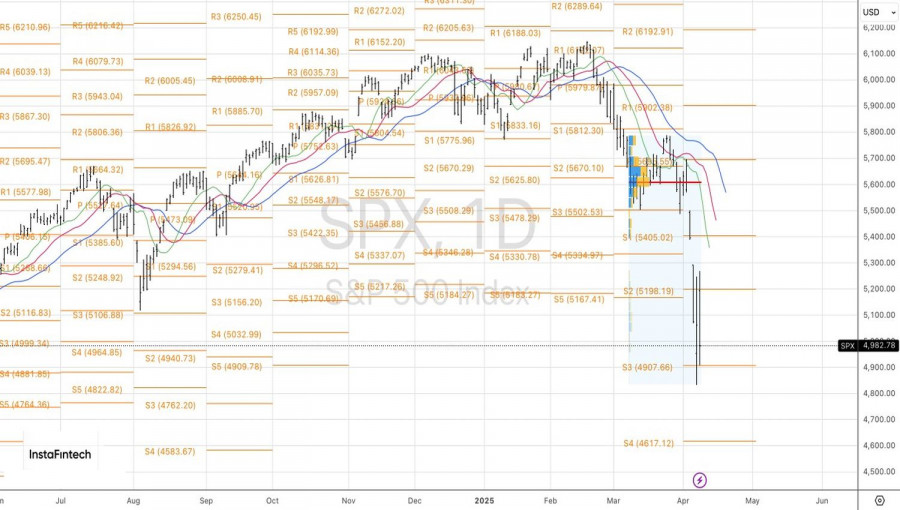

The latest AAII (American Association of Individual Investors) survey recorded the highest number of bears since March 2009—even before America's "Liberation Day." So, the market may soon post a new anti-record. Still, any attempt to buy the S&P 500 purely because of extreme bearish sentiment could turn into a "fools' rally." We saw a similar case in 2008 during the VIX spike, when the broad market index jumped by 20% between October and November, only to lose 25% over the next four months.

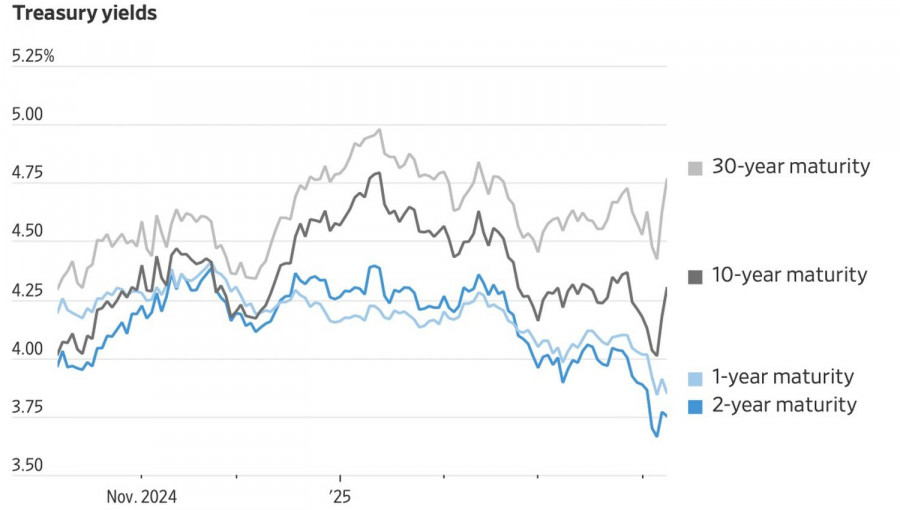

There's still room for the S&P 500 to fall, and a rise in Treasury yields could be the next trigger for a sell-off. Yields have been swinging back and forth as investors struggle to determine what the Federal Reserve will do amid stagflation. Meanwhile, China's willingness to escalate the trade war raises the risk that it could dump U.S. debt holdings. Higher yields on Treasuries would be another nail in the coffin for the broad stock index.

Technically, the S&P 500 continues its downtrend on the daily chart. A break below the pivot support at 4910 would justify building on short positions initiated from the 5200 rebound. Conversely, a bounce would allow the continuation of the existing buy-the-dip strategy on the broad index.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par de divisas GBP/USD continuó cayendo durante el jueves. El dólar fortaleció sus posiciones durante tres días consecutivos, para lo cual objetivamente no había ninguna razón. El contexto macroeconómico

El par de divisas EUR/USD volvió a negociarse el jueves con bastante calma, pero esta vez la divisa estadounidense ya no logró mostrar un fuerte crecimiento. Lo bueno, en pequeñas

El par GBP/USD se corrigió ligeramente a la baja después de subir el lunes sin motivo aparente. Sin embargo, llamar a este movimiento mínimo hacia abajo un «crecimiento del dólar»

El par de divisas GBP/USD también se negoció el lunes con baja volatilidad y prácticamente en una dirección lateral, aunque la libra esterlina mantiene una ligera inclinación alcista. A pesar

El par de divisas GBP/USD el viernes también se negoció con baja volatilidad y sin ningún entusiasmo. Sin embargo, la libra esterlina todavía mantiene una ligera inclinación alcista

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.