Vea también

10.04.2025 08:24 PM

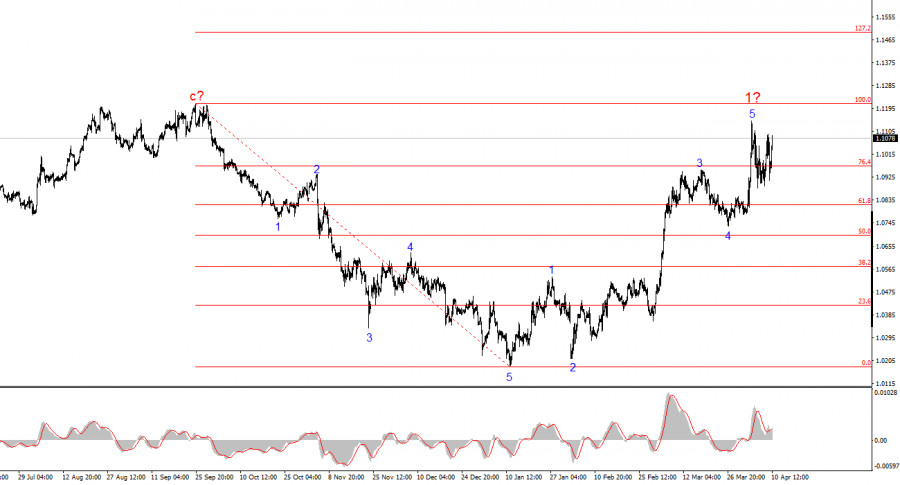

10.04.2025 08:24 PMThe wave pattern on the 4-hour chart for the EUR/USD pair has shifted to a bullish structure. I believe there is no doubt that this transformation occurred solely due to the new U.S. trade policy. Until February 28, when the sharp decline of the U.S. dollar began, the entire wave structure was forming a convincing bearish trend, developing a corrective wave 2. However, Trump's weekly announcements of various new tariffs took their toll. Demand for the U.S. dollar began to fall rapidly, and now the entire trend segment that began on January 13 has taken on a five-wave impulsive form.

Given this, we should now expect the formation of corrective wave 2 of the new bullish trend segment, which may consist of three waves. After that, the U.S. dollar is likely to continue declining—unless Donald Trump reverses his trade policy by 180 degrees. We've witnessed a clear case where the news background changed the wave structure.

On Thursday, the EUR/USD pair rose by 220 basis points. Demand for the U.S. dollar is once again declining, and the market can't even build a simple three-wave correction—something that would provide a clear basis to continue selling the dollar if that's what the market intends. Yesterday evening, Trump finally shifted from anger to leniency and lifted all tariffs above 10% for every country except China. He justified this by saying that 75 countries had essentially lined up at the White House, eager to negotiate and make deals with the U.S. So, Trump decided to give everyone a break and cut tariffs to the minimum for 90 days.

One might expect a de-escalation of the trade conflict and a strengthening of the U.S. dollar, especially since demand for it had been falling on escalation news. However, I don't see the U.S. currency gaining value, even when both the news flow and the wave structure suggest it should. The reason is simple: the market doesn't see real change, and it doesn't trust Trump.

The U.S. president can reverse any of his decisions within 24 hours. That's why confidence in his 90-day pause is just slightly above zero. Moreover, tariffs against the main trade adversary—China—have not been lowered. On the contrary, they've been raised to 125% "because Beijing continues to rob the U.S. and refuses to negotiate." So, this de-escalation is only temporary and may end well before the three-month mark.

Based on the current EUR/USD analysis, I conclude that the pair has begun building a new bullish trend segment. Serious concerns remain focused on Donald Trump. If his actions reversed one trend, they can certainly reverse another. Therefore, in the near future, the wave structure will be entirely dependent on the position and actions of the U.S. president. This must always be kept in mind. Based purely on wave analysis, we should now expect the formation of a corrective wave sequence, which traditionally consists of three waves. After that, a new upward wave should follow, and we can start looking for long entry points with targets well above the 1.10 area.

On the higher time frame, the wave pattern has also shifted into a bullish structure. Most likely, we're in for a long-term upward sequence of waves—but the news background, especially from Donald Trump, could turn everything upside down again.

Core Principles of My Analysis:

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Lo más probable es que se esté formando una tendencia alcista mayor en el panorama global del SP500, cuya estructura es similar a la del impulso. Si nos fijamos

La estructura de ondas del instrumento GBP/USD sigue siendo bastante complicada y muy confusa. Alrededor del nivel de 1.2822, que corresponde al 23.6% de Fibonacci y está cerca del pico

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado y confuso. Un intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó

El patrón de onda para el instrumento GBP/USD sigue siendo bastante complicado. El intento exitoso de romper el nivel de Fibonacci del 50,0% en abril indicó que el mercado está

El patrón de onda del gráfico de 4 horas para el instrumento EUR/USD se mantiene sin cambios. En este momento, estamos observando la construcción de la onda esperada

El análisis de ondas del gráfico de 4 horas para el par euro/dólar sigue siendo bastante claro. Durante el año pasado, solo hemos visto tres estructuras onduladas que se alternan

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.